By Rick Manning

The New York Post reports that “nearly 9 million Americans failed to make their first [student loan] payment” after a resumption of payments following a Supreme Court decision overturning President Joe Biden’s attempt to forgive $500 billion of loans.

69 percent in a survey by Intelligent.com say they cannot afford to pay them, others still are waiting until Sept. 2024 when bigger penalties go into effect but there is also about 10 percent who are simply refusing to pay out of some weird sense of entitlement built around a belief that if enough people refuse, there is nothing the federal government can do about it.

Currently, the federal government is owed approximately $1.75 trillion dollars in student debt. And one of the repercussions of government actions to limit the economic impact of Covid is that when the three and one-half year pause on the requirement to repay student loans ended in October of 2023, many borrowers simply got out of the habit of paying.

It is also likely that many who budgeted to pay the student loan debt replaced that debt with a mortgage, car payment or some other form of debt under the assumption that the Biden administration without consulting Congress would wipe the student debt away. They were wrong.

Now with the increased capacity to organize online, and the outsized impact of “internet influencers” surveys indicate that about 900,000 of student loan debtors are simply refusing to repay the debt in a mass civil disobedience effort. But there is no great moral push behind it, instead it is merely a movement built around the idea that they can get away with it, so why not?

The bad news for the Redditors and Tiktokkers who believe they can’t be touched is that they can. The federal government has the Social Security numbers for every student loan debtor. The IRS has the Social Security numbers of every person who has a job or independent business which is not on the black market. All the federal government needs to do to begin collecting these loans is to forcibly deduct the loan amounts as automatic deductions from each of the non-payers paychecks until they come to the government to make other arrangements.

As someone who in his youth went to the personnel department of the company I worked for trying to figure out a way that I could boycott having money taken out of my paycheck over my personal disagreement with a federal government policy that threatened to take over the steel industry, I sympathize with moral attempts to deny the feds money. But taking out a loan, benefitting from the product that you received in exchange for that borrowing, and refusing to repay that loan because you don’t want to must be punished.

At the very least it needs to be reflected on a credit score like a personal bankruptcy, so home lenders and others can make a fully informed decision about the reliability of potential liabilities and price the loans accordingly.

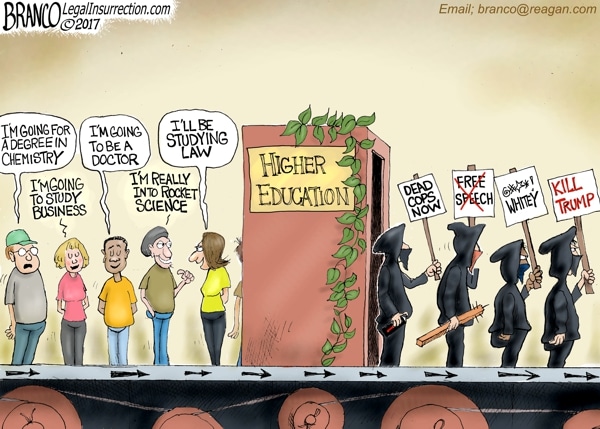

When then-President Barack Obama shoved a federal takeover of student loans into the Obamacare health care legislation, it was inevitable that student loan repayments would become a political football. Those who choose to not pay and have no intention of ever repaying these obligations, must face consequences for this theft from the federal treasury. Perhaps even more importantly, the federal government student loan experiment has failed, and the system needs to be re-privatized with reforms put into place to hold the colleges themselves accountable for defaults by their students and graduates.

Rick Manning is the President of Americans for Limited Government.