Seemingly contradictory economic headlines jumped out over the past couple of weeks.

In one, federal revenues are reaching all-time highs with the Department of the Treasury projecting another 5 percent gain in revenues after posting a whopping 13 percent increase in 2013 due at least in part to tax increases. This is great news for budget hawks as the increased revenues are projected to further narrow the budget deficit to $583 billion.

In the other headline, the Rockefeller Institute for Government reports that state tax revenues declined in real dollar terms for the first quarter of 2014 with further declines projected in the second quarter.

One would expect if the economy were truly growing that our nation’s revenues at the state and federal levels would each be growing due to a virtuous cycle of employment, increasing consumption and investment and the resulting tax benefits these activities create.

However, over the last four quarters, state tax revenues have been “softening” and now have slid into decline signaling tough budgetary decisions for state lawmakers who don’t have the federal government luxury of running deficits.

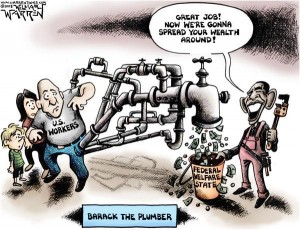

The answer to these contradictory indicators of the nation’s economic direction can likely be found in the 2012 federal government fiscal cliff deal that returned payroll taxes to their 2010 levels, increased capital gains taxes and raised taxes on higher earning taxpayers.

This dramatic tax increase created a wave of new revenue into the federal government, which can at least partially explain the revenue increases. In 2013, the federal government collected more than $100 billion more in Social Security and Disability payroll taxes alone over the previous year, and in 2014 the OMB projects an additional $60 billion in those same areas on top of that.

According to the Rockefeller study at the state level, “personal income tax revenues showed a decline at 1.2 percent in the first quarter of 2014 compared with the same period in 2013, which marks the first time states are reporting declines after sixteen consecutive quarters of growth.”

The study asserts that this “is not an indication of a slowing economy” but blames it on income shifting from the 2012 federal fiscal cliff deal.

However, given the report’s contention that “early figures for the second quarter of 2014 indicate potentially another quarter of declines in overall state tax collection, and more pronounced declines in personal income tax collection,” (emphasis mine) it is reasonable to ask if this drop is an indicator of a broader economic slow-down.

Nationally, we know that retail sales growth, a great proxy for consumer spending, has been on a steady decline since March having hit the near-zero growth threshold last month. With consumer spending making up approximately two-thirds of the U.S. economy, this is hardly of positive sign for the future.

And when it is combined with declining state tax revenues, it provides a bright yellow warning light about the direction of the national economy.

It makes perfectly logical sense that retail sales would follow a drop in state income tax revenue collections, as the latter indicates that people are clearly making less money, resulting in less tax revenue.

These two indicators confirming one another should give pause to any politically motivated happy talk about the continually rebounding economy. If anything, based upon this data, it appears to be headed back under water, not news that President Obama and those in his party hope become apparent prior to the November election.

The author is the vice president of public policy and communications for Americans for Limited Government.