By Rick Manning

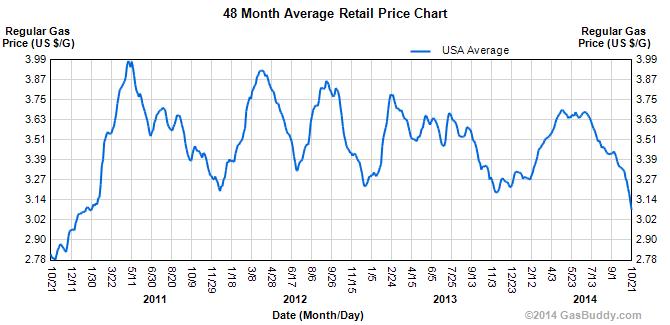

Every autumn, gas prices fall providing consumers weary from peak summer prices a windfall. In 2014, Michael Green a spokesman for AAA estimated that Americans are spending about $230 million a day less on gasoline than on July 4th, and the price continues to plummet.

In fact, according to GasBuddy.com retail gasoline prices on average have reached levels not seen since 2010 as a combination of the seasonal demand drop off, a slowing global economy, and declining world oil prices continue to create downward pressure.

The non-partisan, apolitical AAA, best known for maps and travel guides, goes so far in their October report to make a bold proclamation writing,

“Gas prices generally have been less expensive than in recent years due to the dramatic boom in North American petroleum production. U.S. refineries have taken advantage of increased crude oil supplies to make more gasoline. In addition, increased domestic production has helped insulate U.S. consumers from conflicts and instability overseas.”

If you are an anti-drilling environmental activist, you might want to put your fingers in your ears and start making nonsense sounds if someone read this report out loud to you.

The AAA attributes the development of shale oil fields in North Dakota, Texas and around the country for not only stabilizing and decreasing gasoline prices, but also for protecting our nation from energy price shocks resulting from Middle East oil country’s blackmailing the world by manipulating oil availability.

In fact, the United States Energy Information Agency (EIA) concurs reporting, “Record-setting liquid fuels production growth in the United States has more than offset the rise in unplanned global supply disruptions over the past few years.”

Now, on top of the rapidly growing U.S. and Canadian production, those same OPEC countries that historically have ruled the market with an iron fist have opened their oil spigots as they need to maintain cash flow and market share.

Oil is still a weapon in the Middle East, but due to a private sector led energy renaissance in the United States and Canada, it is not aimed at us. Instead, cash strapped Iran is under extraordinary economic duress, while at the same time attempting to expand their empire. The Saudis, who are Sunni Muslim, have an interest in stifling Shia Iran’s rise. And lower prices has just that effect.

Adding to the drop in worldwide oil prices is the decrease in demand for oil amongst industrialized countries, which the U.S. Energy Department reported was down 200,000 barrels a day this year compared to last.

The New York Times reports that, “the government expects American consumption, which increased by nearly 500,000 barrels a day in 2013, to decline by 40,000 barrels a day this year.”

With Europe continuing in recession bordering on depression, Japan’s stagnant economy on the verge of another recession, and China’s economy rapidly slowing, the drop in demand for oil worldwide is a symptom of a potential major economic crisis.

However, this same drop in oil prices resulting from what some view as a glut of crude on the market has a palliative impact on economies around the world. Lower energy costs put more dollars in consumers’ and business owners’ pockets, providing every bit as much of a stimulative effect as lowered interest rates or tax cuts.

A primary example of the market providing the exact remedy that the world’s economies need.

And back in America, consumers are, according to AAA, saving, “between $5 to $15” per fill-up. Providing extra cash to spend or save as each individual chooses, with even more savings expected to come as the fall turns to winter.

The only people who could complain about an American and indeed, worldwide, economy being bolstered by an oil boom would be the perpetually sour environmentalists who have a long history of openly pining for high priced “fossil fuels” to make their preferred alternative energy schemes more attractive in the marketplace.

Unfortunately, with these curmudgeons in charge of the Environmental Protection Agency (EPA), some of the savings at the pump will be eaten up by anti-coal, regulation generated increased electricity costs.

Yet, somehow in spite of the environmentalist war on real energy sources like coal, oil and natural gas, North America is on the verge of energy independence, insulated from the whims of far-away dictators and free to begin thriving due to this energy certainty.

Rick Manning is the vice president of public policy and communications for Americans for Limited Government.