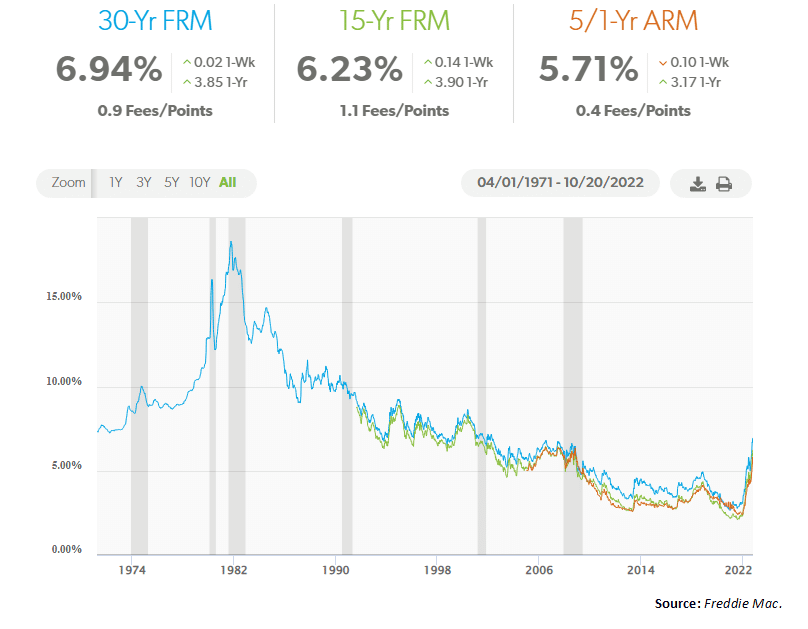

30-year mortgage interest rates continued skyrocketing to an average 6.94 percent on a national basis the week of Oct. 10, according to the latest data by Freddie Mac, nearing the consumer inflation rate reported by the Bureau of Labor Statistics.

As the U.S. economy continues overheating, existing home sales have also collapsed 27.4 percent since Jan. 2022 to 4.7 million annualized, according to National Association of Realtors (NAR) data. This collapse in demand almost certainly is a recession signal, and mirrors 2007 and 2008 collapses annually of existing home sales of 22 percent and 18 percent, respectively, as home sales fell from their 2005 high of more than 7 million to just 4.1 million by 2008.

The housing recession is here. And it explains why inflation consumes your money before you have a chance to spending, thereby lowering real spending. As housing prices have gone to the moon — median home prices are up 15.1 percent compared to a year ago according to Department of Housing and Urban Development data — banks have also demanded much higher interest rates, curtailing demand.

It’s a vicious cycle, but it won’t last forever—provided the inflation the economy is currently experiencing corrects itself in the imminent global recession emanating from the post-Covid supply crunch that was inextricably worsened by Russia’s invasion of Ukraine.

One role that higher interest rates play is to sop up additional dollars that were created, in this case during the Covid pandemic, where Congress and the Federal Reserve borrowed and printed about $6 trillion to shore up demand after the global economy shut down briefly.

But even now, the Federal Reserve has kept its powder dry, only raising banks’ effective lending rates to about 2.56 percent, according to Federal Reserve data, low below consumer inflation and interest rates as American households shoulder the burden of the inflation in a massive transfer of wealth — the so-called hidden tax.

It’s a double-whammy for households with debt, eventually leading to the constriction of spending as credit gets maxed out and prices start dropping. That’s when consumers wait, because prices will be lower tomorrow. In the case of housing, that process is already happening. While home prices are up 15.1 percent annualized, in January that number was 20 percent, indicating that the inflation is working its way through the system.

The question is whether it leads to a decrease in home prices nationally. Usually in a recession, home prices will approach zero percent growth or even cross into negative territory, briefly, or in the exceptional case of the financial crisis and Great Recession, for a spate of years, lasting from 2007 to 2011.

But another factor to consider again is the supply crunch. The population is much larger than it was in 2007, and in some regions housing shortages remain a problem amid high demand for labor. After the housing collapse of more than a decade ago, construction has not kept up with demand. Meaning, prices today might only slow down their rate of growth, but not necessarily go negative.

In the meantime, Americans will continue feeling the pinch from higher lending rates and prices, and likely continue to put off their next home purchase — until after the economic storm is over.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.