The Federal Reserve on June 15 once again hiked the Federal Funds Rate — the rate at which the central bank lends to financial institutions — up another 0.75 percent to 1.5 percent to 1.75 percent, following 0.25 percent and 0.5 percent rate hikes at its March and May meetings.

That came after the January meeting when the Fed left its rate at 0 to 0.25 percent, even though inflation was already running north of 7 percent.

The acceleration of the Fed’s rate hikes, after tepid expectations of just 0.25 percent increases at each meeting, now stand out as an admission that the central bank thinks it was wrong. That, in sum, the central bank waited far too long to begin the process of ending the emergency measures enacted to mitigate the economic impacts of the Covid pandemic lockdowns.

A quick gander at the Fed’s economic projections tells the tale. Just in Dec. 2020, the Fed was projecting just 1.7 percent Personal Consumption Expenditures (PCE) Price Index inflation for 2021. It came it at 3.87 percent. In Dec. 2021, it was projecting 2.7 percent for 2022. So far, it’s already up to 6.3 percent as of April 2022.

When compared to a separate measure of inflation, the Consumer Price Index, now at 8.6 percent, compiled by the Bureau of Labor Statistics, similarly, since inflation first rose above 5 percent in June 2021, the Federal Reserve has kept its policy rate far below that of the inflation rate.

Just in Nov. 2021, the central bank was confidently promising the inflation would be “transitory”: “Inflation is elevated, largely reflecting factors that are expected to be transitory… an easing of supply constraints are expected to support continued gains in economic activity and employment as well as a reduction in inflation.”

A month ago, Federal Reserve Chairman Jerome Powell said the Fed was not even considering a 0.75 percent rate hike, telling reporters on May 4, “Seventy-five basis points is not something the committee is actively considering.”

And yet, a month later, that is exactly what the Fed did.

Meaning, the Fed has not only been consistently wrong about the state of the economy, it is not even a reliable source of information about what its own policy posture actually is on a month-to-month basis. It doesn’t even know what it wants to do.

Of course, the American people have noticed the inflation, as their money doesn’t go as far as it used to. Real average hourly earnings are down 3 percent from May 2021 to May 2022, according to the Bureau of Labor Statistics.

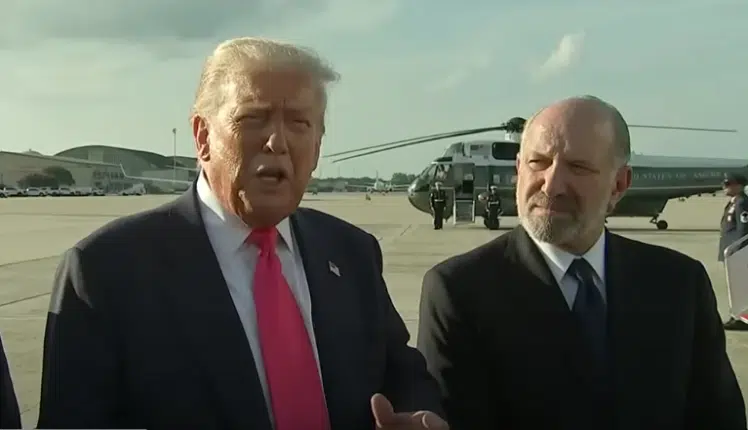

The inflation itself is little wonder. Congress spent and borrowed more than $6 trillion to fight Covid after Jan. 2020: the $2.2 trillion CARES Act and the $900 billion phase four legislation under former President Donald Trump, and the $1.9 trillion stimulus and $550 billion of new infrastructure spending under President Joe Biden.

As a result, the national debt has increased by $7.2 trillion to $30.4 trillion since Jan. 2020, of which the Fed monetized half, or $3.4 trillion, by increasing its share of U.S. treasuries to a record $5.7 trillion while the M2 money supply has increased by $6.3 trillion to $21.8 trillion, a 41 percent increase, since Jan. 2020.

To be fair, one exigent event is Russia’s invasion of Ukraine, which unquestionably disrupted global grain supplies, with Russia and Ukraine accounting for one-third of all wheat exports, and the world’s oil and gas supply, since Russia is a top producer.

And, the Fed knew about the war in March and May when it did its tepid 0.25 and 0.5 percent rate hikes.

Still, the supply crisis has not improved. Production slowed down in 2020 in response to the Covid lockdowns, demand picked up sooner than expected, but when it comes to agriculture or oil and natural gas production, both are still below pre-Covid levels. Whether rates are rising slowly or very fast, if we don’t boost production soon, it might not matter where the Fed sets the interest rate, inflation will still get worse. Stay tuned.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.