By Rick Manning

Inexpensive, reliable electricity is an essential element that business leaders consider when choosing where to locate a job-creating factory, and this is one of the United States’ natural competitive advantages.

America is blessed with abundant natural resources, including natural gas reserves that have caused President Obama to call our nation the “Saudi Arabia” of natural gas. We have a new abundance of oil with the potential of massive amounts of recoverable oil reserves, along with at least one field that would dwarf Texas and North Dakota combined when the technology is developed to release it. Our nation has 28 percent of all the recoverable coal in the world, enough to meet our needs for 261 years.

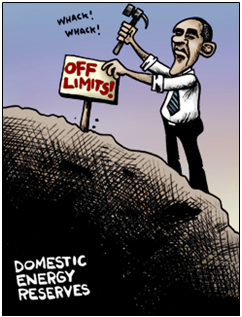

As virtually everyone knows, this potential economic boon is a direct result of the ingenuity of people in the oil and gas industry who have developed innovative ways to safely release shale oil and natural gas to the surface and those who have created safer ways to extract coal from the earth. And it is these creators who Obama’s environmental team are desperately trying to regulate out of existence through manufactured concerns about methane, coal-fired power plants and other global warming schemes.

But this is not a piece about the environmental regulations, but rather one about the economic peril facing our nation should Obama’s agenda prevail.

Here is the economic reality our nation faces: America has a national debt of approximately $18.6 trillion. The last time the national debt was paid down by any amount was 1957, fifty-eight years ago. Even in the so-called balanced budget years in the 1990s, the national debt went up, putting the lie to one more Clinton legacy.

But why does the national debt matter at all, and what impact might it have on America’s economic future?

The way to understand the national debt is to think of it as a credit card balance in your household — a balance that you are constantly adding to, and the payments you make only cover the interest payments. Eventually, even those interest payments swamp your ability to pay them if the principal becomes too large.

That is where the United States is headed unless something drastic happens.

The Office of Management and Budget projects that America will add approximately $3 trillion more to the national debt if we stay the course and don’t go on a spending spree. In these projections they estimate that total interest payments, including those owed to Social Security and Medicare, on the debt will double from last year’s 2014 payments to just under $800 billion in 2020. These assumptions are based upon a return to normal interest rates. Should the market demand higher rates of return on U.S. debt, the problem gets even worse.

These same estimates have revenues increasing from $3 trillion to $4.3 trillion from 2014 to 2020 with our nation’s economic growth holding steady between 2.3 and 3.1 percent, while spending increases over the same period by slightly less than $1.5 trillion.

Why is all this important?

Because it demonstrates that the current economic path is unsustainable, and only two solutions present themselves: spend less money and/or increase revenues.

On the spending side, it is unlikely that Congress and the President will have the political will to substantially cut, much less stop, the growth of the majority of spending, which rests in the entitlement side of the equation and is on autopilot.

While not giving up that fight, the best way to win it is to lower the demand for government services like Medicaid, welfare and unemployment insurance by changing the economic landscape in our nation by ratcheting up GDP growth dramatically.

And this brings us back to inexpensive electricity, and the high-paying domestic jobs that are created as a consequence.

Should the Obama administration have their way on the strangling environmental regulations that are projected by the U.S. government to increase electricity costs by 16 percent over the next two decades – as well as threaten the availability of stable electricity supplies – we will have squandered any opportunity to grow out of the debt death spiral in which our economy finds itself.

If Obama’s job-killing climate agenda is stopped, creating increased revenue flows without the need for new taxes, our nation will still need to tackle the spending side of the equation to balance the budget and lower our national debt to GDP levels to healthy levels. However, if we fail to defeat Obama’s environmental agenda, it becomes almost impossible to reverse the vicious economic cycle of debt that has ensnared us.

Obviously, there are a myriad of other factors like currency, trade rules, and labor costs which factor into the economic growth equation, but America’s natural resource abundance is our worldwide competitive advantage. Eliminating that advantage through environmental rules deliberately designed to drive up energy costs can only be classified as suicidal.

Congress can take the first step in thwarting Obama’s environmental strangling of America’s economic growth by defunding the enforcement of his anti-coal burning utility regulation and methane regulations this month, allowing the next President to decide if our nation should be fundamentally transformed into dust left on the ash heap of history.

The author is president of Americans for Limited Government.