By Rick Manning

The Virginia legislature is rushing to pass a bill that would have disastrous consequences for Old Dominion residents.

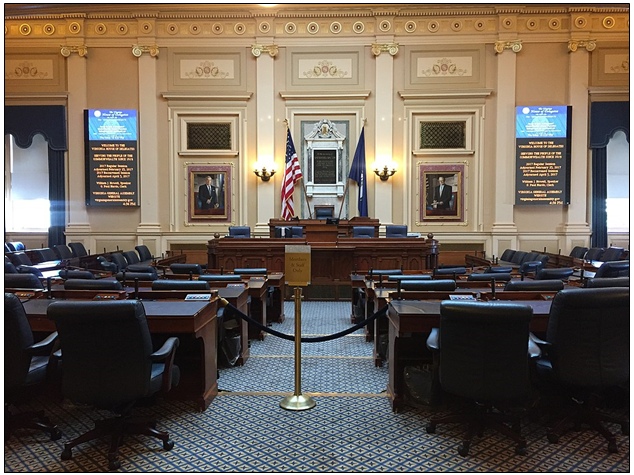

In the coming weeks, a law that would cap at 36 percent the interest rate on short-term loans up to $2,500 and impose other limits on lenders will be voted on in the General Assembly after the bill passed through committee.

Rep. Terry Kilgore argues the potential adverse impacts of the bill are not being thoroughly considered. “We have no statute to cover somebody offshore. [The bill is] going to drive a lot of people to the internet and offshore lending,” he said.

In contrast to this hastily assembled bill, the current small-dollar lending regulations were carefully crafted by lawmakers, in consultation with stakeholders representing consumers and lenders, to balance access to credit while preserving critical consumer protections.

The new bill would undo these regulations in favor of measures restricting Virginians’ consumer choice, forcing those who need cash to turn to unregulated sources.

People in need of cash to pay bills or cover unexpected expenses like car repairs will not disappear after this law is passed. Virginians will instead turn to unregulated lenders, pawnshops and lenders who are uncompetitive in Virginia, but who will offer loans if the state drives their competition out of business.

Several out-of-state lenders publicly support the bill and promise to provide loans in Virginia if the bill passes. There is no guarantee these businesses, who have no track record of serving Virginia consumers, will be reliable lenders. Additionally, most of these companies have strict standards that would exclude many of those who use short-term loans.

What’s more, if these outside corporations offered a better deal for Virginia consumers, they would already be winning the business of consumers due to their superior, lower-cost product.

The simple truth is that the legal, regulated short-term loan business met needs that traditional banking establishments failed to meet. In fact, the usurious fees for account overdrafts contribute greatly to the de-banking of our nation’s least affluent consumers.

Before hastily enacting a rate cap, the Virginia legislatures needs to consider what has happened in other states that passed similar bills.

After the Ohio legislature, for example, passed a similar bill, over 100 lenders went of business and Ohioans found different ways to obtain cash through pawnshops, second mortgages and unregulated lenders.

Professor Stefanie Ramirez analyzes Ohio restrictions on short-term lenders writing, ”Policymakers may have simply shifted operating firms from one industry to another, having no real effect on market conduct.”

This bill does not protect consumers; it forces them to use less preferred and riskier options to obtain cash. This bill will not change the reality that Americans are often strapped for cash and need a loan in a pinch.

Take for example, the fact that one in 10 Americans, according to conservative estimates, would be unable to afford a $400 emergency expense, according to a recent report from the Federal Reserve.

More importantly, this same group of people wouldn’t even be able to charge a $400 surprise bill to a credit card. “Twelve percent of adults would be unable to pay the expense by any means,” reads the report.

That leaves a significant percentage of Americans in a precarious financial situation, which current, regulated short-term lenders meet. If small-dollar lenders are forced out of the marketplace, or if large financial-service companies are allowed carve-outs and permitted to monopolize the industry, these same Americans will be forced to seek out riskier, black-market kinds of short-term loans.

As Diego Zuluaga, a policy analyst at the Cato Institute, says, “Low usury caps were once widespread across American credit markets. But Progressive reformers in the early 1900s recognized that these caps harmed low-income people by throwing them into the hands of loan sharks. Gradually, they persuaded legislators to lift or remove interest caps, helping the formal market for small-dollar credit to flourish.”

It’s important to learn from the mistakes of past legislators, not repeat the same mistakes. That, however, is exactly what this bill would do if Virginia lawmakers decide to move forward with it—a move that would only serve to eliminate the few safe options low-income households have to makes ends meet when unexpected bills hit.

Even the U.S. Hispanic Chamber of Commerce agrees with the notion small-dollar-loan caps hurt Americans. The chamber fought back when in 2016 the Consumer Financial Protection Bureau proposed a rule change that capped interest rates on small-dollar loans.

As the chamber said in a statement back then, “The CFPB’s rule would harm the millions of consumers who use payday loans responsibly to manage unexpected and periodic financial difficulties.”

Despite the rhetoric, the Virginia Bureau of Financial Institutions annual report shows the regulations passed in 2009 are working. Instead of proposing changes to Virginia’s current payday lending laws that could put the entire industry out of business, legislators should re-direct their attention to focus on unregulated credit products.

Americans aren’t stupid. They understand the risks involved when taking out small-dollar loans. Shrinking or eliminating the small-dollar-loan market will only serve to hurt those who find themselves in difficult circumstances. For this reason, lawmakers should make sure this bill never makes it to the governor’s desk.

Rick Manning is the President of Americans for Limited Government.