Whoop-dee-doo. But how many people are really finding work in this economy?

Since January 2007, before the recession began, the population of those aged 25 to 64 has increased by 7.8 million. But only 633,000 of the increased population have found jobs on a net basis.

As a result, the employment to population ratio of that age group has dropped, from 76.5 percent in 2007, to just 73.3 percent today. This is the percent of people with jobs, aged 25 to 64.

If that ratio had remained where it was, 5.3 million more 25 to 64 year olds would have jobs.

And forget about 16 to 24 year olds. Although their population has increased by 1.4 million since 2007, the number of them with jobs actually decreased by 1.38 million. The percent of them with jobs has dropped from 54.4 percent to 48.9 percent.

This is a catastrophe, particularly for younger Americans, relatively fewer of whom are entering the labor force.

Take 25 to 34 year olds. Their population has increased by 3 million since 2007. But only 1.38 million of the increased population found jobs.

The employment to population ratio there has dropped, from 79.7 percent to 76.8 percent. That represents 1.23 million of the missing 5.3 million working age jobs right there.

These are Americans in their prime working years, but thanks to the financial crisis and ensuing recession, relatively fewer are getting their starts. This will in turn create problems economically for years to come.

For starters, we can expect already-slow economic growth to be even slower than it otherwise might have been, since fewer people working should be expected to purchase relatively fewer new goods and services every year.

It’s a vicious cycle.

In the meantime, those 65 years old and older are working longer, and retiring later. But they’d still like to retire, and as a result, are spending less. Meaning less economic growth.

So, those who might spend more cannot find work, and those whose jobs they might take cannot afford to retire. Or simply do not wish to retire. They are, after all, living longer.

Either way, it appears to be a demographic death spiral. But it will not last forever. Eventually, the Baby Boomers will have to retire.

At that point, the question might be whether their jobs are taken by those younger, or if they simply disappear.

Airing on the side that eventually the economy will return to some semblance of normalcy, these may be problems that ultimately work themselves out. For now, we worry about them, but eventually they enter the rearview mirror.

That said, the missed opportunities for those young people during this prolonged downturn may not be replaceable. But we will see.

All of which leads to the overall fallacy of considering the topline unemployment rate, which now stands at 5.5 percent, a rate that does not reflect the shifting demographic makeup of the nation. So what if older Americans are working longer and younger Americans are giving up? How is that a measure of economic health?

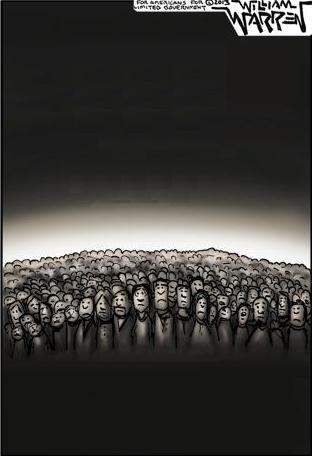

No matter how we got here, one thing cannot be debated. When more working age Americans are dropping out of the labor force than are finding jobs, we’re not growing.

Robert Romano is the senior editor of Americans for Limited Government.