By the end of September, President Joe Biden and Congressional Democrats are hoping to end fiscal year 2021 with a bang, unleashing a torrent of $4 trillion of new spending via a $1.2 trillion infrastructure spending bill that includes $550 billion of new spending, and its add-on $3.5 trillion plan that will include expanded paid family and medical leave, child care, universal pre-K and tuition-free community college, and more child and household tax credits. Since the infrastructure bill has already passed the Senate on regular order, and the $3.5 trillion is being done on reconciliation, all that remains are simple majority votes — two in the House, and one in the Senate — before Sept. 30 when the fiscal year ends. In fact, Democrats have imposed a hard Sept. 27 deadline on getting both bills to President Biden’s desk. Since Jan. 2020, there is $5.2 trillion of new debt, much of it financed by the Federal Reserve’s digital printing presses, after the $2.2 trillion CARES Act signed by former President Donald Trump, the $900 billion phase four legislation signed by Trump and the $1.9 trillion Biden stimulus. That was $5 trillion of new spending. As a result, the M2 money stock measured by the Federal Reserve has increased $5.1 trillion from $15.4 trillion to $20.5 trillion. Unsurprisingly, inflation has increased dramatically, registered 5.3 growth over 12 months in June and July, and 5.2 percent in August after big rallies in oil and other energy commodities following a massive temporary deflation in 2020 where oil prices went all the way to zero. And yet, the monthly inflation rate has slowed to 0.3 percent, down two consecutive months from its high in June at 0.9 percent. Now big spending Democrats are taking it as a green light for another gargantuan splurge of spending as a group of 15 Nobel laureate economics professors on Sept. 15 claimed the $3.5 trillion spending bill would actually “ease longer-term inflationary pressures.”

By the end of September, President Joe Biden and Congressional Democrats are hoping to end fiscal year 2021 with a bang, unleashing a torrent of $4 trillion of new spending via a $1.2 trillion infrastructure spending bill that includes $550 billion of new spending, and its add-on $3.5 trillion plan that will include expanded paid family and medical leave, child care, universal pre-K and tuition-free community college, and more child and household tax credits.

Since the infrastructure bill has already passed the Senate on regular order, and the $3.5 trillion is being done on reconciliation, all that remains are simple majority votes — two in the House, and one in the Senate — before Sept. 30 when the fiscal year ends.

In fact, Democrats have imposed a hard Sept. 27 deadline on getting both bills to President Biden’s desk.

In addition, Congress is still working on a temporary continuing resolution and the debt ceiling just expired in August.

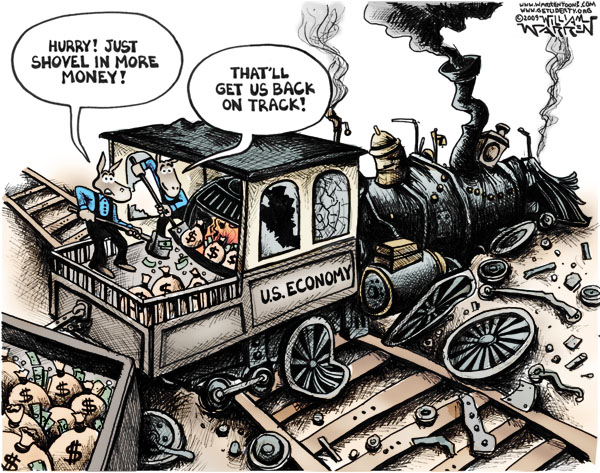

Since Jan. 2020, there is $5.2 trillion of new debt, much of it financed by the Federal Reserve’s digital printing presses, after the $2.2 trillion CARES Act signed by former President Donald Trump, the $900 billion phase four legislation signed by Trump and the $1.9 trillion Biden stimulus. That was $5 trillion of new spending.

As a result, the M2 money stock measured by the Federal Reserve has increased $5.1 trillion from $15.4 trillion to $20.5 trillion.

Unsurprisingly, inflation has increased dramatically, registered 5.3 growth over 12 months in June and July, and 5.2 percent in August after big rallies in oil and other energy commodities following a massive temporary deflation in 2020 where oil prices went all the way to zero.

And yet, the monthly inflation rate has slowed to 0.3 percent, down two consecutive months from its high in June at 0.9 percent. Now big spending Democrats are taking it as a green light for another gargantuan splurge of spending as a group of 15 Nobel laureate economics professors on Sept. 15 claimed the $3.5 trillion spending bill would actually “ease longer-term inflationary pressures.”

“Perhaps the Nobel committee that awarded these economists should ask for their awards back, because they appear to be nothing more than politicians manipulating statistics on behalf of a failed president,” Americans for Limited Government President Rick Manning commented.

“Since the letter came out the day after the August consumer price index number, which showed the highest inflation since 2008, it is clearly aimed at Democrat senators like Joe Manchin who have expressed legitimate concerns about the inflationary impacts of the massive additional debt that President Biden seeks to incur,” Manning added.

In a Sept. 2 Wall Street Journal oped by Sen. Joe Manchin (D-W.Va.), he outlined his opposition to the current $3.5 trillion spending bill (he already voted in favor of the $1.2 trillion infrastructure bill): “I have always said if I can’t explain it, I can’t vote for it, and I can’t explain why my Democratic colleagues are rushing to spend $3.5 trillion… I, for one, won’t support a $3.5 trillion bill, or anywhere near that level of additional spending, without greater clarity about why Congress chooses to ignore the serious effects inflation and debt have on existing government programs.”

So far, though, House Democrats have not backed off their $3.5 trillion price tag for the second round of spending, and are hoping to leverage the $1.2 trillion infrastructure bill in limbo. But that strategy could be backfiring on House Speaker Nancy Pelosi (D-Calif.), since it appears Manchin would rather nothing pass than the entire $4 trillion spending package.

This will be the second budget reconciliation bill this year. The reason that’s possible is because Senate parliamentarian Elizabeth MacDonough effectively changed Senate rules with regards to budget reconciliation, allowing only requires 51 votes to pass spending legislation in the same fiscal year.

The provision of law being invoked is 2 U.S. Code § 635 allowing for amendments to the budget resolution: “At any time after the concurrent resolution on the budget for a fiscal year has been agreed to pursuant to section 632 of this title, and before the end of such fiscal year, the two Houses may adopt a concurrent resolution on the budget which revises or reaffirms the concurrent resolution on the budget for such fiscal year most recently agreed to.”

Previously, both parties in the Senate had informally agreed that meant just one budget resolution a year, and that amendments could be made before it was signed into law. Now Congress is getting at least two bites at the apple per fiscal year.

That seems be why Democrats are demanding the legislation before Sept. 27. If the $3.5 trillion bill fizzles, watch for Democrats to maneuver at the last minute to produce a scaled back version, claiming they’ll get the rest of it done next year — with two fresh opportunities to pass budget bills in fiscal year 2022—inflation or no inflation. Stay tuned.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government.