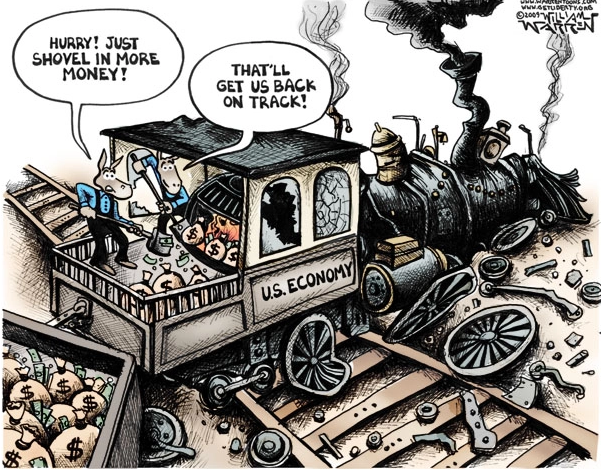

Thanks to the endless spending, the economy is definitely overheating resulting in stagflation, but has Congress noticed?

“No one got everything they wanted, including me, but that’s what compromise is. That’s consensus. And that’s what I ran on.”

That was President Joe Biden on Oct. 28 unveiling his latest $1.75 trillion spending bill—watered down from $3.5 trillion after Sen. Joe Manchin (D-W.Va.) refused to budge on the topline number—that Congress is expected to vote on this week.

It will include $555 billion for green energy subsidies via tax credits, $400 billion for both universal pre-kindergarten for all 3- and 4-year-olds and child care subsidies by capping what is paid at 7 percent of income, $150 billion to build 1 million affordable housing units, health exchange insurance subsidies for 4 million uninsured who live in 12 states that refused to expand Medicaid under the Affordable Care Act for four years, restore the state and local tax exemption for 2022 and 2023, and a $100 billion one-year extension of the $3,600 tax credit for children under six, and a $3,000 child tax credit for children over six.

The proposal also includes the additional $1 trillion bipartisan infrastructure with $500 billion of new spending, bringing the total of new spending from the combined proposals to $2.25 trillion.

The bill also raises taxes, according to the White House fact sheet on the proposal. It will “impose a 15% minimum tax on the corporate profits that large corporations—with over $1 billion in profits—report to shareholders… [and] includes a 1% surcharge on corporate stock buybacks… it’d adopt a 15% minimum tax on foreign profits of U.S. corporations… apply a 5 percent rate above income of $10 million, and an additional 3 percent above income of $25 million. close the loopholes [on]… the 3.8 Medicare tax.”

Left out is $500 billion for universal paid family leave, $111 billion for universal tuition for two years of community college, $400 billion of the extended child tax credits another four years and a plan to have the Internal Revenue Service monitor every bank account $600 and over.

With the national debt soaring to almost $29 trillion and inflation running hot the past three months at 5.3 percent annualized, the American people are already feeling the effects of the torrent of unbridled spending by Congress in the wake of the Covid pandemic.

Since Jan. 2020, the national debt has increased by $5.6 trillion as Congress has passed stimulus after stimulus to shore up the economy after 25 million jobs were lost at the height of the Covid lockdowns in April 2020: the $2.2 trillion CARES Act and $900 billion phase four signed by former President Donald Trump, and the $1.9 trillion stimulus signed by President Joe Biden.

Of that, $3.1 trillion was directly monetized by the Fed, which increased its treasuries holdings from $2.3 trillion to $5.4 trillion. About $500 billion has come from foreign central banks, which finally resumed new purchases beginning in about May 2021 after remaining at about $7 trillion for 17 straight months. The rest, about $2 trillion, was mostly purchased by U.S. financial institutions, in part by using emergency lending from the Fed.

As a result, the M2 monetary base has increased by $5.4 trillion since Jan. 2020 to its current level of nearly $20.8 trillion. We literally printed money to cover every bit of the debt that has been incurred due to the Covid pandemic and lockdowns.

In the latest Gross Domestic Product data, although the inflation-adjusted GDP for the third quarter came in at just 2 percent, that’s because of the inflation. Without adjusting for inflation, nominal GDP grew at a whopping 7.8 percent.

Thanks to the endless spending, the economy is definitely overheating resulting in stagflation, but has Congress noticed?

Robert Romano is the Vice President of Public Policy at Americans for Limited Government.