A recent poll by Rasmussen Reports revealed that a large plurality of Americans, 44 percent, have no opinion at all with regards to the Dodd-Frank financial takeover bill. They are neither for it nor against it.

A curious result, to say the least, since 2010 has thus far been characterized by a voting public that has very strong feelings — one way or another — on just about every vital issue facing the nation.

This bill was Barack Obama’s top legislative priority after ObamaCare and “stimulus.” With a final vote on the legislation in the Senate now imminent, and passage all but guaranteed thanks to the support of Republican Senators Olympia Snowe, Susan Collins, and Scott Brown, this means that opponents of the legislation did not do their jobs effectively.

Perhaps overwhelmed by a news cycle filled with the Gulf oil spill and the fight over the Arizona immigration enforcement law, fighting this legislation was not viewed as a top priority.

Or, maybe anticipating the ultimate success of the legislation, opinion leaders chose to stick with issues that would not dispirit the conservative base of the Republican Party in an important election year. Although that is really a poor excuse when the implications of the legislation —with its unlimited regulatory discretion — are considered.

Possibly another reason was that given the complex nature of the debate, with “orderly liquidation funds”, derivatives regulations, and bank assessments, it was deemed too difficult to educate the public on the issues surrounding the legislation.

If so, then today’s would-be tyrants have succeeded where demagogues of yesteryear have failed. In this view, it turns out that all that is required to establish a system for government to seize property, levy unlimited taxes, and monitor individual finances, all without any vote in Congress or the possibility for judicial review, is to simply use really big words to confuse the public.

The ultimate irony, however, was that while Democrats claimed to be reining in Wall Street, the very firms who were targeted politically as scapegoats for the financial crisis were the chief beneficiaries of the legislation. While Goldman Sachs was the whipping boy of the Obama Administration, the firm came out in support of the legislation. “The biggest beneficiary of reform is Wall Street itself,” said Goldman’s head Lloyd Blankfein.

So, there was no concerted effort by the affected industry — financial services — to educate and mobilize public opinion against the legislation. Because they supported it. Hidden in the bill was the implicit guarantee by the federal government of some 60 bank holding and insurance companies with $50 billion or greater in assets that have now been deemed, as a matter of law, to be “too big to fail.”

A new regime for bailouts has been instituted. And it will never end. The Federal Deposit Insurance Corporation (FDIC) will levy taxes on financial institutions, who will in turn pass on those costs to consumers, and the money will be kept in a so-called “orderly liquidation fund”. The American people will not even realize that they are the ones paying the tax, because it will be hidden. There will be no visible vote in Congress. No debate.

It will be taxation without representation. Despite Senator Scott Brown’s bizarre claim that the bill “is paid for without new taxes,” the much-maligned bank tax is still in the legislation. He said he was against bank taxes, because they would be passed on to savers and investors, but he’ll still be voting for one.

The money raised from the taxes will be used to bail out politically-favored firms, seize disfavored ones, and redistribute their assets to other favored political constituencies, as were the assets of GM and Chrysler when they were brought under the TARP fund and given to the UAW.

It didn’t have to be this way, as the fundamentals within the poll reveal. For example, 56 percent said government should let failing banks fail. Too bad. Unlimited bailouts are in the bill, which institutionalizes “too big to fail”. If only the American people had been educated as to what was actually in the bill, they would have had stronger feelings against it.

This was a failure of leadership. But in this case, Congressional Republicans were not necessarily to blame. Senate Republicans in particular, despite the ultimate treachery of Senators Snowe, Collins, and Brown, fought hard against the legislation, and offered strong amendments bringing an end to Fannie Mae and Freddie Mac and auditing the Federal Reserve whose loose lending and easy money policies brought about the financial crisis.

Senate Republicans successfully defeated four cloture motions on the bill, S. 3217, three to proceed to debate, and one to proceed to a final vote. But, if the American people did manage to hear about these filibusters, a good number of them really had no idea why Republicans were objecting, as evidenced by the Rasmussen poll.

Ultimately, the poll result reveals a missed opportunity by the political Right to have shaped public opinion on the financial debate — and it will have critical consequences on the American people, their property, their financial privacy, and the economic system that rules the nation.

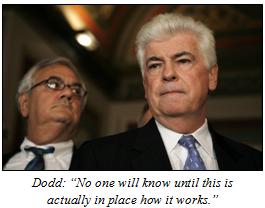

Unfortunately, Senator Chris Dodd, who largely authored the legislation, was prophetic when he said of the conference legislation, “No one will know until this is actually in place how it works.” The sidelines were not the place to be in this debate.

Robert Romano is the Senior Editor of ALG News Bureau.