The Obama Administration would like to cap the amount of savings that can go into an individual retirement account (IRA) and other tax-preferred investments like municipal bonds to a total of $3 million.

That amount yields $205,000 a year in retirement income at today’s interest rates, and is all that is “needed to fund reasonable levels of retirement savings,” according to the Obama 2014 budget proposal.

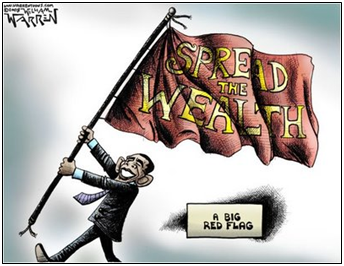

“This is the beginning stages of a wealth tax, a tax on savings in the U.S.,” Americans for Limited Government President Bill Wilson suggested. “It’s an absolute affront to the idea that you can keep what you earn.”

Currently, about $10 trillion sits in IRA and 401(k) accounts, a situation Wilson called an “irresistible temptation for government to tax.”

The tax would fall on many who have invested more than $3 million in these tax-preferred investments.

The White House complains that “under current rules, some wealthy individuals are able to accumulate many millions of dollars in these accounts,” more than it says is “needed.”

“This is a complete breach of faith, a bait-and-switch. Americans who saved the most and put their income into lower yielding municipal bonds and other tax-preferred investments would be punished for that decision under Obama’s budget,” Wilson added.

That is because municipal bonds have lower yields precisely because the tax incentive artificially increases demand for the asset. That makes removing the incentive a double tax on the activity. Moreover, if it hurts the market for municipal bonds, then that could hurt investors that much more.

In the meantime, the government wants to tax everything above the $3 million threshold put into current tax-deferred and tax-exempt investments. It projects $9.3 billion in additional revenue over the next 10 years. But that assumes the money will stay put and be taxed, and not be diverted elsewhere.

“One reason retirement savings are tax-deferred is because after taxes, the American people have very little to save,” Wilson explained, adding, “If inflation hits and interest rates begin to rise, the cost of living goes up, the cost of debt service increases, with the cap in place, the end result will be insufficient retirement income.”

Of course, the government could care less about that outcome. It’s not seeking to help Americans save for their own retirement, it’s attempting to punish those who do so.

A lesson perhaps those who suppose that Cyprus can’t happen here. In an administration that pumps out bad ideas by the minute, creating a disincentive for retirement savings may just top the list.

Robert Romano is the Senior Editor for Americans for Limited Government.