NRD Editor’s Note: This column originally appeared at TheHill.com.

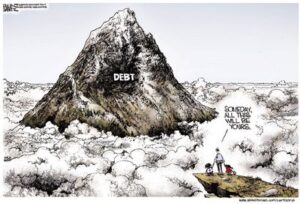

$5.3 trillion is a lot of money. It is more than any other president has increased the national debt in history. In fact, $5.3 trillion constitutes about one-third of the entire national debt of the United States.

But most stunning of all, $5.3 trillion is more money than the gross domestic product of all but two other countries in the entire world — China and Japan.

If we only took the $1.2 trillion deficit that was created this past year, the story would be different. After all, Canada, the world’s 10th-largest economy, has a gross domestic product of $1.7 trillion. In fact, you have to go to our 14th-ranked neighbor to the south, Mexico, to find an economy that is smaller than Obama’s 2012 fiscal-year deficit.

That’s right, in one year the United States had a larger deficit than the entire economy of Mexico.

This explains why, as Obama admitted on the David Letterman show, we now owe a lot of that debt to ourselves. The Federal Reserve has become a major purchaser of the debt, financing it through printing more than $1.6 trillion. The Fed is buying the debt because the debt has grown so large that there isn’t enough money in the world to soak it all up.

As such, the United States government is the ultimate “too big to fail” where world leaders and economic gurus pretend that issuing debt and then printing money to buy it is sound and sustainable economic policy.

Smaller countries like Spain or Greece (ranked 13th and 40th, respectively) get hammered with dramatically higher interest rates on their debt when it becomes too risky due to their debt becoming too large compared to their national economy.

This is not unlike in an individual household where it becomes more expensive to borrow money when the credit report shows that you owe 40 or 50 percent of your total annual income to credit cards and car payments. When you owe even more, it becomes almost impossible to borrow, no matter what interest rate you are willing to pay.

At some point, lenders know that you are more likely to declare bankruptcy rather than ever repay the debt, so they won’t put more of their money at risk by lending it to you.

The big difference between personal finance and the U.S. government is that our government has the Federal Reserve to buy the debt with money created out of thin air. So long as the rest of the world closes a blind eye to this manipulation, the game can continue. But once this acquiescence ends, the scheme collapses.

And the collapse is inevitable if the game continues indefinitely. The only question is, will the American people wise up and end this game of Russian debt roulette before the world wakes up to the opportunity to crush our economy completely?

Rick Manning (@rmanning957) is the communications director of Americans for Limited Government.