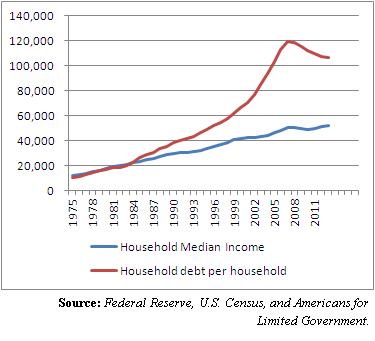

While median income for households grew by $929 to $51,939 in 2013, the amount of debt per household remained elevated at $106,921.

A positive sign is that household debt is dropping from the financial crisis days. It is down from its 2007 peak of $119,213.

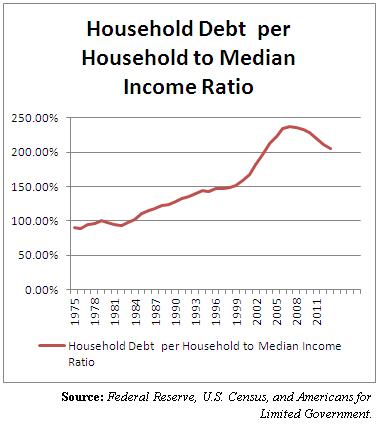

As a result, the household debt per household to median income ratio has dropped from 237.4 percent in 2007 to its current level of 205.9 percent.

The problem is that is still really, really high by historical standards. In 1975, as far back as Census and Fed data correspond, the debt to income ratio was just 90.1 percent.

There is no getting around it. Debt grew far faster than income. The question is why.

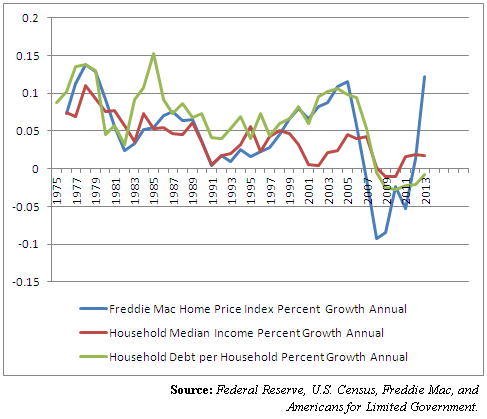

The answer is home prices. From 1976-2006, right before the bubble popped, home values accelerated at an average 6.17 percent a year, according to the Freddie Mac Home Price Index.

Comparatively, median income only grew at a 4.61 percent average nominal rate during those years.

The result? Household debt per household grew at a whopping 8.11 percent a year.

The rest, as they say, is history. But the story is not over yet.

Debt remains far too high, and income far too low, for far too many Americans.

Yet, this is not a story about the minimum wage. Americans who live on the minimum wage are not buying houses and taking on mountains of debt, they are technically in poverty. Their impact upon home prices approaches nil.

Instead, this is a story about the Americans who are not impoverished, but are nonetheless being pulverized by debt dynamics that today make it next to impossible to get ahead.

So, if you read stories about how the housing market has quieted or that the economy is still sluggish or spending is flat, now you know why. A combination of three interrelated factors:

1) Americans are still deleveraging from the last financial crisis and getting their balance sheets in order, and are still too much in debt.

2) Incomes have never kept up with the growth of home prices, resulting in an extreme and growing affordability gap.

3) As a result, home prices are still too high, thanks to artificial demand created by government easy lending policies by Fannie Mae, Freddie Mac, and the Fed.

All of which means, there may be more pain to come. Stay tuned.

Robert Romano is the senior editor of Americans for Limited Government.