In the entire history of our nation, the federal government has never taken in more money than that in revenues in a single year. 2008 was the last year, this revenue amount was achieved.

$3.6 trillion dollars!

That’s how much money our federal government spent last year, and it is how much it is projected to spend this year.

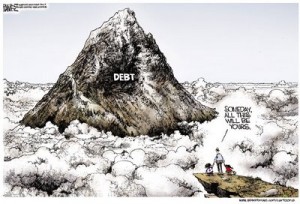

$15.9 trillion!

That is our nation’s current national debt.

$454 billion!

That’s how much our federal government spent last year in interest payments on our national debt last year.

19.7 cents!

That’s how much of every dollar our federal government receives is being spent on paying the interest on the debt.

2.8 percent!

That’s the average interest rate that the federal government is paying on the $15.9 trillion national debt.

4 percent!

That’s the amount of interest our nation would have to pay on the national debt if interest rates simply return to their historic norm. If interest rates rise from historic lows, billions of additional dollars will have to be spent and there won’t be anything that Congress or the president will be able to do about it.

The Point!

Interest payments on the debt threaten to eat up more and more of the revenues that the federal government receives. In fact, in 2017, just five years away, the Obama Administration projects that interest on the debt will reach $809 billion, and by 2022, they will rise to $1 trillion.

That would mean that before any other program is funded or bill is paid, the federal government would send $1 trillion out the door.

The so-called sovereign debt crisis in Greece has been triggered by this exact situation. In short, interest payments on the Greek debt are now eating up so much of the revenues of the country that the only way for the country to remain solvent is through partial default and massive budget cuts. The proposed cuts have caused civil unrest and increased the likelihood that the Greek government will simply walk away from all of its debts they accrued, sending those who lent them the money into their own financial tailspins.

Today, America is at a crossroads. We aren’t where Greece finds itself yet, but we can see it on the horizon if bold action is not taken in this upcoming year.

The question is actually simple. Will America continue our spending splurge that started in fiscal year 2008, or will be make relatively small cuts now, that ensure that the safety net for those who need it most remains intact?

Some want to pretend this problem away and call those who support returning our federal budget spending to Fiscal Year 2007 levels mean spirited. Ask yourself, where would you prefer our nation to be in ten years?

Under the Obama budget, we will be paying a trillion dollars in interest payments on the debt and the debt will still be increasing by more than $1 trillion a year. This means in just ten years every dollar we pay in interest payments will need to be borrowed from someone else (likely the same people we owe it to.)

The alternative offered by the House Republican Study Committee doesn’t even go back to 2007 spending levels, falling just short of the levels approved by then Speaker Nancy Pelosi in 2008. The proposal would bring the federal budget to balance in 2017 and only require $355 billion in cuts the first two years. While these cuts would be felt initially, they can be achieved by rolling back the eligibility expansion for social welfare programs that now extend them well beyond our neediest citizens.

The House Republican Study Committee budget proposal results in budget surpluses from 2017 to 2022, limiting the increase in the overall national debt to just $848 billion over the next ten years.

Admittedly, economists are like weathermen, in that they get paid the same whether they are right or wrong, but the choices are stark.

Continue forward with the current economic plan that ensures draconian cuts to social services programs later just to pay the countries and banks that have lent us the money, or make relatively modest reductions now and allow those who need help the most to have a safety net without having that same net strangle the incentives to work.

The only compassionate, and indeed the only rational, choice is to follow the lead of the Republican Study Committee budget plan. To continue forward on the current path is signing an economic suicide pact that guarantees that the least of these in America will pay the price for our collective national fiscal irresponsibility.

So, the next time a liberal/progressive/socialist, or whatever label they choose to give themselves, starts talking about helping the poor, and castigating those who want a balanced budget as selfish and heartless, just remember it is their policies that guarantee that the social safety net gets torn to shreds so our creditors can be paid.

Rick Manning is the Communications Director for Americans for Limited Government.