Congress is passing plans to provide for long-term paid sick leave and family medical leave to tens of millions of Americans, actively encouraging people to stay home, and essentially telling employers to lay off employees while brick and mortar businesses, schools and government offices are all closed, all in a bid to slow down the spread of the Chinese coronavirus.

But by actively encouraging unemployment, the federal government has an important responsibility to ensure that these relief measures are temporary, and that when the virus passes, everyone gets back to work as soon as possible.

With so many millions of Americans suddenly leaving the labor force, this will almost certainly cause a recession. The question is how big.

The House-passed bill would pay individual taxpayers up to $4,000 for every month of lockdown up to 90 days, but if the pandemic continues throughout the year, that might be extended.

But eventually, this crisis will pass and the temporary economic shutdown will end. After the virus, many will desire to extend these provisions, but they must not be renewed or else we will find ourselves in the midst of a deep recession or worse.

That is when it has the potential to rapidly become universal income.

In many ways, the coronavirus lockdown and Congress’ response shows on a grand scale what universal income schemes have the potential to do — which is to shut down the entire economy.

If the government provides enough of an incentive for people to stay home, millions Americans will respond by ceasing labor participation. And if too many give into this mindset, when the pandemic is over it has the potential to utterly devastate the U.S. economy, with reverberations felt for a generation just like the financial crisis.

Back then, Congress kept on readily extending unemployment benefits for up to 99 weeks. Remember? Do we want to do that again?

That is why as soon as the virus passes, the unemployment assistance should automatically transform into a rehiring tax credit for employers to quickly get back up and running. For essentially the same price as the unemployment assistance being dispensed, the government could provide tax credits to businesses to bring back and rehire everyone they put on unpaid sick leave at the beginning of the shutdown.

In principle, that would shorten the duration of expanded government assistance, hopefully saving taxpayers billions and ensure that when this over, the nation can get back on its feet as quickly as possible.

Alternately, and as it stands under current law, all Americans with wages that suddenly cease due to a lapse in employment are already entitled to receive assistance until they can locate new employment. In a recession, the budget deficit swells due to a combination of lower revenue from fewer taxpayers and more spending on unemployment benefits and food stamps.

To prevent a long-term recession and unemployment situation like in 2009, businesses should be incentivized to quickly rehire furloughed workers.

But first, we must stop the virus. Thankfully, the steps being undertaken today by you and every person who is staying home and using social distancing will save lives. Follow CDC guidelines at Coronavirus.gov to keep your families and the elderly safe. By everyone uniting with national determination to extinguish the virus, we shall prevail.

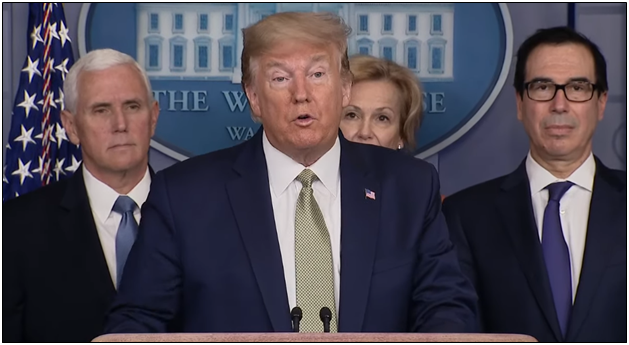

The economic damage of the 2020 coronavirus outbreak will likely be felt for many years. The fact is the federal government and state governments are shutting down vast portions of the economy affecting every single American, and they have a responsibility to limit the damage being caused. Hopefully, the steps being taken every day by President Trump and Congress will save lives and mitigate the long-term fallout of the virus.

Just make sure they really are temporary, Mr. President. When this is over, we all need to get back to work.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government.