Another month, and another interest rate hike by the Federal Reserve on July 26, this time to 5.25 to 5.5 percent, to combat sticky inflation that has beleaguered the U.S. economy since 2021 when consumer inflation first rose above 5 percent annualized in June 2021 to 5.4 percent, up to 7.5 percent by Jan. 2022 immediately prior to Russia’s invasion of Ukraine, and peaking at 9.1 percent in June 2022.

Since then, as global oil and other markets have stabilized from the Covid recession, economic lockdowns and production halts from 2020 — wherein demand recovered sooner than supply, resulting in the inflation — annualized inflation has cooled hitting 4.9 percent in April, 4 percent in May and 3 percent in June.

With the price spikes of 2022 largely in the rearview mirror, gasoline is now down 26.5 percent the past 12 months, fuel oil is down 36.6 percent and piped gas service is down 18.6 percent.

Unfortunately, core inflation still remains quite sticky, that is, inflation minus food and energy, still coming in at 4.8 percent the past 12 months, although that is owed no thanks to food, the prices of which have grown by 5.7 percent the past 12 months.

Electricity is still up 5.4 percent the past year.

New cars are up 4.1 percent.

Medical care commodities are up 4.2 percent.

Shelter is up a whopping 7.8 percent.

And transportation services are up 8.2 percent.

With that in mind, the Fed is still hiking rates. Speaking at a press conference following the central bank’s rate hike on July 26, Federal Reserve Chairman Jerome Powell stated, “My colleagues and I are acutely aware that high inflation imposes significant hardship as it erodes purchasing power, especially for those least able to meet the higher costs of essentials like food, housing, and transportation… We have been seeing the effects of our policy tightening on demand in the most interest-rate-sensitive sectors of the economy, particularly housing and investment. It will take time, however, for the full effects of our ongoing monetary restraint to be realized, especially on inflation. In addition, the economy is facing headwinds from tighter credit conditions for households and businesses, which are likely to weigh on economic activity, hiring, and inflation.”

Powell added a word of warning, “Reducing inflation is likely to require a period of below-trend growth and some softening of labor market conditions.”

That is, either an economic slowdown or even a recession. Unemployment is still near record lows, currently at 3.6 percent in June and the Federal Reserve in June projected it to keep rise steadily to 4.1 percent this year and up to 4.5 percent in 2024, an implied 1.3 million jobs losses between then and now, as it sees inflation continuing to cool off from its current levels. And it only sees 1 percent inflation-adjusted economic growth in 2023, 1.1 percent in 2024 and 1.8 percent in 2025.

However, those GDP estimates were from a month ago, and the minutes for the Fed’s July meeting are not yet available. Since then, the Bureau of Economic Analysis reported 2.4 percent inflation-adjusted growth in the second quarter, following a 2 percent increase in the first quarter. So, to hit just 1 percent growth for the entire year would require almost no growth or negative growth going forward.

At the press conference, Powell acknowledged that the June reading of consumer inflation was better than expected, and so was the second quarter economic growth numbers. And he also noted that stronger growth might lead to further inflation, and so is still holding out for further rate hikes at future meetings, stating, “we’re going to look at two additional job reports, two additional CPI reports, lots of activity data, and that’s what we’re going to look at and we’re going to make that decision then. And that decision could mean another hike in September, or it could mean that we decide to maintain at that level…”

Meaning, the current business cycle could still have some life left to it. Usually, disinflation or even deflation coincide with upticks in the unemployment rate, but so far, that hasn’t happened — yet. But if inflation were about to do another set of upticks, necessitating more rate hikes, that could indicate that peak employment could persist for several more months before cooling off, leading to layoffs and the inevitable increase in unemployment.

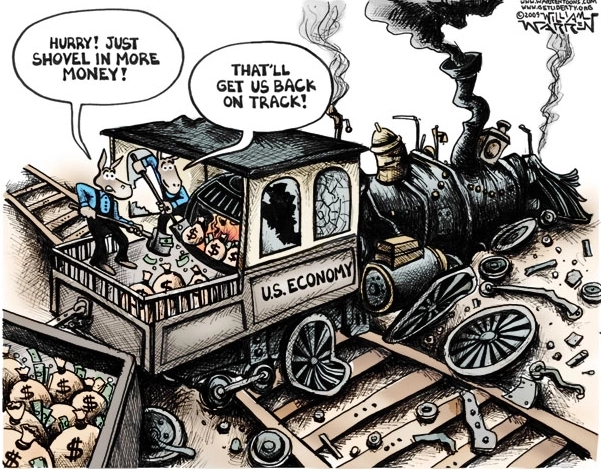

Interestingly, nowhere in the press conference was the 2022 Inflation Reduction Act passed by Congress even mentioned. Apparently, despite its moniker, the legislation, which included green energy subsidies, has nothing to do with monetary policy and the actions that a central bank must take to curb inflation, including reducing or restricting the growth of the M2 money supply, which grew by almost $7 trillion from 2020 to 2022 thanks to Congress spending about that much and the national debt skyrocketing by $8 trillion, to counteract the effects of the economic lockdowns and productions halts and slowdowns from Covid.

Given how much was spent, borrowed and printed into existence, at the same time as production and economic activity was slowing down, the most significant thing Congress could do would be to cut spending and reduce deficits and borrowing, as it did with the most recent debt ceiling increase, which reinstated budget sequestration to reduce the growth of spending by $1.5 trillion below the previous baseline.

But even if spending was held steady — it won’t as Social Security and Medicare spending continue to skyrocket over the coming decade amid the Baby Boomer retirement wave — that still would not soak up all the additional dollars that were created by Congress and the Fed in the first place. The only mechanism we have right now to destroy the dollars are higher interest rates charged to banks, which are passed on to consumers. It’s called the hidden tax for a reason. And Powell is saying as long as the inflation persists, the Fed may keep on hiking, until such time that economic activity and labor markets do respond. Stay tuned.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.