Consumer inflation cooled a bit in July down to 8.5 percent from its prior high of 9.1 percent, according to the latest data from the Bureau of Labor Statistics as President Joe Biden touted “zero inflation” at an Aug. 10 press conference for the month of July. The annualized rate is still rather high, but any softening of inflation — that is, a slowdown in the growth rate of prices on a month-to-month basis — is yet another indicator that the U.S. economy has fallen into a recession.

President Biden has maintained that despite two consecutive quarters of negative growth in the Gross Domestic Product (GDP) reported by the Bureau of Economic Analysis, the economy is not necessarily in a recession. But peak inflation would make a much stronger case.

In recessions dating back through the postwar era, peak annualized inflation always occurs right before or at the moment of the recession, and then softens all the way through the next business cycle, where it bottoms, only to start climbing again towards the next recession.

In Feb. 1954, inflation peaked at 1.5 percent annualized for that recession, and then plummeting to slightly negative by Nov. and Dec. 1954 after the recession.

In April 1957, inflation peaked at 3.7 percent for that recession, and then dropped to 0.13 percent by April 1959 after the recession.

In April 1960, inflation peaked at 1.9 percent for that recession, and then dropped to 0.77 percent after the recession.

In Feb. 1970, inflation peaked at 6.4 percent for that recession, and then dropped to Aug. 1972 to 2.95 percent after the recession.

In Nov. 1974, inflation peaked at 12.2 percent for that recession, and then dropped to 5 percent by Dec. 1976 after the recession.

In April 1980, inflation peaked at 14.6 percent for that recession, and then dropped to 9.7 percent by June 1981 after the recession.

In Aug. 1981, inflation again peaked at 10.8 percent for that recession, and then dropped to 2.45 percent by Aug. 1983 after the recession.

In Oct. 1990, inflation peaked at 6.4 percent for that recession, and then dropped to a low of 1.4 percent in March 1998 after the recession.

In Jan. 2001, inflation peaked at 3.7 percent for that recession, and then dropped to 1.1. percent in Feb. 2002 after the recession.

In July 2008, inflation peaked at 5.5 percent for that recession, and then dropped to -1.95 percent in July 2009.

In Jan. 2020, inflation was at its then-current peak of 2.46 when Covid struck for that recession, and then dropped to 0.24 percent by May 2020 just as labor markets were beginning their recovery.

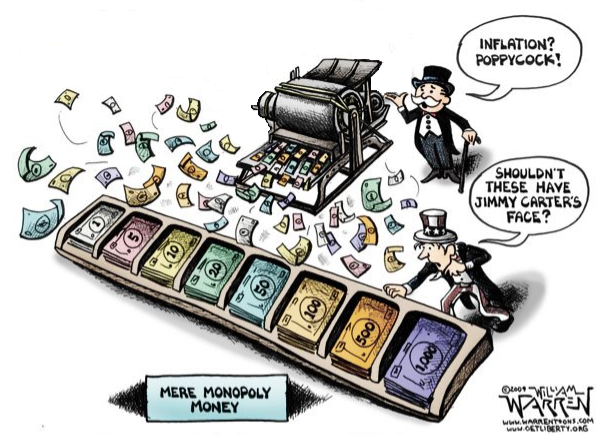

Now, President Biden appears to be arguing that with prices softening for a single month, that peak inflation has been reached. If so, maybe that means we’re in a recession, Mr. President.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.