By Rick Manning

The office discussions at Americans for Limited Government are lively with voices often raised over various interpretations of what the news of the day means. While none of us are economists and we don’t even belong to the Holiday Inn Rewards Program, we still have extended and sometimes loud discussions on the meaning of different economic events.

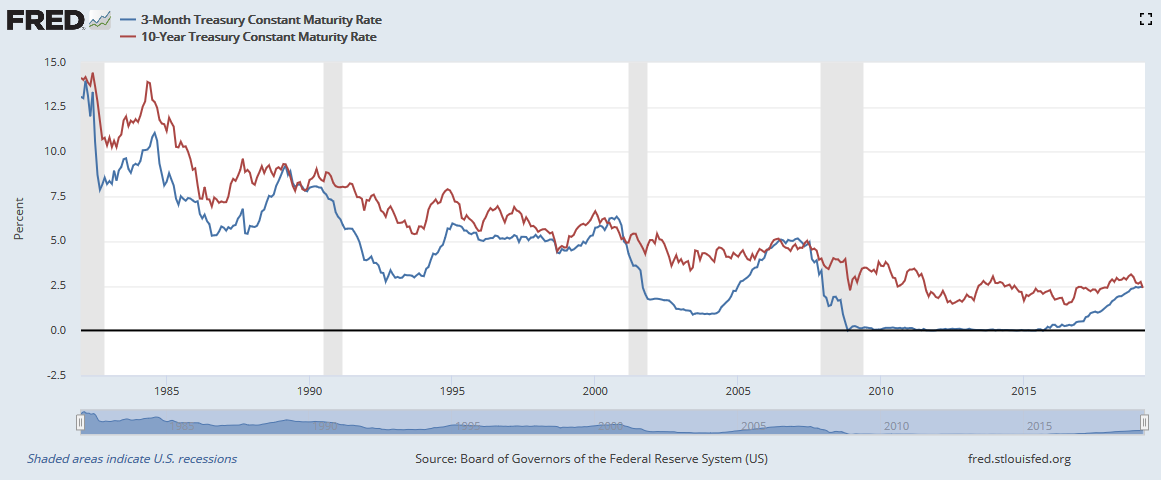

Last week, a future recession signal was hit when the interest rate paid by a 3 month Treasury bond went higher than the interest rate paid for a 10 year Treasury bond.

Wait, don’t go away, this is really easy. It is logical that the interest rate investors would seek for a short term debt would be low, while investors would seek a higher return for parking their money in a ten year investment. After all, the three month bond goes away rapidly so if interest rates rise higher than what you are earning on your investment, you are not stuck with a loser for long (in this case a maximum of 3 months.) But if you buy a 10 year bond which only pays 2.39 percent interest as was the case on March 29, when the 3 month bond is paying 2.43 percent, it typically says that you expect interest rates to drop long-term due to actions by the Federal Reserve to stimulate the economy by lowering interest rates.

And that is why many in the economic forecasting community are predicting economic slowing or a recession in the next eighteen months. CBS reported, “Simply, the yield curve tends to invert before economic downturns. Economist Will Denyer of Gavekal Research notes that the yield curve has flattened, and eventually inverted, before every U.S. recession since the mid-1950s.”

Robert Romano, Americans for Limited Government’s Vice President of Public Policy is a pure chartist and shares this view, with the caveat that the 10-year, 2-year has not inverted just yet which could mean the recession predictions are premature. He wrote, “Assuming such an inversion happened soon, that might mean a recession might be just beginning in Oct. 2020. But if it doesn’t happen soon, it’s worth noting that there hasn’t been a recession in modern history without such an inversion.” If it does invert soon, he stated that the Federal Reserve’s interest rate hikes could not have been timed any more effectively to potentially force a recession prior to the 2020 election.

I however do not believe a recession is inevitable.

First, the charts themselves tell us something about the way the 3 month and 10 year yield curves have worked. As short term rates rose, the Fed ratcheted up interest rates, but the longer term 10 year interest rates fluctuated up a little but by and large it was stable.

Remember, one of the primary reasons to hold short-term debt is as a parking place for capital, not as a actual investment. Anyone who owns Certificates of Deposits from their bank knows that if you want to be able to access your money in the near term, you get a 3 month CD, and if you are investing in the long-term you buy one for a year or longer.

