Correction: The national debt would surpass the GDP some time in 2011, not 2010, based on OMB estimates that the 2010-11 budgets would have a gross deficit of $2.624 trillion, bringing the debt to somewhere in the ballpark of $14.524 trillion by the close of the 2011 fiscal year.

With gold topping a whopping $1049 an ounce this week, and the Independent reporting that the Saudi Arabia, Abu Dhabi, Kuwait, Qatar, Japan, France, Brazil, Russia, and China may all be planning to stop trading oil in dollars, some are wondering what has changed to bring King Dollar to its knees.

The answer is unsettling: nothing. Nothing has changed—particularly in the nation’s monetary expansion, which has more than doubled from a year ago. Nothing has changed, either, on the fiscal side of the equation, with the national debt expected pile on another $14.025 trillion between 2010-2019, practically 100 percent of the Gross Domestic Product.

What’s worse is that the nation appears poised to shut itself down economically—with a ludicrous, ruinous tax on energy, oil, gasoline, natural gas, and coal. And to spend itself into the grave—with “health care for all” and an expansive entitlement regime extended far beyond the nation’s means to sustain itself.

Throw on bad debt, waves of foreclosures, and ever increasing unemployment (U-6 came in at 17 percent for September), and one starts to get the picture. The dollar is only as good as the economy, the nation’s ability to produce, and importantly, our collective ability to pay back our debts.

Only problem is: it now appears that it will never happen. The national debt has grown every single year since 1958. And it will equal the entire GDP some time in 2011. Call it a tipping point. Call it decline. Call it whatever one wants. But it is a crisis of epic proportions.

Unfortunately, the nation’s leaders are either oblivious—in which case they are fools. They are powerless—and cannot even save their own land. Or they do not care—in which case they are not “leaders” at all. Instead, they are charlatans, pretending to embody the national interest but only driving the nation into The Abyss.

Neither party has produced a plan to deal with this emergency, although the warning signs have been abundant for over a decade. And without a demonstrable will to boldly act, nations overseas will continue to make their own plans.

The dollar is involved with transactions the world over. And when the Fed, Treasury, and Congress inflate the currency and expand our debt obligations the way they are, foreign nations know eventually it means their dollar holdings will be that much less valuable. Combined, this includes trillions of dollars of reserves, treasuries, corporate bonds, and securities. So they want to dump them.

Who could blame them? We make bad decisions. And then, in essence, ask foreign powers (who are often hostile) to pay for them.

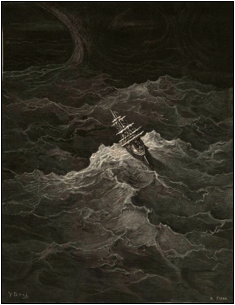

So, what do we do? Do we steer the ship of state out of turbulent waters? No, we have continued to steer it toward the deep beyond.

Which means the run on the dollar is close at hand. Perhaps even inevitable. Fear in our ability to pay back our debts will encourage that run—the capability and willingness by the nation’s leaders could prevent it.

But since nothing has yet changed, the best Americans can do is stock up on gold and, perhaps, canned goods. And hold on tight.

Robert Romano is the ALG Senior News Editor.