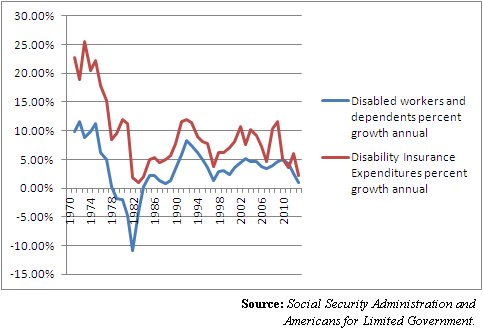

The Disability Insurance Trust Fund is set to run out of funds in 2016 according to the Social Security Trustees, having lost $113.1 billion since 2009 alone.

One might think the shortfall has come about due to the two-year payroll tax holiday that was enacted in 2010. However, little reported has been the fact the holiday was completely offset by reimbursements from the General Fund of Treasury in 2011 and 2012, which undoubtedly were borrowed.

In fact, $216.8 billion was infused into the Old-Age, Survivors, and Disability Insurance Trust Funds those years, according to data compiled by the Social Security Administration.

Meaning, the program’s impending insolvency can only be attributed to a combination of the Great Recession, the loss of millions of jobs that would have contributed revenue, and the expansion of the disability insurance program that was enacted unanimously by Congress in 2008, and signed into law by then-President George W. Bush.

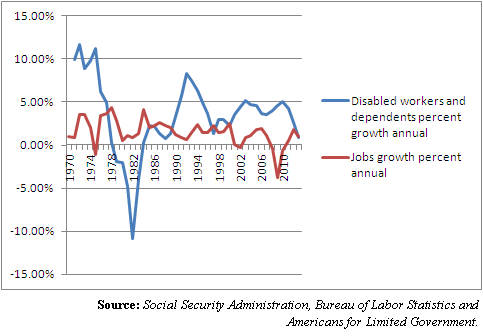

The fact is, the number of people with jobs aged 16 to 64 has decreased 338,000 since the beginning of 2008, despite the population that age increasing by 7.5 million, according to the Bureau of Labor Statistics. Meanwhile, 2 million people including dependents went on disability in that timeframe.

Yes, you read that correctly. More people have gone on disability than found jobs since 2008, even after you include seniors who are still working. And that’s with a one year gap between the jobs data, which goes through 2014, and Social Security, which is only up through 2013. No wonder it’s in trouble.

All of which means that Congress is more than likely to be addressing this issue in the new 114th Congress, trying to figure out where the program went wrong.

With that in mind, in H. Res. 5 establishing the rules of the House for 2015 and 2016, a point of order was created that according to Democrats on the House Rules Committee “would protect the Old-Age and Survivors Insurance (OASI) Trust Fund from diversion of its funds to finance a broken Disability Insurance system.”

So, the shortfall cannot be addressed by taking any money from the retirement program, leaving but three obvious options for lawmakers: raise taxes, cut spending by reducing eligibility for the program, or borrow more money from the Treasury.

Indirectly, Congress can also do more to help the private sector to create jobs, which would mean more taxpayers contributing to the program.

After all, a growing economy is the solution to all of these problems.

Which makes slowing growth in the U.S. economy all the more troubling. We have not seen growth above 4 percent since 2000, and not above 3 percent since 2005.

Barring a miracle this year, that means Congress will likely resort to its remaining options to shore up the disability program.

So, which is it, raise taxes, cut spending, or just send the bill to our kids and grandkids?

Since higher taxes at this moment might hurt economic growth and job creation — which damages the program over the long run — that will be a tough sell.

And since Republican majorities in the House and Senate have promised to reduce the debt when they ran for office in 2014, borrowing another $200 billion to shore up the trust fund for what may only be a few years will be politically toxic to their base voters.

Meaning, it is high time that Congress address who is and is not eligible to receive disability. The 2008 Bush expansion of the program must be reconsidered.

Robert Romano is the senior editor of Americans for Limited Government.