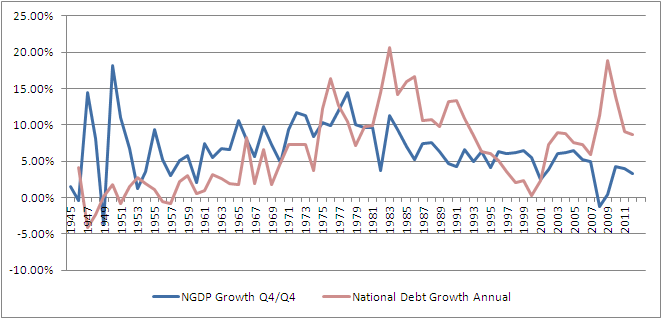

The past 3 years the $16.7 trillion national debt has grown at an average rate of 10.5 percent, while nominal Gross Domestic Product (GDP) has averaged just 3.85 percent. This is one of the primary reasons why the debt has soared to 103.8 percent of GDP at the beginning of this year and will continue rising.

The future growth of debt is already baked into the cake. Unless the baseline, particularly on mandatory spending, is moved downward, 30 years from now we are going to be in serious trouble. There is no way economic growth will be able to keep up.

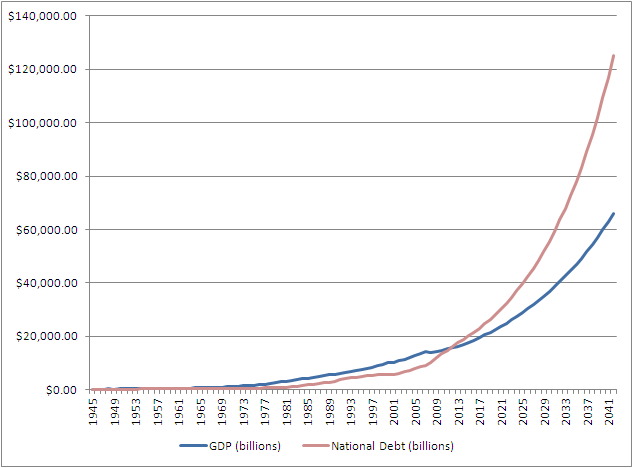

How much trouble? If nominal GDP, now $15.289 trillion grows 5 percent every year for the next 30 years — a rate faster than the Congressional Budget Office’s (CBO) 10-year baseline — without interruption, by 2042, the economy will total $66.08 trillion.

The debt, which was $16.432 trillion at the beginning of the year, if it continues growing at an average 7 percent rate annually like it did the last 60 years, by 2042, the debt will be $125.08 trillion.

That’s a debt to GDP of 189.2 percent. This is what eventually happens when the debt is allowed to grow uncontrollably faster than the economy.

And this is a conservative estimate that assumes interest rates never rise to catastrophic levels. Right now, one of the only things keeping interest rates down is outright monetization of the debt by the Federal Reserve, wherein the central bank already holds $1.76 trillion of U.S. debt — and will add $540 billion every year for the foreseeable future.

On that count, we had better hope inflation never returns, because these dynamics may prevent the Fed from being able to use interest rates as a tool to rein it in. That is, not without leaving us with interest costs that will make refinancing a nightmare down the road.

With these assumptions, one might quibble that nominal GDP has averaged 6.5 percent growth the past 60 years. But per Carmen Reinhart and Kenneth Rogoff’s exhaustive study on this issue, since we’re above 90 percent of gross debt to GDP, average growth may be reduced by as much as 1.7 percent going forward.

One might also note that the CBO baseline projection for debt growth is much lower than 7 percent, and perhaps over the short term that will be true, but history suggests the run-up of debt will return to its current trajectory over the next 30 years.

Debt grows as a function of political foolishness anyway, of which there is never a shortage. The spenders in Washington, D.C. will likely find a way to increase the baseline of spending, because that is what has always happened. All there have been are brief pauses on the road to bankruptcy.

So, something must be done. For example, House Republicans have proposed a budget that balances within 10 years. But just a day after the House budget was proposed, House Speaker John Boehner took the debt ceiling, continuing resolution, and spending prioritization options all off the table in an interview with talk show host Sean Hannity — i.e. the only things that might have helped pass the Republican plan.

So, the House will pass its plan and that will be it. Then they’ll just move on to the next topic. Which means the nation is not on the verge of a serious debate or a fight of any kind over entitlements.

Why should the American people even pay attention to this debate, let alone rally around or spend time defending a plan that has zero chance of passing by the House’s own admission? When you lower the stakes, you lessen the need to even pay attention.

The House could fight for entitlement reform, its leadership is just choosing not to. To hear the Speaker tell it, unless and until Republicans control the House, Senate, and White House, we should never expect any repeal of Obamacare or entitlement reform.

And even then if an electoral miracle occurs with a Republican sweep, their excuse for inaction would likely shift to the fact they cannot reach 60 votes in the Senate. Since the advent of cloture, Republicans have never had a filibuster-proof majority in the Senate, and whether they run Sharron Angles or Linda McMahons for those seats, they probably never will.

Even if the fiscal calamity we face is not for another 10, 20, or 30 years, do we anticipate Republicans securing every elected branch of government with supermajorities for the first time in history during that time?

In the meantime, Congress is rapidly becoming irrelevant in the budget debate anyway. They’ve taken themselves out of the fight by allowing 59.5 percent of the budget to operate on autopilot, and now they are doing nothing to reassert the power of the purse.

Unless something changes, it appears increasingly likely that come 2042 — if we even get that far without a funding crisis — the American people will eventually be left with a debt that cannot be refinanced, let alone be repaid.

Robert Romano is the Senior Editor of Americans for Limited Government.