In January, Janet Yellen will be easily confirmed to be the next head of the Federal Reserve.

One question for the New Year that is certain to come up once every six weeks will be the Fed’s Open Market Committee, and specifically, whether there will be more tapering of the central bank’s purchase of $900 billion of government and mortgage bonds.

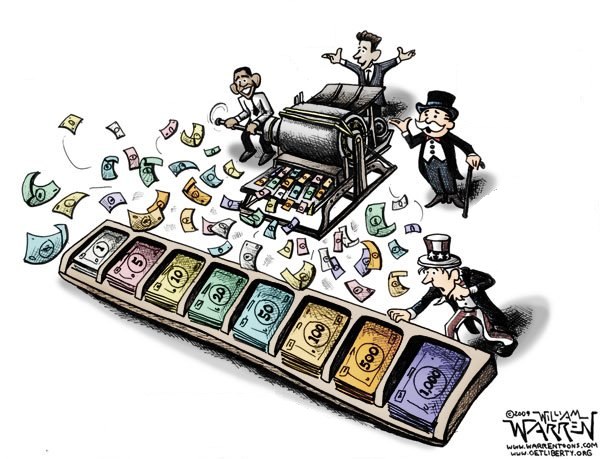

To date, the Fed’s money printing has poured more than $3 trillion worth of new securities onto its balance sheet since August 2007 when the financial crisis started. Today, it stands at more than $4 trillion total.

In testimony in November, Yellen suggested that she would not remove the near-trillion dollar a year bank subsidy too soon given the fragile nature of the economic recovery, persistently high unemployment and below-Fed-target inflation.

Think about what this means.

The stagnant growth of the past five years is now the excuse to continue the same policies that failed to ignite the economy. It is this circular logic that is likely to result in more stagnant growth and calls for more fiscal and monetary stimulus from the government.

The slightest hiccup, whether it’s trouble in Europe or emerging markets or municipal bonds here in the U.S. or even the continued deterioration of labor market conditions will be enough to keep emergency quantitative easing policies in place throughout all of 2014 and likely beyond.

Ironically, because the government bond buying by the Fed encourages Congress to spend more than it takes in via revenue, it in effect diverts resources away from private investment and towards Washington, D.C.

With the expected confirmation of Mel Watt and the expansion of low-to-mid income mortgage lending programs under the Federal Housing Administration, the Fed’s continued mortgage bond purchases will likely keep interest rates low and continue recycling the bad debts of banks, likely pushing home values higher.

This in turn pushes investment toward the financial sector at the expense of other areas of the economy. When the cost of living increases too much, discretionary consumer spending elsewhere can only take a hit.

Overall, given the unprecedented nature of the Fed’s bond buying scheme, it appears the longer it goes on, the greater the risks when the central bank stops.

Consider that rates have been collapsing for thirty years since the great inflation of Nixon, Ford, and Carter.

Slightly higher interest rates in the mid-2000s are said to have been enough to help prick the housing bubble that brought the global economy to its knees in 2007 and 2008.

The impact of higher rates today on mortgage markets or Treasuries markets could be devastating.

Can Yellen, and indeed, the entire country, afford for interest rates to rise again? For every percentage point rates increase, taxpayers will ultimately owe an additional $172 billion a year of gross interest on the $17.2 trillion national debt.

With $58 trillion of debt outstanding — that is, all debts public and private — the entire economy will ultimately owe an additional $580 billion in interest. Although it takes a while for those costs to enter the economy, that is still a huge tax — a growth killer.

It is possible slightly higher rates are already slowing down credit expansion. We’ll know more in March when the Fed is done calculating its L.1. release for the fourth quarter, but if the first three quarters are any indication, credit is definitely decreasing in velocity.

So far, credit has only increased 2.57 percent annual rate so far in 2013, well below its 8.4 percent average annual growth rate in the postwar period through 2007. It is even below its 2012 rate of 3.34 percent.

If Yellen gets another bad number in March, expect quantitative easing to continue indefinitely. She won’t see any way out, just as Japan has still not figured a way out of its 25 year foray into aggressive easing. She will prop up markets today, but only fuel the greater bubble that could crush the economy tomorrow.

Happy New Year!

Robert Romano is the senior editor of Americans for Limited Government.