Democrats believe shutting down the government always benefits Democrats—and they’ve got the polling to prove it, with a Washington Post poll taken Oct. 1 finding more Americans blame Republicans for the shutdown than Democrats, with 47 percent blaming President Donald Trump and Congressional Republicans, and only 30 percent blaming Congressional Democrats.

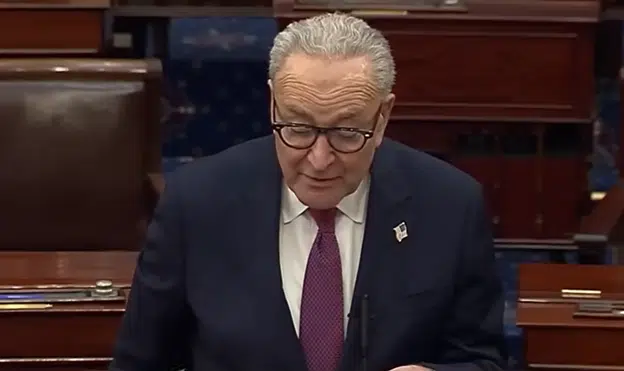

That, even though Senate Democrats are in fact blocking a vote for the clean continuing resolution that would reopen the government on the floor of the Senate.

The last vote had 55 Senators voting in favor of the Republican-led proposal to simply keep spending at current levels through Nov. 21 to provide more time for appropriators to talk, including Pennsylvania Democratic Sen. John Fetterman, Nevada Democratic Sen. Catherine Cortez Masto of Nevada and Maine Independent Sen. Angus King.

And even though Senate Democrats are otherwise demanding Senate Democrats are holding out for a $349.8 billion permanent expansion of Obamacare subsidies known as premium tax credits and another $270 billion to repeal sections of the One Big Beautiful Bill Act that bar illegal aliens from getting Medicare, Medicare or Obamacare insurance exchange subsidies and otherwise were directed to remove waste, fraud and abuse from these programs.

Specifically, Sec. 2141 of S. 2882, Senate Democrats’ latest continuing resolution proposal that was defeated only garnering 47 votes, states, “Subtitle B of title VII of the Act titled ‘An Act to provide for reconciliation pursuant to title II of H. Con. Res. 14’ (Public Law 119–21) is repealed and any law or regulation referred to in such subtitle shall be applied as if such subtitle and the amendments made by such subtitle had not been enacted.”

Here are all the sections for Subtitle B of title VII of the One Big Beautiful Bill Act that Democrats want gone:

Subtitle B—Health

CHAPTER 1—MEDICAID

SUBCHAPTER A—REDUCING FRAUD AND IMPROVING ENROLLMENT PROCESSES

Sec. 71101. Moratorium on implementation of rule relating to eligibility and enrollment in Medicare Savings Programs.

Sec. 71102. Moratorium on implementation of rule relating to eligibility and enrollment for Medicaid, CHIP, and the Basic Health Program.

Sec. 71103. Reducing duplicate enrollment under the Medicaid and CHIP programs.

Sec. 71104. Ensuring deceased individuals do not remain enrolled.

Sec. 71105. Ensuring deceased providers do not remain enrolled.

Sec. 71106. Payment reduction related to certain erroneous excess payments under

Medicaid.

Sec. 71107. Eligibility redeterminations.

Sec. 71108. Revising home equity limit for determining eligibility for long-term care

services under the Medicaid program.

Sec. 71109. Alien Medicaid eligibility.

Sec. 71110. Expansion FMAP for emergency Medicaid.

SUBCHAPTER B—PREVENTING WASTEFUL SPENDING

Sec. 71111. Moratorium on implementation of rule relating to staffing standards for

long-term care facilities under the Medicare and Medicaid programs.

Sec. 71112. Reducing State Medicaid costs.

Sec. 71113. Federal payments to prohibited entities.