A second reason for caution in the increase in the 3 month bond is that the Federal Reserve has been divesting itself of debt that it purchased during Quantitative Easing, when it bought U.S. Treasuries on the open market to artificially keep interest rates low during the Great Recession. Now, the Fed is dumping debt that it holds onto the open market creating more debt than there is demand for at the near zero interest rates that short-term Treasuries were yielding — so to sell them on the market the price (interest rate) must go up so people, banks and other foreign governments will buy them. So, the yield curve inversion is not a product of normal bond markets, but instead is completely artificial.

While the history since the 1950s dictate that when the short term interest rates get higher than the long term ones, a recession is in the offing in the next two years, the unprecedented Federal Reserve bond market interventions since the banking collapse of 2008, create an added variable which is different than any previous bond market.

There are five other major factors that I believe are important, two are positive and one is negative toward recession avoidance.

Congress cut taxes in 2018, and the positive impact of those cuts are having an impact on the economy now and should have a continued carryover effect for the next few years. When American consumers have more money in their pockets, they spend at least a portion of it which stimulates the economy. And this stimulus is happening at the exact time it is needed to offset any economic contraction pressure.

Also, there are some aspects of the corporate tax cut that will have long-term positive impacts on the U.S. economy. Multi-national businesses have five years to “repatriate” profits to the United States at a low tax rate with as much $4 trillion overseas at the time of the bill’s passage. This is money that is being brought back home for investment. To date about $650 billion have been repatriated. As this moving of foreign-held capital continues to move here, it is reasonable to expect it to create a recession offsetting economic burst. Remember that last year our nation’s Gross Domestic Product grew by a record $1 trillion and the amount of dollars reinvested in the U.S. was about 65 percent of this amount.

The corporate tax cut also allowed 100 percent of capital investment to be deducted in the year of the expenditure. This incentivizes those multi-national companies to invest in factories and equipment here in America using that cash from overseas and be able to deduct the costs of those investments from their taxes immediately.

The corporate tax cut lowered the tax rates from amongst the highest in the developed world to somewhere in the middle. This change made it make more sense from a profit and loss perspective to make things in America rather than importing them from elsewhere.

When these factors are combined with the President’s trade agenda, including increased steel tariffs and the new U.S.-Mexico-Canada agreement which is pending before Congress, the incentive for manufacturing domestically rather than importing goods from abroad is being expanded and these four factors should result in increased economic activity offsetting the presumed economic dip.

What’s more, the President has stated on multiple occasions that Japanese President Abe expects seven new U.S. auto factories to be built by Japanese automakers in the near future. The President’s trade agenda is forcing companies to rethink their build it overseas with cheap labor and ship it here for sale strategy.

The proof that the manufacturing sector is recovering rapidly under the Trump policies lies in the Bureau of Labor Statistics report that 450,000 more Americans are employed in the manufacturing sector now than when the President took office two years ago after those jobs being left for dead by the previous president.

Finally, and most importantly, our nation did not get a real recovery from the Great Recession due to the previous administration’s strangling regulatory policies designed to export U.S. wealth overseas. The Trump administration has eliminated 22 regulations for every single one it has put into effect freeing up the energy and other sectors to produce. As a result, the U.S. is now the top oil producer in the world and while there has been a short-term spike in oil costs due to the Venezuela disaster, both oil and natural gas prices are incredibly low meaning the energy costs for producing things in the U.S. is low, providing another encouragement for manufacturing to locate domestically.

The one potential fly in the ointment is the massive federal debt which is sucking up capital from around the world including in the U.S.

To put the debt into perspective, the entire world economy has a GDP of approximately $87.5 trillion. The U.S. debt is now at a staggering $22 trillion, or one quarter of the entire wealth generated in the world last year.

A study titled, Growth in a Time of Debt by Professors Carmen M. Reinhart and Kenneth S. Rogoff finds, “When external debt reaches 60 percent of GDP, annual growth declines by about two percent; for higher levels, growth rates are roughly cut in half.”

To put this into perspective, the United States total debt to GDP is 105 percent. The debt drag on our economy is the one thing that is holding back the rocket ship that President Trump could be delivering and may be the determining element in limiting the positives that should be accelerating growth during the end of the second decade of the 21st century.

While the chartists say that a recession is in the offing, I believe there are enough positives in the economy to sustain moderate growth rates over the next couple of years and that is not even mentioning the real wage growth being experienced by blue collar workers as America makes things again.

At a time when the media professionals will focus on negatives in an attempt to talk down the economy and people’s hopes for the future, there is a case to be made that this economy is just beginning to really recover from the devastation of 2008, and if we can get our national spending addiction under control, the future would be even brighter — bond yield charts notwithstanding.

Rick Manning is the President of Americans for Limited Government.