By Robert Romano — Right now, in Europe, stronger economic powers like Germany are deciding whether or not to fire up the presses at the European Central Bank to monetize the debts of their southern neighbors, importing their inflation in return.

By Robert Romano — Right now, in Europe, stronger economic powers like Germany are deciding whether or not to fire up the presses at the European Central Bank to monetize the debts of their southern neighbors, importing their inflation in return.

So far, Chancellor Angela Merkel has insisted on keeping to the original criteria that founded the Eurozone, which prohibits such bailouts. As a condition of adopting Euro, member countries pledged to keep their deficits within 3 percent of the Gross Domestic Product (GDP).

Instead, countries racked up debts so numerous that Europe’s financial system eventually could not even keep up with the demand for government credit, forcing a showdown between Euro members over whether to monetize the debt or not.

We should be having the same debate here in the U.S. in 2012.

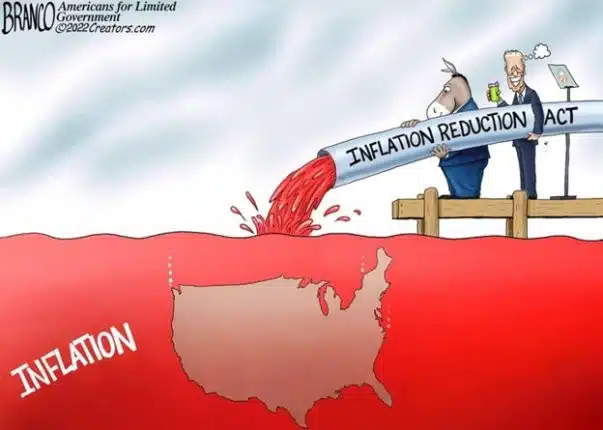

The American people should hear from both Mitt Romney and Barack Obama about whether we should continue the disgrace of printing money to refinance and expand the debt, using ever-spiraling credit to cover ever-widening spending obligations.

We should hear from our leaders whether they think it’s sustainable or not. Whether the Federal Reserve can indefinitely purchase mountains of U.S. treasuries, now over $1.6 trillion worth, and forever keep interest rates locked at near-zero percent rates like Japan to facilitate cheap borrowing by the federal government.

We have to decide if the dollar can continue well into the future as the world’s reserve currency as we force the rest of the world, including our allies, to accept our inflation. We should ask what lengths we are willing to go to keep that status. Will we knock non-dollar reserve states back into the Stone Age to keep them trading oil in our currency?

Let that be the debate.

For, if both sides agree, that we can just monetize forever without any consequence, then there really is no choice in this election. Why not just do as Paul Krugman and other Keynesian economists suggest, and just print and borrow money to boost aggregate demand?

Why not just throw money from helicopters, as Milton Friedman once joked?

But, if at least one candidate believes that it is not sustainable, then now is the time to level with the American people. If printing money to ever expand and refinance the national debt is untenable over the longer term, then surely the level of spending today is far too high.

Obama has already made his views known. He would spend, borrow, and print another $10 trillion in debt for the next ten years, until the national debt rises to over $25 trillion.

So, it falls on Mitt Romney, if he believes our spending is truly unsustainable, to reject monetization.

Because the only thing that could make our trajectory unsustainable, as in Europe, is if printing money forever to refinance and expand the debt cannot last without consequence.

If we can, then Obama’s right. But if not, as it appears is the case in Europe, it may not be long before the debt crisis spreads here, too.

Robert Romano is the Senior Editor of Americans for Limited Government.