SUBCHAPTER C—STOPPING ABUSIVE FINANCING PRACTICES

Sec. 71114. Sunsetting increased FMAP incentive.

139 STAT. 78 PUBLIC LAW 119–21—JULY 4, 2025

Sec. 71115. Provider taxes.

Sec. 71116. State directed payments.

Sec. 71117. Requirements regarding waiver of uniform tax requirement for Medicaid provider tax.

Sec. 71118. Requiring budget neutrality for Medicaid demonstration projects under

section 1115.

SUBCHAPTER D—INCREASING PERSONAL ACCOUNTABILITY

Sec. 71119. Requirement for States to establish Medicaid community engagement requirements for certain individuals.

Sec. 71120. Modifying cost sharing requirements for certain expansion individuals under the Medicaid program.

SUBCHAPTER E—EXPANDING ACCESS TO CARE

Sec. 71121. Making certain adjustments to coverage of home or community-based

services under Medicaid.

CHAPTER 2—MEDICARE

SUBCHAPTER A—STRENGTHENING ELIGIBILITY REQUIREMENTS

Sec. 71201. Limiting Medicare coverage of certain individuals.

SUBCHAPTER B—IMPROVING SERVICES FOR SENIORS

Sec. 71202. Temporary payment increase under the Medicare physician fee schedule to account for exceptional circumstances.

Sec. 71203. Expanding and clarifying the exclusion for orphan drugs under the Drug Price Negotiation Program.

CHAPTER 3—HEALTH TAX

SUBCHAPTER A—IMPROVING ELIGIBILITY CRITERIA

Sec. 71301. Permitting premium tax credit only for certain individuals.

Sec. 71302. Disallowing premium tax credit during periods of Medicaid ineligibility due to alien status.

SUBCHAPTER B—PREVENTING WASTE, FRAUD, AND ABUSE

Sec. 71303. Requiring verification of eligibility for premium tax credit.

Sec. 71304. Disallowing premium tax credit in case of certain coverage enrolled in during special enrollment period.

Sec. 71305. Eliminating limitation on recapture of advance payment of premium tax credit.

SUBCHAPTER C—ENHANCING CHOICE FOR PATIENTS

Sec. 71306. Permanent extension of safe harbor for absence of deductible for telehealth services.

Sec. 71307. Allowance of bronze and catastrophic plans in connection with health savings accounts.

Sec. 71308. Treatment of direct primary care service arrangements.

CHAPTER 4—PROTECTING RURAL HOSPITALS AND PROVIDERS

Sec. 71401. Rural Health Transformation Program.

That is the reason for the government shutdown: The Republican continuing resolution is comparatively clean and does not impact these provisions of law at all. It simply funds the government under existing laws through Nov. 21.

Meaning, the Democrats who are blocking it and insisting on changes are the ones responsible for the shutdown — whether the public is aware of it or not. Therefore, Democrats should derive no legal benefit from the current shutdown, even if it benefits them politically.

The Washington Post shows similar support for Democrats over the years in the 1995-1996 government shutdown, the 2013 government shutdown and the 2018-2019 government shutdown. They can’t lose!

Apparently, Democrats believe past support plus a lack of public awareness of what Congress is currently voting on grants them a license to lie about it — especially on Obamacare and other federal health programs being given to illegal aliens, a long-standing controversy.

That’s the message Democrats are sending to Republicans on Capitol Hill right now. That they will never negotiate in good faith on this issue as evidenced by their unbelievable denials of what’s clearly written in their own bill (see above) and especially their insistence that Republicans now vote for the provisions of the Democrats’ bill that clearly restore health insurance coverage to illegal aliens.

