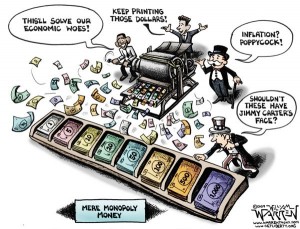

Namely, if central banks around the world can just engage in unadulterated monetary expansion to enable profligate governments to perpetually refinance new and existing debt obligations — hardly a new practice — what need is there to ever cut spending?

Beyond that, we previously noted that even though too much debt can inhibit economic growth, and that a debt-induced funding crisis can even bring a society to its knees as in Greece, the world central bank cartel possesses a trump card.

So dependent are governments (and other financial institutions) on this unlimited financing scheme that, if the printing presses were shut off, it would likely crash the world financial system as governments and banks defaulted on their borrowings. That is because the large bulk of debts, particularly by governments, are never paid. They are simply rolled over via refinancing.

In addition, financial elites argue that cutting government spending and borrowing would have a deflationary effect, increasing unemployment, causing a recession or worse.

This creates something of an impasse to adopting responsible fiscal reforms in Washington, D.C. and other capitals the world over.

But since that is more or less the state of affairs — the world central bank cartel, after all, is in a position to dictate such terms — the onus is therefore on fiscal reformers to show why spending should be cut anyway, and that sound money should be restored. The fiscal reformer’s case is very much a prescriptive one to make, whereas those in favor of unlimited, perpetual deficit-spending and never repaying the national debt need only argue for the status quo.

Why act?

The first reason for action is because it is necessary — before it is too late. The greatest threats to the current system are black swan, worst-case scenarios. For example, 1) the increasing possibility of widespread rejection of the dollar as the world’s reserve currency because our debt load is too great; 2) that oil and other commodities will no longer be settled and priced in dollars, causing rampant inflation domestically; or 3) China and other foreign creditors actively dump their U.S. treasuries holdings in an attempt to crash the market for U.S. debt and dollar-denominated assets.

Any one of those events occurring would likely cause the other two to take place, and therefore pose considerable downside risks. The death of the dollar as the world’s reserve currency would significantly increase the costs of servicing U.S. debt privately, and lead to much higher prices (i.e. hyperinflation) here in the U.S.

That situation alone would be orders of magnitude far worse than any temporary recession caused by even drastic austerity measures.

But it might even be worse than that as the dollar’s collapse would set in motion a series of events not easily reversed. Domestically, civil order would be threatened as the economy deteriorated and basic goods and services could not be delivered. Socially, the impact would be devastating. Politically, it would lead to calls for authoritarian control over society as a means to restoring order.

Critically, it is not a matter of if these black swan events outlined above will ever occur, but when they or something very much like them will occur. Murphy’s Law dictates that whatever can go wrong, will go wrong. And through the ages, no nation has ever lasted as the world’s unipolar great power. The U.S. and its dollar-based regime will be no different and one day it too will be consigned to the ash heap of history.

This piece postulates on perhaps the most likely cause for such a precipitous decline: too much debt and unsustainable obligations throughout the world that if not brought to a measure of sustainability will surely crash the system all on their own.

Averting decline

So, what is to be done about it? If decline is as inevitable as the sunset, why even bother? Because, with the gift of both hindsight and foresight, there are actually means to mitigating the downside risks of disengaging the fiat monetary system and the gargantuan amount of government spending to sustainable levels. This in turn, will buy future generations time and space to grow and be prosperous.

Because, in short, while nothing lasts forever, some things last longer than others. And while the process of debt monetization is accelerating, it is still relatively in its early stages that it can be dispensed with prior to reaching critical mass.

Now, to what can be done — which is not a comprehensive, inclusive list.

Economist and New York Times columnist Paul Krugman argues that austerity measures will have a depressing effect on economic output. Here’s a little bit of news: Krugman is right.

That is, if all you’re doing is cutting. However, things won’t get worse if fiscal reforms are implemented concurrent with other bold measures that will facilitate expansion of the private sectors of the economy. Specifically, they are:

1) First, the Supreme Court must declare Obamacare unconstitutional in its entirety. Not only will this save $2 to $3 trillion a decade in its full implementation costs, but it will salvage the legitimacy of the relationship between the individual and the government. But it is imperative that not just the individual mandate be taken out. If the mandate is removed, but the rest of the law stands, it will lead inextricably to a single-payer model (which will be even more expensive than Obamacare). That is because the mandate was supposed to cover the costs of coverage and regulatory expansions on private insurance carriers. Without the additional revenue, this law will drive private insurers out of business, leaving the populace with but one option: government-run health care.

2) The radical environmentalist agenda must be defeated in Congress, the courts, and at the grassroots level. Whatever their motives are, the goal is to hamstring us and eliminate low-cost energy as the lifeblood of our economy. This will make it so that we cannot grow our way out of the debt mess we are in. Therefore, the army of bureaucrats standing in the way of fossil fuel and nuclear energy exploration, production, and expansion must be eliminated. We can have a common sense, measured approach to conservation and environmental stewardship without entering into an economic suicide pact.

