Adjusted for inflation, the U.S. economy has not grown above 3 percent since 2005. That’s a near nine-year losing streak, marked by a financial crisis, record deficits, quantitative easing, and ultra-low interest rates.

As a result, we have seen three wave elections in as many years in 2008, 2010, and now, 2014, with Democrats being swept in and, now, out of power. The sort of political volatility thought to only be a once-in-a-generation event has now become common place.

In a September 25-30 Gallup survey, 86 percent of Democrats and 91 percent of Republicans said the economy was their top issue. 89 percent of Democrats and 83 percent of Republicans said good paying jobs was, too.

Six years after the financial crisis, nobody was impressed with the recovery — which has been the worst since the end of World War II.

With that in mind, as Republicans prepare to take the majorities in the 114th Congress, they too will begin to share responsibility for the economic malaise in the coming years — should they fail to foster an environment conducive to growth.

When the economy fails, politicians are thrown out on their ears. No party is immune.

Which is why writers such as Daniel Henninger at the Wall Street Journal warn, “The ascendant GOP congressional majority needs to do one thing: Liberate the locked-in U.S. economy.”

But how?

Glenn Hubbard, former George W. Bush Council of Economic Advisors chairman and Dean of Columbia Business School called for a bipartisan, grand deal on growth that would include infrastructure spending, which the Obama administration wants, and corporate tax reform, which congressional Republicans want.

Former Pimco founder and head Bill Gross called for more deficit spending to jumpstart the economy: “The real economy needs money printing, yes, but money spending more so, and that must come from the fiscal side — from the dreaded government side — where deficits are anathema and balanced budgets are increasingly in vogue.”

New York Times columnist Paul Krugman for his part called for even more fiscal and monetary stimulus.

Missing from each analysis, however, is an examination of what caused the financial crisis in the first place. That is, the rapid expansion of household debt.

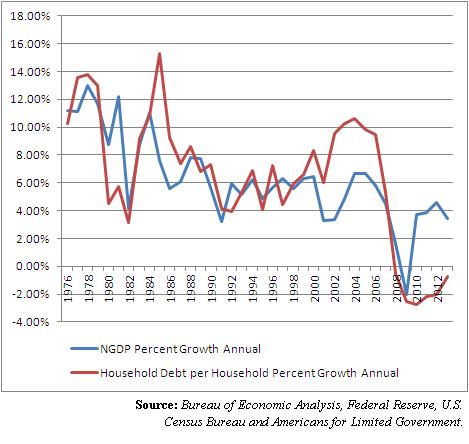

From 1976 onward, household debt per household — that is, overall household debt as measured by the Federal Reserve, divided by the number of households, measured by the Census Bureau — has served a fairly accurate proxy for the nominal growth of the U.S. economy.

When people borrow more, they are spending more, and the economy grows. When they slow down borrowing, so too does spending and the economy.

And then in the mid-2000’s, it took a nose dive after home values became unsustainable and millions could no longer afford their mortgages. The American people had maxed out their credit and could leverage no further. The rest is history.

Household debt has been contracting every year since 2008, and the economy has not recovered since.

So, what would each of the above proposals do to help people get their household balance sheets in order, or otherwise, find a good-paying job or get a raise to have the same effect?

Obama’s infrastructure spending certainly won’t create demand for Americans to take on more debt. At best, it might create some heavy and civil engineering construction jobs, but those only employ about 918,000 people right now. So that’s not going to help the millions of other Americans struggling right now.

Corporate tax reform, while a good idea, depending on how it is done may or may not have a job creating or income-raising impact. For example, if focused on the U.S.-based companies that employ Americans, it could very well help. If focused on transnational companies that make stuff overseas, probably less so.

On that count, we’d eliminate taxes on every business based in the U.S. that exclusively employs Americans. That would be an incentive to create jobs here, and boost incomes.

Of course, it’s not a panacea. More needs to be done to lower the cost of doing business in the U.S., including reducing regulatory burdens imposed by Obamacare, the EPA, and other agencies.

But even then, the debt weighing down Americans remains the root of the problem.

As far as more deficit-spending goes or even monetary expansion, neither of those have helped so far to stabilize household budgets, let alone boosted demand for taking on debt.

The national debt has expanded an average 10 percent a year since the beginning of 2008. By the time Obama leaves office, it will have doubled, growing more than $10 trillion in eight short years. On top of that, much of it was monetized, with the Federal Reserve purchasing some $3.7 trillion of U.S. treasuries and agency mortgage-backed securities.

Both were unprecedented, and both did almost nothing except increase future interest owed obligations on taxpayers. Besides that, QE is still largely sitting in a vault. It did not jumpstart borrowing by households.

So what to do? Everything that lowers the cost of doing business, creates jobs here, and boosts incomes. That is what will help Americans to clear their balance sheets, and stimulate demand again. Americans will start taking on more debt when they feel confident about their financial future, and that will happen when businesses feel confident to expand again.

One way or another, America needs to get its economy moving again. Because if it doesn’t, voters will once again show whichever party is in power the door.

Robert Romano is the senior editor of Americans for Limited Government.