Combined with the uncertain outcome of the fiscal cliff negotiations — which threaten tax increases on all Americans — weaker earnings, plus the ever-present threat of a collapsing eurozone, and the economy could be headed for some rough waters this month.

Particularly, if policymakers do not soon address capital gains and dividends taxes rising to as high as 23.8 percent and 43.4 percent by year’s end, respectively, there is every reason to expect that markets might crash before Christmas.

That is because many investors would sell their stocks now to lock in the lower tax rate. So, each day that goes by without resolution to the fiscal cliff, the more likely a selloff becomes.

“Tax rates are going up, and if you don’t plan to hold these stocks for a long time, now is the time to take advantage of the lower tax rates,” the Wall Street Journal reports wealth advisor Peter Disch as saying in Nov.

All of which could spell big trouble for the American people’s retirement savings, particularly if they are tied up in stocks and other public-traded securities. In 2008, when markets crashed, so too did 401k’s and IRA’s, which lost billions.

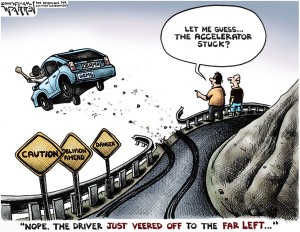

It’s clearly an avoidable crisis. But is the Obama Administration running the same risk today by playing chicken with tax rates?

Overall, the rest of the tax increases, if they go into effect, could be enough to send the economy back into recession.

Personal income tax rates will increase from 10 to 15 percent, 25 to 28 percent, 28 to 31 percent, 33 to 36 percent, and 35 to 39.6 percent. Payroll taxes too will increase, from 4.2 to 6.2 percent for individuals, and from 10.4 to 12.4 percent for those self-employed.

Estate taxes also are set to increase, from the current 35 percent rate with a $5 million exclusion to the old 55 percent rate and $1 million exemption. And the alternative minimum tax patch will similarly expire.

Adding to the mess, the $16.394 trillion debt ceiling will be hit by year’s end, too. The problem there is the U.S. Treasury has no contingency plan should the debt ceiling be reached, as revealed in a recent inspector general’s report. Instead, the Treasury would postpone payments in lieu of a legislative resolution, failing to prioritize payments of principal and interest to our creditors.

In short, the administration would effectively default on our debts until Congress caves and gives the White House what it wants. Call it legislative blackmail.

In the meantime, negotiators have made zero progress on the fiscal cliff talks, reports House Speaker John Boehner.

Here’s an idea. Obama will not be able to fund the government without a national debt ceiling increase. A potential compromise would be to tie permanent tax relief for all Americans to a deal that increases the nation’s borrowing limit.

Certainly, it’s worth a try. The alternative appears to be to watch taxes increase across the board — with the economy taking a severe hit — and Obama getting another blank check to fund annual trillion dollar deficits. Why would House Republicans let any of that happen?

Robert Romano is the Senior Editor of Americans for Limited Government.