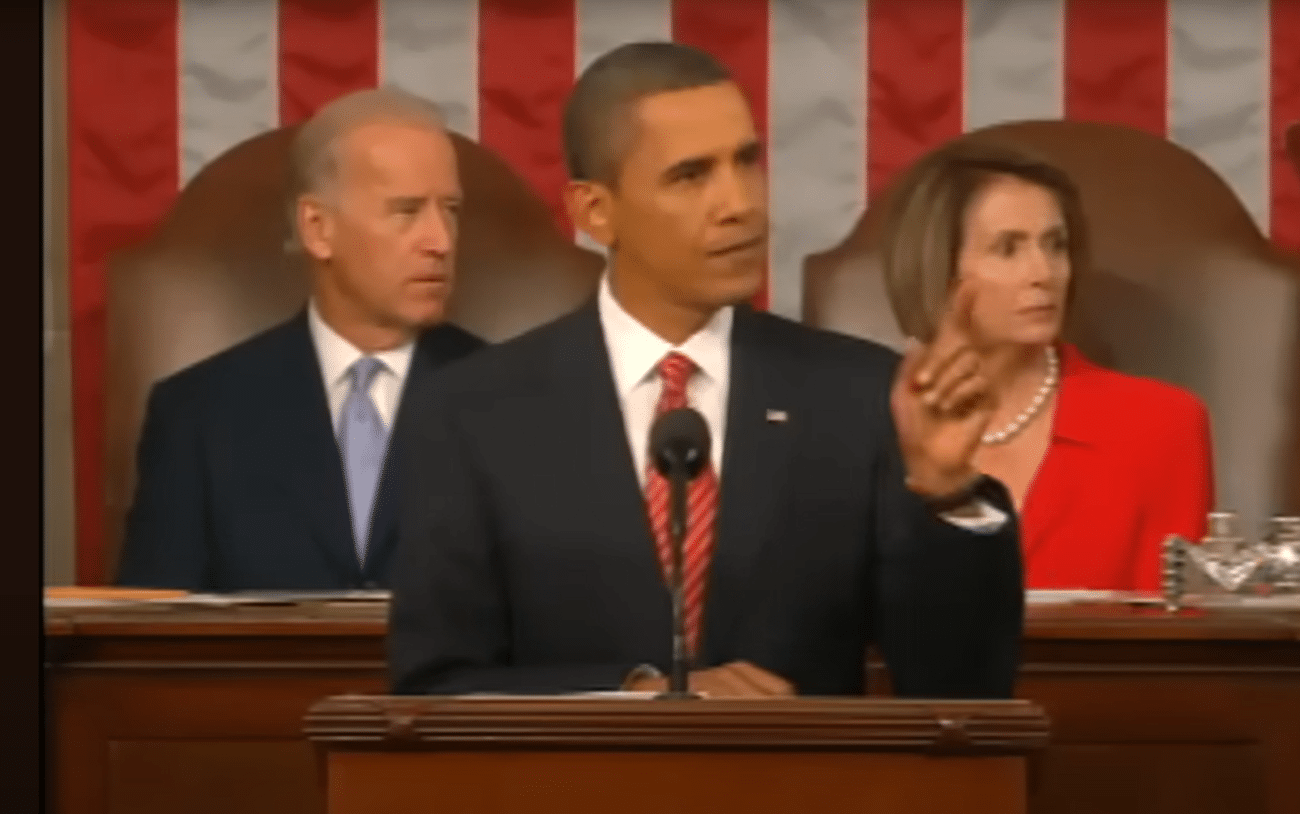

As U.S. Rep. Joe Wilson (R-S.C.) told then-President Barack Obama in 2009 when Obama insisted no health benefits would go to illegal aliens: “You lie!”

Now, Republicans will accept the lie, formalize it and codify it — and they’ll like it. President Donald Trump would never sign the bill adding illegal aliens to the taxpayer-funded health rolls, but no matter, just keep lying. In contemporary parlance, they are gaslighting the American people.

And if Democrats’ own supporters still cannot tell the difference after 16 years, why start telling the truth now?

Robert Romano is the Executive Director of Americans for Limited Government.