Right now, Predictit.org markets are forecasting only a 19 percent chance that Congress will pass any tax cuts in 2017, either for individuals or corporations. There is an 81 percent chance Congress won’t.

And everyone knows why. The Senate, in its current form with its current leaders and current composition, is not a true Republican majority. It will not act in a partisan manner to pass something that every Republican since Reagan says they are in favor of, and that is tax cuts.

We can quibble about who is to blame — McCain, Murkowski and Collins who killed any chance of an Obamacare repeal stand out — but the point is, nothing’s getting done.

Which is why the House of Representatives should simply pass its ideal version of tax cuts, which cut everyone’s taxes regardless of where they live.

The House is the constitutional body of origin for all revenue bills, so it can put forward any tax cut plan it wants.

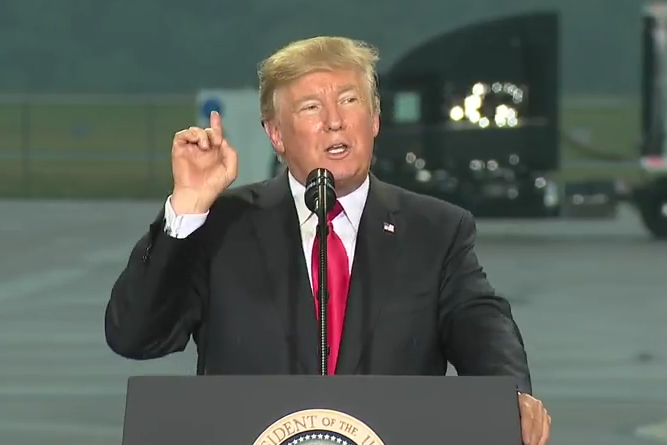

Make it the largest tax cut in American history, as President Donald Trump promised in May, at more than $5 trillion. Even larger than the 1981 Reagan tax cut.

The economy could sure use the juice. It has not grown above 4 percent inflation-adjusted since 2000 and not above 3 percent since 2005.

Don’t worry about deficits. There’s nothing in House rules that says a budget bill needs to be deficit neutral. That’s the Senate’s rules. Let the Senate worry about that.

Here’s the key. It might not pass the Senate either way. The GOP majority is too narrow and courting Democrats in the present political environment, although desirable, may be a bridge too far.

So, why should House members take a lot of political heat from their own constituents trying to “pay for” their tax cut plan with unpopular provisions the Senate won’t care about because liberal Senate Republicans are still demanding a bipartisan bill?

Right now, members, particularly those who live in high tax states and cities, are unable to tell their constituents if they’re going to actually get a tax cut and if so, how big, or if in fact, their taxes might increase under the Republican plan now being pursued.

In the very least, Republicans should be able to tell their individual constituents how they will fare under the tax plan. How else do they expect to garner support for the bill?

Read their lips. If they say “tax reform” but not “tax cuts,” hold onto your wallet.

But none of this is necessary. The House does not need to pass legislation that takes Senate rules into account. It can just pass the bill it wants.

Then, see what the Senate can produce, if anything. If at the end of the day, the cynics are right, and the Senate can’t get a thing done, at least Republican members in the House can say they supported a tax cut for every American. They won’t have been stuck defending a tax cut for some at the expense of a tax increase for others.

Of course, there’s a chance that the Senate could pass some version of a tax cut. Maybe it would even cut spending to get there, requiring no offsetting tax increases to pass the Byrd Rule. Who knows?

But House Republicans do not need to engage in legislation by speculation about what might pass the Senate’s archaic budget rules. Just pass the biggest tax cut that is possible to get the economy moving again. Let the Senate worry about its rules.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government.