3) Federal spending must be reduced at every level, anywhere and everywhere. This ranges from the discretionary waste, whether idiotic guaranteed “green” energy loans to bankrupt firms like Solyndra and Ener1, or insurance co-op grants to favored special interests like the Freelancers Union and the Alinsky-tied Common Ground Healthcare Cooperative. Add to that rolling back things we simply don’t need like public broadcasting and the National Endowments for the Arts and Humanities. Subsidies to favored industries should be wiped out, whether direct or via the tax code. In almost every Congressional District there is a pet project that is simply not necessary to carry on the enumerated responsibilities of the Constitution. Much of the federal workforce could be reduced as whole departments and agencies are eliminated. One could go on, but hundreds of billions of dollars could be saved by aggressively slashing these unnecessary programs to the bone.

On the mandatory side of the equation, hundreds of billions more can be saved by engaging in serious welfare reform. For example, just returning to 26 weeks of unemployment benefits would save $80 billion. Going back to 2008 spending levels on Medicaid and food stamps would save $75 billion and $40 billion respectively. Eliminating the earned income and making work pay tax credits would save another $64 billion. Right there, that’s $260 billion that could be saved annually, and that’s merely scratching the surface.

Overall, Senator Tom Coburn found a massive $9 trillion in savings and a balanced budget over a single decade with massive changes on both the discretionary and mandatory sides of the ledger in his “Back in Black” plan, including entitlement reform. This is where to start. Cutting $1 trillion in the first year alone would save $22.5 billion of annual interest payments at today’s rates — $50 billion should rates normalize to their historical average. And the congressional Republican “Cut, Cap, and Balance” constitutional amendment should be adopted for good measure to prevent future politicians from ever again putting us in the red.

4) In the same vein, the bulk of welfare spending should be returned to the state and local levels of government. This would necessarily mean a restoration of federalism — but also of localism and community-based decision making. If certain communities have a preference for higher taxes and a greater social safety net, that is a decision best left to individual local authorities. Compulsory welfare statism paid for by a dwindling number of taxpayers is not a means to building a just society, it is a path to tyranny.

5) The tax code must be thoroughly reformed, reducing the highest corporate tax rate in the developed world, so that it is competitive to set up shop here in the U.S. once again. Overall, complexity in the current code should be eliminated and tax loopholes, deductions and credits gotten rid of on an average revenue-neutral basis. For firms that currently pay no taxes, this may not be a good deal, but on balance this will be helpful for new and upcoming business expansions, creating millions of jobs. Competition is always healthy for an economy, and a flat tax system fosters just that.

6) Restrictions on capital creation must be removed. Antiquated securities laws and state-by-state blue sky laws make it cost prohibitive for new businesses to raise capital over convenient venues like the Internet. Allow new businesses to flourish with capital from common investors, and suddenly trillions of dollars currently in savings becomes a ready means of business creation and expansion. This too will create millions of jobs.

7) We must dismantle unlimited central bank financing programs in the areas of housing, education, and health care. These have resulted in bubbles that wreck the economy. Mortgage-based assets are well-known as the culprits behind the 2008 financial meltdown when foreclosures exceeded the amount of money financial institutions held in capital. Now, today, as reported by Fitch, “as many as 27 percent of all student loan borrowers are more than 30 days past due.” That amounts to as much as $270 billion in potential losses for the Department of Education and Sallie Mae, which when realized will fall upon taxpayers to honor.

The reason is because low-cost government financing results in very low credit criteria being used to dispense with as many loans as there is a demand for, which in turn creates systemic risk to financial institutions that are undercapitalized.

In short, the financial system needs to be thoroughly reformed with an eye toward ensuring that banks are not undercapitalized and are using sound lending practices, and that Government Sponsored Enterprises like Fannie, Freddie, and Sallie are put out of business for good. Arbitrary, fiat credit expansion must become a thing of the past. We need to return to the days when money can no longer be lent into existence.

8) Finally, we need to return to a sound form of money, dismantle the world central bank cartel piece by piece, and return to a currency as a store of real value in transacting goods and services. This will lead to price stability, lower prices for consumers, and result in sustainable economic growth. Hiring decisions can be made with a reasonable expectation of what economic conditions will look like years down the road. For individual consumers, food and energy prices will be affordable instead of skyrocketing. That’s something any family budget can agree with.

This list of suggestions comes with a caveat: The central bank cartel’s only means of “paying” the current $15.6 trillion national debt is through rampant inflation that will surely undermine the purchasing power of most Americans. It will also destroy millions of jobs and lead to untold social ills.

In this context, all it may take is for a single major power (i.e. Saudi Arabia, China, etc.) to reject the dollar as the world’s reserve currency to get these dominoes tumbling. Why would we leave the future of our nation’s prosperity in the hands of our enemies?

The attempt at inflation today by central planners as the way for honoring our financial obligations will be the last gasp of a dying civilization. Fed head Ben Bernanke for now is not taking any options off the table for further accommodation, including more purchases of U.S. treasuries, of which the central bank already holds $1.66 trillion — more than 10 percent of the total national debt.

Even with more debt monetization, the crippling price impact on regular citizens will be more than we can bear. Overseas, powers currently using the dollar as their reserve currency will not abide the civil disorder that inflation can lead to, as in Egypt and Tunisia, which began as food riots.

So, central banks’ attempts today to flood the world with new currency will eventually provoke the very run on the dollar this piece warns against.

The way to mitigate that is clear movement on all of the above fronts to reform our fiscal, regulatory, financial, and monetary systems. This prudent approach will simultaneously recreate the conditions for growth, set us on a sustainable trajectory once again, and restore an economic system of true value.

That truly would be a new normal.

Bill Wilson is the President of Americans for Limited Government. You can follow Bill on Twitter at @BillWilsonALG.