Much has been made of the Federal Reserve dropping its “patient” stance against raising the Federal Funds Rate from its near-zero rate where it has stood since late 2008.

Previously, the nation’s central bank had promised as recently as January 28 that “it can be patient in beginning to normalize the stance of monetary policy.” Meaning, a rate hike was not expected any time soon.

In its March 18 statement, this line was dropped, yet the Fed still promised that “an increase in the target range for the federal funds rate remains unlikely at the April Federal Open Market Committee meeting.”

Still, the writing is on the wall.

“Higher interest rates are coming,” Time Magazine promises. “Points to ponder when Fed raises interest rates,” a CNBC.com op-ed Barry Glassman notes. Federal Reserve Vice Chairman Stanley Fischer said raising the Federal Funds Rate “likely will be warranted before the end of the year.”

Okay, then. The Fed plans to hike its benchmark rate after 7 long years.

But so what?

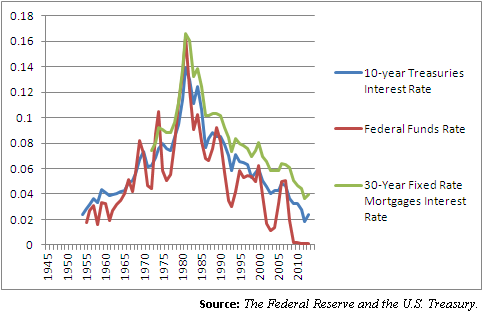

Federal Reserve Chairman Janet Yellen can do whatever she wants, but markets still tell us a different story. In fact, since the March 18 announcement, 10-year treasuries rates have continued their long march downward, dropping to 1.91 percent as of March 23.

So, if Yellen decides to raise the rate from its current level by, say, 0.25 percentage points, so what?

That might result in a narrowing of profit margins for those financial institutions that borrow from the Fed and use it to lend money. But is it suddenly going to turn around the 30-year collapse of overall interest rates, inflation, nominal Gross Domestic Product, credit demand, incomes, and the size of the working-age population?

It harkens back to the legend of King Canute ordering that the tides would recede — to no effect.

Meaning, there may be short-term adjustments to interest rates, corrections if you will, based on this or that announcement from the Fed, but really, they’re not the biggest mover and shaker in the overall market.

So, what are the conditions for real interest rates rising on a steady and prolonged basis?

Higher demand for credit, faster economic growth, a surge in the working-age population, job creation, incomes rising, and increasing inflation. These were all factors one could point to after 1945, and it eventually resulted in the Great Inflation of the 1970s.

Believe it or not, those are the good reasons rates might rise, because although the 1970s were a period of great tumult economically, we lived through it.

More to the point, although rates were rising throughout that period, the economy was still growing fairly rapidly on a nominal basis and so were incomes. So, then we could afford to pay the higher rates, as bad as they were.

Yet none of those factors exist today. Instead you see aging populations, relatively lower fertility, resulting lower demand, and weakening growth. The economy has not grown above an inflation-adjusted 3 percent since 2005.

Even the Fed in its forward-looking forecasts sees weaker economic growth on the horizon. As the New York Post’s Jonathon Trugman notes, citing Fed projections, “In December, [the Fed] was calling for GDP in 2015 to come in at 2.6 percent to 3 percent. Wednesday, she downgraded that to 2.3 percent to 2.7 percent. In fact, she downgraded projections all the way out to 2017. The 2016 estimate was also revised to 2.3 percent to 2.7 percent, down from 2.5 percent to 3 percent. The 2017 estimate was revised down to 2.0 percent to 2.4 percent.”

So, if rates were going to start rising, it would not be because of growth. Meaning, if they do, it might not be for benign reasons. It might be, such as recently occurred in Europe with the sovereign debt crisis, because global demand by financial institutions for U.S. government debt was called into question.

And God forbid that happens.

But barring those two things, robust economic growth or a sovereign debt crisis, there really is very little reason to project higher interest rates over the long-term — after all, rates have been collapsing for 30 years — and certainly not because King Canute proclaimed it would be so.

Robert Romano is the senior editor of Americans for Limited Government.