Consumer inflation remained elevated in April above the Federal Reserve’s 2 percent target range at 3.4 percent the last twelve months, according to the latest data from the Bureau of Labor Statistics (BLS).

Decreases in electricity (down 0.1 percent) and piped gas service (down 2.9 percent) were offset by increases in gasoline (up 2.7 percent) and fuel oil (up 2.8 percent) as energy was up 1.1 percent in just a month.

Food was unchanged with food at home decreasing 0.2 percent being offset by food away from home increasing at 0.3 percent.

New vehicles were down 0.4 percent and used vehicles were down 1.4 percent.

Apparel was up 1.2 percent.

Medical care commodities were up 0.4 percent.

Shelter was up another 0.4 percent.

Transportation services were up 0.9 percent—and up 11.2 percent the last twelve months.

And medical care commodities were up another 0.4 percent.

Minus food and energy, the overall number for the month was a 0.3 percent price increase, which was the same as with food and energy still included in the number.

It’s still above the Fed’s normalization target of 2 percent for inflation. What’s worse, overall prices are up 18.8 percent since Feb. 2021 while personal incomes are only up 17.6 percent, although another report is due out later this month from the Bureau of Economic Analysis as incomes try to catch up.

Part of the problem was the Fed waited too long to raise interest rates. Inflation was already 7.5 percent in Jan. 2022 prior to Russia’s invasion of Ukraine but the central bank was still at a near-zero percent Federal Funds Rate after Covid.

If the Fed had been hiking in 2021 as prices were rocketing up, inflation might not have gotten as high as it did. On the other hand, it could have moved the arrival of a full-on recession to sooner rather than later, but the worst might already be behind us.

This is what happens when you try to sweep problems under the rug. Instead, with the 10-year, 2-year spread between treasuries still inverted, meaning upheaval in labor markets may yet be on the horizon.

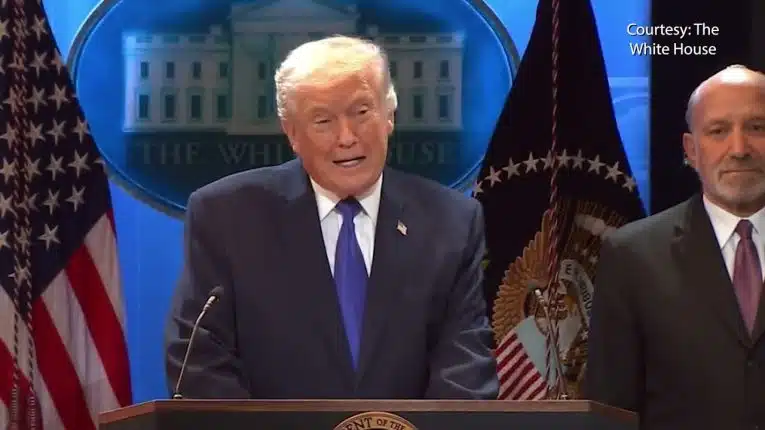

Leaving aside some of the policy elements at play, sentiments about the state of the economy are definitely solidifying. Eventually, incomes will catch up to prices — right now the American people on average have been underwater since Jan. 2022 when looking at both metrics — but it might be too late to save President Joe Biden’s struggling reelection bid.

It seems doubtful the Biden economy will be able to get back to 2 percent inflation before November.

The last inflation report before the election will come out Oct. 10, but voter attitudes about where they are financially will have set in long before then. Right now, the pain is real, and the American people know it.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.