That day, Barack Obama told the American people he was keeping his campaign promise that he would “do all that I could to give every American the chance to make of their lives what they want, to see their children climb higher than they did.”

He declared upon signing the bill, “I’m back here today to say we have begun the difficult work of keeping that promise. We have begun the essential work of keeping the American dream alive in our time.”

Now, four years and two months later — including more than $6 trillion of new debt and $2 trillion of monetary easing by the Federal Reserve — it is worth considering just what ever happened to that promise.

To put it bluntly, what recovery, Mr. Obama?

Not even the White House pretends any more that the economy will ever get back to normal growth, as indicated by the economic assumptions in the 2014 Obama budget.

If accurate, nominal economic growth will never again reach its postwar historical 6.5 percent average rate of increase. Instead, it will only grow an average 4.8 percent a year this decade, casting a dark shadow on the nation’s financial picture for a generation.

The Obama economic team has already been proven wrong about everything. In 2009, it overestimated the Gross Domestic Product (GDP) by a whopping $1.046 trillion in its first term. It overstated revenues by $1.1 trillion. But for sequestration and the Federal Reserve’s quantitative easing and low interest rate bailouts, the debt would be much larger today.

Despite those bailouts, in 2013, the national debt will grow by 7.5 percent — above its 7 percent historical growth rate.

If sequestration over the coming decade is cancelled and/or should inflation strike, forcing interest rates to spike, and if the low growth assumptions going forward prove correct, by 2042, debt to GDP could rise to be as high as 189 percent, if not higher.

Until the economy starts growing faster than the debt, we are skidding down a slippery slope to certain insolvency, with a national debt of $16.8 trillion and counting.

But the problem does not just extend to the GDP.

The housing market, whose downturn caused the current depression we’re stuck in, has not recovered either. Home values are stuck where they were in 2003, and new home sales are still about 64 percent below where they were that year.

And there has been no recovery in labor force participation. Since Obama took office, more than 9.4 million Americans have left the labor force as college graduates cannot find work and Baby Boomers head into their retirement years without enough saved.

The question is why. Why, after more than four years are we still stuck in these doldrums.

The answer is because there has not been a robust recovery in credit markets where the financial crisis began.

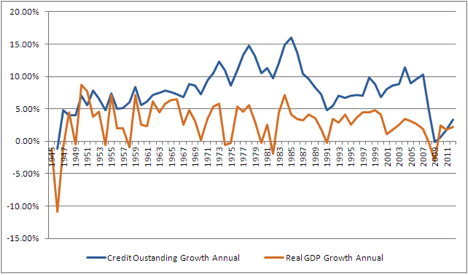

From 1946 through 2008, credit outstanding nationwide — that is, all debts public and private — grew at an average 8.3 percent annual rate according to an Americans for Limited Government analysis of Federal Reserve data. That is, until the economy crashed in 2008 amid the first credit contraction since 1946.

Since then, credit has only expanded an average 1.4 percent each year. In 2012, it grew by just 3.3 percent. It has picked up slightly but is nowhere near where it once was. To get back to its historical trend, credit will need to increase by $4.6 trillion in 2013.

The trouble is, there is a direct correlation between credit expansion and economic growth, which in turn has consequences for unemployment, inflation, and other indicators. Whereas once for every dollar of new debt there was a dollar of growth, now it takes more than 2 dollars of debt to generate a dollar of growth.

In short, the economy is addicted to debt. And when credit contracts or even just slows down its rate of expansion, as it has in recent years, the economy tends to follow suit.

This puts in perspective why the financial media is in a panic over banks holding more than $1.7 trillion of excess reserves. And why the government is so desperate to get credit creation started again. Since 2008, it has nationalized mortgage lending markets by placing Fannie Mae and Freddie Mac into conservatorship.

It nationalized student lending in 2010 by taking over Sallie Mae. It has a guaranteed loan program for so-called “green” energy projects. It is even contributing to the budding market for subprime auto loans.

It also lends tens of billions more for housing via the Federal Housing Administration, to bankrupt socialist countries via the International Monetary Fund, and to businesses via the Small Business Administration.

It even wants to create an $8.8 billion so-called “infrastructure bank” to be leveraged up to make tens of billions of loans to state and local governments and enrich public sector unions that will be the primary beneficiary of the spending.

In addition, as noted by Investors.com, government has even overtaken the private sector as the largest issuer of credit: “At the end of 2012, government-financed home mortgages and consumer credit outstanding totaled $6.4 trillion, up from $4.4 trillion at the end of 2006. Private-sector financed loans fell to $6.3 trillion from $8.45 trillion over the same span” from 2006 to present.

None of it is working. $6 trillion of new debt, $2 trillion of monetary expansion, and hundreds of billions of dollars of government-financed loan programs have all failed to get the economy out of the ditch.

And that’s not just hyperbole. As noted above, Obama is projecting subpar economic growth for the rest of the decade and beyond. Even his own economic team is acknowledging we’re likely to remain in this state for some time.

Ironically, it was John Maynard Keynes, considered the father of fiscal “stimulus,” who reportedly once said, “When my information changes, I alter my conclusions. What do you do, sir?”

Now, Obama has 1 trillion reasons to change course — as his economic projections have fallen flat by that much. To continue down the same worn path of demonstrated failure, can only lead to more debt, and eventually economic collapse when, not if, interest rates rise and the bill comes due.

If we wait too long to act, the American people will be left with a debt that cannot be refinanced, let alone be repaid. We will lose the dollar’s status as the world’s reserve currency, and then, default will be the only option. More debt is not going to get us out of this crisis.

Absent Obama waking up, it is the sworn duty of members of Congress to stand up and say no to any further erosion of the nation’s economic capacity through Obama’s failed fiscal and monetary “stimulus” dogma.

Bill Wilson is the President of Americans for Limited Government. You can follow Bill on Twitter at @BillWilsonALG.