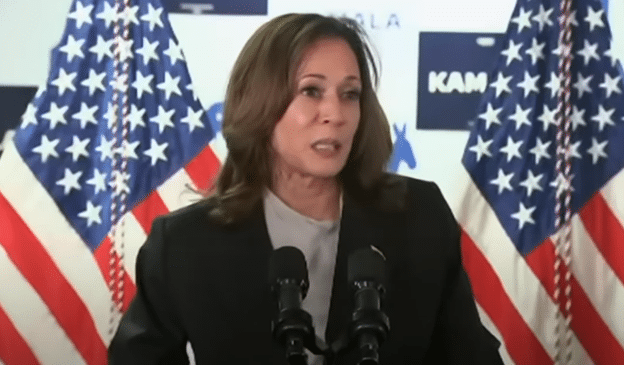

With President Joe Biden no longer on the Democratic Party ticket, attention is now shifting to the new presumptive Democratic nominee, Vice President Kamala Harris. While she may indeed get a bump in the polls against former President Donald Trump taken in the aftermath of Biden’s withdrawal from the race, one thing that won’t change anytime soon is Harris will be inheriting the Biden economy and the policies that led to incipient inflation the past four years.

To summarize, consumer prices are up 18.76 percent since Feb. 2021, even with the rate of increase slowing down from its 9.1 percent annual peak in June 2022 to 3 percent today, according to data compiled by the Bureau of Labor Statistics.

As a result, 30-year mortgage rates have spiked from about 2.7 percent when Biden and Harris entered office, to a peak of 7.8 percent in Oct. 2023 and still at a pretty high 6.77 percent today.

And, the growth of consumer credit peaked at 9.9 percent annualized in April 2022, but as households max out their credit cards and the economy has overheated, has slowed to 2 percent in May 2024 — as has the economy.

In the meantime, personal incomes including government transfer payments are only up 18.1 percent, according to Bureau of Economic Analysis data. Meaning, American households are objectively worse off than they were four years ago financially speaking—and that will almost certainly continue to rub off on Harris just as it has Biden.

Namely, because Harris fully supported the spending torrent that occurred not just during Covid but also after, with almost $7 trillion printed, borrowed and spent into existence to counter the temporary economic lockdowns.

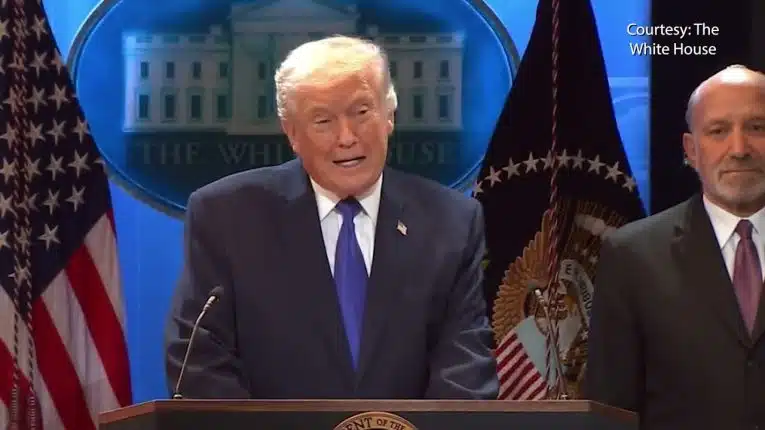

Because $2.2 trillion spent on the CARES Act in 2020 was not enough for the then-incoming Biden administration, no, even as 16 million out of the 25 million jobs temporarily lost during Covid were already recovered by Jan. 2021, Biden and Harris wanted an economic stimulus of their own to take “credit” for.

And so, not to be outdone, another $1.9 trillion for the American Rescue Plan Act of 2021 was ordered up by Congress and signed into law by Biden.

But why stop there? In the so-called Inflation Reduction Act, yet another $891 billion of green energy subsidies and other spending were also signed into law by Biden, all supported by Harris.

In fact, on April 29 began a multi-state Economic Opportunity Tour in Atlanta, Ga. directed at shoring up black voters in swing states, with her pitch being “we are in the process of putting a lot of money in the streets of America…” No kidding.

Harris put forward the pitch including with the Inflation Reduction Act’s subsidies, “what we are doing with the inflation reduction act which is about at least a trillion dollars invested in the climate but a clean energy economy…”

Harris added, “[O]ne of the compelling reasons for me to start this tour now and to ask all the leaders here for help in getting the word out about what is available to entrepreneurs and small businesses is because we are in the process of putting a lot of money in the streets of America for this growth.”

Inflation has always been an albatross for incumbent presidents when they go back to the polls, particularly when it outpaces incomes for any considerable length of time. Just ask Gerald Ford, Jimmy Carter and George H.W. Bush.

Under Nixon and Ford, from Jan. 1973 to Jan. 1977, consumer prices grew a whopping 37.4 percent, but personal income kept pace, growing 44.8 percent. The problem was that from March 1974 to May 1975, inflation was outpacing incomes.

Under Carter, overall consumer prices increased 45.8 percent, and incomes were up 55.4 percent, but from Aug. 1979 to Oct. 1980, inflation was growing faster than incomes.

And under the first Bush, consumer prices increased 17.2 percent while incomes barely outpaced inflation growing at 21.4 percent. However, from Oct. 1990 to Sept. 1991, inflation was outpacing incomes.

The consistent outcome is that these were all one-term presidents. Whenever inflation outpaces incomes for any significant length of time, it has harmed household budgets, and then it shows up at the polls when the incumbent party returns, even when there is a different candidate, as in the case of Ford coming in after Nixon for the 1976 election (even if Nixon hadn’t resigned he would have been term-limited).

And so, there will be a perhaps temporary boost for Harris as she hits the campaign trail, but once she is in play and we get past the convention, harsh economic realities will once again set in — and voters will only have one person to blame when they get to the polls. Stay tuned.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.