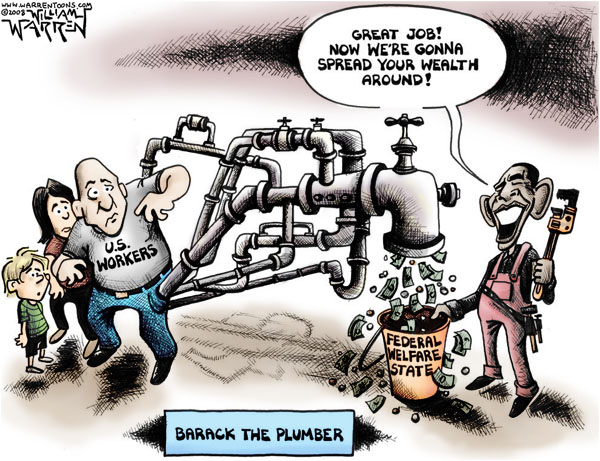

“It’s not that I want to punish your success, I just want to make sure that everybody who is behind you, that they’ve got a chance at success, too… I think when you spread the wealth around, it’s good for everybody.”—Sen. Barack Obama (D-IL) speaking to Joe Wurzelbacher, Ohio plumber.

At the last presidential debate on Wednesday, Barack Obama described his encounter with Joe the Plumber by saying that what he “essentially said to him was, ‘Five years ago, when you were in a position to buy your business, you needed a tax cut then.’”

Right. And he also needs a tax cut now. Which under the Obama “spread the wealth” plan he doesn’t stand a snowball’s chance in hell of ever receiving.

Senator Obama’s claim is that in order for Joe the Plumber—who has practically reached folk hero status amongst aspiring small business owners—to ever be able to afford to open a small business, he needs Obama’s tax plan. In fact, if only Joe had Obama’s tax “cut” five years ago, he would have been able to already start his business. Right?

Wrong. That is simply not true. The current tax code—with the Bush tax cuts still the law of the land—was just fine in order for Joe to save his money to be in a position to buy the business he works for. The problem, and the reason he confronted Mr. Obama, is that he is now having second thoughts about doing so based upon what he knows about the Senator’s plan to increase taxes on those who make over $250,000—including independent business owners.

What Mr. Obama obviously doesn’t get—or perhaps with his Alinsky background, simply doesn’t want to admit—is that his tax plan will actually disincentivize Mr. Wurzelbacher from ever starting his small business. Read the following quote from Mr. Obama during the debate:

“[W]hat I want to do is make sure that the plumber, the nurse, the firefighter, the teacher, the young entrepreneur who doesn’t yet have money, I want to give them a tax break now. And that requires us to make some important choices.”

Truth be told, Barack Obama is not campaigning for the vote of Joe the Plumber who wants to buy the business he loyally worked at for years. He is campaigning for the vote of Tammy the Teacher, Nancy the Nurse, and Fred the Firefighter who might not yet have saved up their own money—and whom he wants to tie to the government’s apron strings. He might as well have told him on that street in Ohio, “If only I could have gotten to you before you pulled yourself up by your own bootstraps, I could have made you government-dependent from the start—and then I could community organize every move you make.”

Yes, the American people do have important choices to make. Should they even bother saving money under the Obama tax plan (if, in fact, they actually can)? Should they even try to get ahead? Why bother? What’s the incentive—under the Obama tax plan—to get ahead? Once you take a step forward, Big Government will just knock you two steps back—and grab your wallet as you stumble to the ground.

Of course, that doesn’t sound good on television. Which is why Mr. Obama came up with his convoluted justification for how his class warfare tax plan—which severely increases taxes on those earning $250,000 and above, and then prints checks to those who don’t pay any taxes at all—would “help” everyone build a business at taxpayer expense.

When pressed by Joe at the rope line, Senator Obama revealed his true intention: not to help Joe buy the plumbing business, but to take the hard-earned money of those who already have businesses and “spread the wealth around…” Because, “it’s good for everybody.”

Actually, Senator, a massive “income redistribution” plan—rationing scarcity, as it were—discourages business creation. It discourages wealth creation. It discourages job creation. It, instead, creates a permanent underclass, who with private sector opportunities dwindling will increasingly either work for the government or go on public assistance.

And that, of course, sounds just fine to a lifetime, tax-supported, career politician like Barack Obama, who so far as we know has never even owned a business, run a business or even worked in private enterprise.

Now is the time to stimulate the economy with a flatter tax code at a lower rate, not to play class warfare with an economy that is hurting badly. Joe the Plumber will never become Joe the Small Businessman under the Obama plan. He will become Joe the Ward of the State. And, we suspect, that is exactly how Barack Obama wants it.

Robert Romano is the Editor of ALG News Bureau.