Amid a spectacular banking crash over the weekend, the Federal Reserve and U.S. Treasury have intervened to guarantee $230.6 billion of uninsured deposits at Silicon Valley Bank (SVB) totaling $151.6 billion in California and Signature Bank in New York totaling $79 billion.

It goes without saying this is a terrible precedent. There are $20.8 trillion of checkable and time and savings deposits of which $1 trillion is said to be uninsured—that is, those in accounts above the statutory $250,000 limit for Federal Deposit Insurance—in U.S. affiliated banks as of March 9, according to the latest data compiled by the Federal Reserve.

Are the Fed and Treasury planning on guaranteeing all of those deposits, too? Because that’s the door they just opened, without any vote in Congress, utilizing authority from the 2010 Dodd-Frank financial takeover legislation, in particular, 12 U.S. Code Section 5463, “Designation of systemic importance,” which provides that the “Financial Stability Oversight Council… on a nondelegable basis and by a vote of not fewer than ⅔ of members then serving, including an affirmative vote by the Chairperson of the Council, shall designate those financial market utilities or payment, clearing, or settlement activities that the Council determines are, or are likely to become, systemically important.”

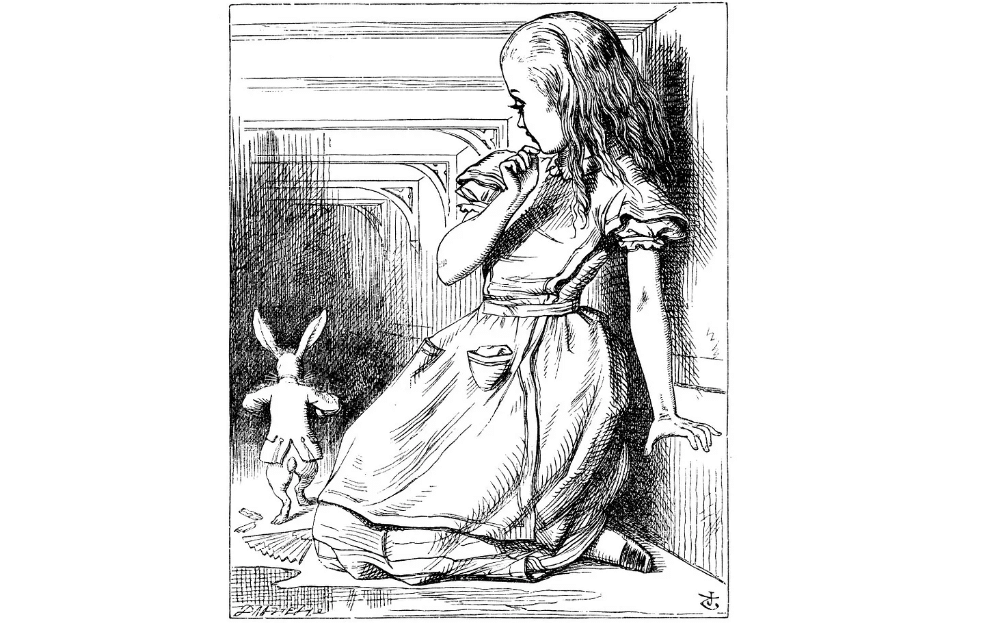

This is exactly what Americans for Limited Government warned would happen back in 2010 in a backgrounder on the Dodd-Frank financial legislation I authored, “Down a Rabbit Hole: The Threat Posed by the Dodd Bill to the Private Sector,” which stated, “the Fed and Treasury Secretary would… have the power to determine which companies fall under the terms of the legislation, and which do not, depending on which activities they together determine to be financial in nature, or incidental thereto. Because of the broad authorities involved, any company or institution in the entire country could be deemed ‘financial’ in nature and subject to seizure by the FDIC because it might default at some point in the future.”

Now, SVB Bank and Signature Bank will be “resolved” by the Federal Deposit Insurance Corporation (FDIC), according to the March 12 joint statement by the U.S. Treasury, Federal Reserve and the FDIC: “After receiving a recommendation from the boards of the FDIC and the Federal Reserve, and consulting with the President, Secretary Yellen approved actions enabling the FDIC to complete its resolution of Silicon Valley Bank, Santa Clara, California, in a manner that fully protects all depositors. Depositors will have access to all of their money starting Monday, March 13. No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer. We are also announcing a similar systemic risk exception for Signature Bank, New York, New York, which was closed today by its state chartering authority. All depositors of this institution will be made whole.”

The statement added, “As with the resolution of Silicon Valley Bank, no losses will be borne by the taxpayer. Shareholders and certain unsecured debtholders will not be protected. Senior management has also been removed. Any losses to the Deposit Insurance Fund to support uninsured depositors will be recovered by a special assessment on banks, as required by law.”

So, the losses will not be borne by taxpayers via votes in Congress, but by “a special assessment on banks, as required by law.” Those assessments under Dodd-Frank come to institutions with $50 billion or more of assets, you know, the ones you have your own savings and investments currently parked at.

What will happen is what always happens when costs on businesses go up—such as when the Federal Reserve hikes interest rates on banks as has become necessary to cool down inflation—they will be passed on to customers via higher fees and higher interest rates on loans.

So, Congress won’t get the bill, but you will. As if getting charged by private financial institutions to pay for socializing the risk of these bailouts makes it any better. At least you can vote a member of Congress out of office when they raise your taxes.

In this case, if you all try to move your assets to a different bank or your mattress, you’ll likely only be contributing to the problem, and if you choose another financial institution, invariably you’ll end up paying the same fees and higher rates. There is no escape under the law. You’re damned if you do, and damned if you don’t.

On one hand, it is possible that for the duration of the imminent recession—of which bank failures are almost certainly yet another red flag—that the SVB Bank and Signature Bank failures were the only systemic risks that were posed. But now, that the door is open, other institutions, likely even larger ones, could be seeking additional ways to shore up their own balance sheets as depositors are almost assuredly spooked—especially at institutions that were overexposed to areas such as cryptocurrency, which have been down amid continued U.S. dollar strength.

In addition, financial institutions that bought U.S. treasuries when interest rates were low appear to have about $620 billion of unrealized losses after interest rates have risen, according to the FDIC.

The danger are that the assessments made under Dodd-Frank would not be nearly enough to forestall a much larger bank run that would threaten the larger institutions.

Unfortunately, under Dodd-Frank, there is no theoretical limit to which financial and non-financial companies will be deemed systemically important in the new 2023 financial crisis. By opening up the Fed’s unlimited capacity to create reserves and credit windows—it just created the so-called Bank Term Funding Program—the entire $20.8 trillion is now on the table, including the $1 trillion of uninsured deposits, thanks to the Federal Reserve and Treasury’s determination to guarantee just 1.1 percent of it to politically favored financial institutions.

We are fully down the rabbit hole now. Curiouser and curiouser!

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.