“We were simply doing what our bosses ordered.”

So say the Internal Revenue Service (IRS) employees in Cincinnati who were charged with targeting tea party and other conservative groups with improper and invasive scrutiny, according a Fox19 in Cincinnati exclusive report on May 15.

If true, this seemingly contradicts a Treasury Inspector General report on the matter released earlier that day, which stated: “the Determinations Unit developed and implemented inappropriate criteria in part due to insufficient oversight provided by management. Specifically, only first-line management approved references to the Tea Party in the … listing criteria before it was implemented.”

So, if the employees were just following orders, who gave the orders? According to the report, the Determinations Unit supposedly acted alone.

“We asked the Acting Commissioner, Tax Exempt and Government Entities Division; the Director, EO; and Determinations Unit personnel if the criteria were influenced by any individual or organization outside the IRS. All of these officials stated that the criteria were not influenced by any individual or organization outside the IRS,” the report states.

So, the agency says nobody told them to do it. Which does not actually prove the matter. It merely states that agency members denied they were influenced from outside the agency.

But is that true? Did the IRS really just suddenly take it upon itself to target the tea party?

If so, it would have had to internally develop the presumption — without any outside stimulus — that such groups applying for tax-exempt status under section 501(c) of the Internal Revenue Code were actually engaged in electioneering as their primary purpose and subjected them to special scrutiny, meanwhile approving the applications of other organizations.

501(c)(4), (5), and (6) organizations are legally allowed to engage in electioneering so long as it is not the group’s primary purpose.

According to the report, other non-tea party organizations’ applications were approved in a timely manner, while tea party groups’ applications were held up for months and months: “For Fiscal Year 2012, the average time it took the Determinations Unit to complete processing applications requiring additional information from organizations applying for tax-exempt status … was 238 calendar days according to IRS data. In comparison, the average time a potential political case was open as of December 17, 2012, was 574 calendar days.”

A “potential political case” was among those that were targeted at tea party groups. If the employees were following orders from the managers, was it the “first-line management” who developed the criteria? Were they following orders, too?

Why was the tea party targeted? We still don’t know.

One clue may come on page 5 of the report, which states, “According to media reports, some organizations were classified as I.R.C. § 501(c)(4) social welfare organizations but operated like political organizations.”

On one hand, this seemingly contradicts the finding that the IRS was not influenced into targeting the tea party from outside the agency. If media reports at the time in 2010 were essentially suggesting that 501(c) organizations were acting as alleged front groups for electioneering purposes, and if this was somehow relevant to how the agency developed its criteria for targeting the tea party, then it appears that perhaps the agency was influenced from outside sources into developing its criteria.

However, it is hard to comprehend the context for that sentence on page 5, as it appears in a heavily redacted paragraph, with content both before and after omitted.

On the other hand, perhaps the Inspector General was merely commenting on the fact that there were media reports at the time about 501(c)(4) social welfare groups acting politically, but it had nothing to do with how the agency developed its criteria. If so, why include it in a section under the heading, “Criteria for selecting applications inappropriately identified organizations based on their names and policy positions”?

With the redactions, it is hard to know why.

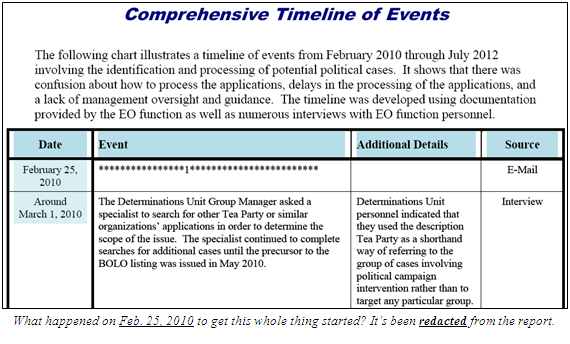

Full timeline can be found in Appendix VII.

One of the only major media reports one can find specifically referencing 501(c) organizations acting politically in the wake of the Citizens United Supreme Court decision prior to Feb. 25, 2010 — when the report’s timeline of events begins — was a New York Times piece, “GOP Group to Promote Conservative Ideas” published on Feb. 3, 2010.

That story was about the formation of Norm Coleman’s American Action Network being formed and patterned after another well-known left-wing 501(c)(4) organization, the Center for American Progress. It referenced that the group would launch on Feb. 22, three days before the report’s timeline of events begins.

It also quoted Center for American Progress founder John Podesta as being against his group acting politically: “Podesta said his group has a policy against that and will not change it. Policy work, he said, ‘has political relevance but we shouldn’t become political actors.’”

Was that the media report the Inspector General was referencing? Who knows?

The fact is, nobody except for the Inspector General and the review board at Treasury knows what actually happened on Feb. 25, 2010 that prompted the IRS to actually develop new criteria targeting tea party and other conservative organizations. That portion of the report has been redacted and omitted.

The report includes an explanation about the omissions: “This report has cleared the Treasury Inspector General for Tax Administration disclosure review process and information determined to be restricted from public release has been redacted from this document.”

In all cases, the redacted information supposedly contained “Tax Return/Return Information,” according to the report.

Unfortunately, the Inspector General report leaves more questions than answers. It merely attributes the targeting of the tea party to breakdowns in management: “the Determinations Unit developed and implemented inappropriate criteria in part due to insufficient oversight provided by management.”

That still does not answer the question of why the Determinations Unit developed the criteria. What caused them to do this. They reportedly say they were following orders. The Inspector General has upper management stating it knew nothing at first. Perhaps, somebody’s lying.

To get to the bottom of this scandal, Congress will need to subpoena witnesses, and the Attorney General will need to name a special counsel — that is, an independent, special prosecutor — to ensure that a fully inquiry can be made without politics intervening.

Robert Romano is the Senior Editor of Americans for Limited Government.