So far in 2017 the U.S. has added 1.4 million new jobs through July, the fastest pace of job creation at this point in the year since 2014, Bureau of Labor Statistics data shows.

If the jobs keep coming at their current pace, another million jobs will be added by the end of the year, bringing the total to 2.4 million new jobs in President Donald Trump’s first year in office. Not too shabby.

The missing link remains robust economic growth. So far in 2017, the economy is only growing at an inflation-adjusted 1.9 percent annualized, still not shaking off the doldrums following the financial crisis that began a decade ago.

In fact, the economy has not grown above 3 percent since 2005, and not above 4 percent since 2000.

In other words, businesses are expanding at the moment, taking on new employees, but if this is not met with increased growth and profits, the expansion could be short-lived.

Similarly, considering the exuberance around current stock valuations — the S&P 500 is up more than 18 percent since November — if robust growth is not restored to the economy this year, it is easy to foresee a scenario where spending and investment is pared back.

Once that tipping point is reached, equity valuations could go into correction as businesses start cutting back on staff and the next thing you know, the economy is not growing at all.

Like all things, time will tell. It has been 8 years since the last recession, so we may be overdue.

On the other hand, the recovery was so lackluster — the worst recovery on record — that might make the next recession harder to predict. If there was no boom, why should there be a bust?

All of which makes the monthly jobs numbers something to watch. Although the last crash came in the fall of 2008, the job losses had begun at the end of 2007 and continued throughout 2008, with unemployment rising.

On the other hand, the dotcom bubble popped in 2000 while the economy was still adding jobs, with the recession and job losses following. Meaning adding jobs is no guarantee of success.

In 2000, the equity bubble popping was the leading indicator. In 2007, the job losses and foreclosures wave led the crisis. In the next recession, rising interest rates and bond bubble popping could become a drag on the economy. Or sovereign debt. Or further implosion of emerging markets.

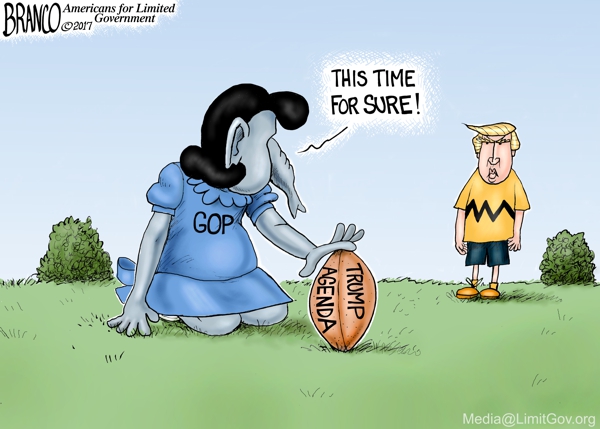

The further we get from the last recession, the more likely the next one becomes, making the lack of Congressional action on items like the Obamacare repeal or tax cuts all the more frustrating to the American people — who in 2016 voted for President Trump to provide a spark to ignite the economy and get Americans back to work.

But Trump cannot do it alone. Congress needs to do their job, too, on behalf of the American people. It’s not a partisan issue. If Trump succeeds, America succeeds. But where is Congress?

Robert Romano is the Vice President of Public Policy of Americans for Limited Government.