Consumer prices increased slightly in June by 0.3 percent to an annual rate of 2.8 percent, but not because of imports, the latest data from the Bureau of Labor Statistics shows, with import prices only rising 0.1 percent. In the past year, import prices are actually down 0.2 percent.

The Federal Reserve has been holding interest rates at an elevated level since 2022 to deal with the crippling inflation that followed the Covid recession and global supply crunch, wherein production did not catch up to demand fast enough following the global economic lockdowns.

The Fed raised the federal funds rate to 5.25 percent to 5.5 percent by the summer of 2023 and then performed three rate cuts last year down to 4.25 percent to 4.5 percent by December 2024.

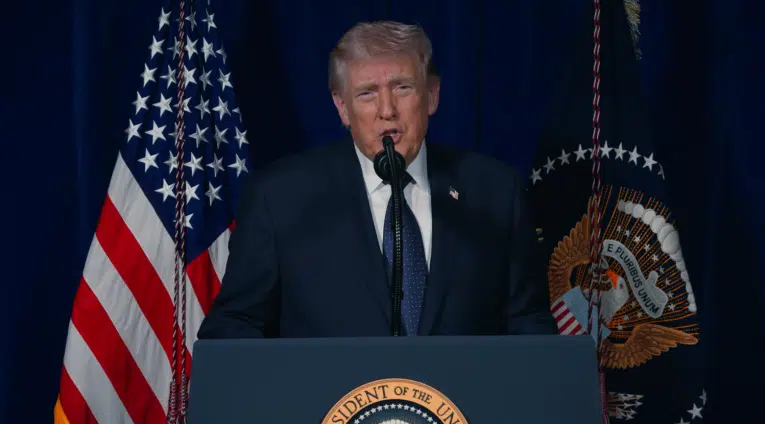

Now, as inflation has continued declining, the Fed has so far kept rates steady in 2025 while Fed Chairman Jerome Powell says he is waiting for how President Donald Trump’s new tariffs he has been imposing since assuming office on Jan. 20 impact prices.

So far, however, there has been no discernable price increases from the tariffs following implementation of much of the President’s initial tariffs through April, and that’s with the 10 percent global baseline tariff in effect, 25 percent tariffs on Mexico and Canada for non-compliant USMCA goods, a 10 percent tariff on Canadian oil, a 25 percent tariff on vehicles and automobile parts, a 30 percent tariff on Chinese goods and a 50 percent tariff on steel and aluminum (excepting the UK which is at 25 percent).

The President has also imposed a August 1 deadline looming for implementation of many of the other tariffs to take effect as the administration issues its letters to nations on the new rates, plus a 30 percent tariff on Mexico and the European Union, a 35 percent tariff on Canada, a 50 percent tariff on Brazil and a 50 percent tariff on copper.

There are also 100 percent tariffs on Russia that could come if it fails to agree to a ceasefire in Ukraine and another 200 percent on pharmaceuticals although the date is not certain there.

Suffice to say, the tariffs on Mexico, Canada and China are already largely in effect, plus the 10 percent global baseline, and we’re still not seeing major jumps in prices. This is generally not too surprising, considering the minimal impacts that import prices have on the overall consumer price index but also one must take into account any weakening of foreign currencies that can also offset the price impacts of the tariffs.

Other factors have included gradually increasing unemployment since January 2023, which is up more than 1.2 million that can have a lessening of demand impact on overall prices, plus the negative growth in the first quarter following consumers slowing down credit allocation.

So far, the price hikes the President’s political opponents in the Democratic Party and also a couple in the Republican Party have proven to be incorrect. Gloom and doom can be used to frighten people but what actually happens is what truly matters.

In the meantime, President Trump is coming out on top, able to reorient U.S. trade policy while the economy is buzzing along without too much price volatility, while the economy appears resilient and now buoyed by the new tax cuts from the One Big Beautiful Bill Act. And the country still awaits lower interest rates, although the Fed could be keeping its powder dry for unemployment to increase more. Stay tuned.

Robert Romano is the Executive Director at Americans for Limited Government Foundation.