Consider the following factors.

North American oil production is experiencing a boom, largely driven by the shale oil miracle.

China is slowing down, including its demand for oil.

Europe is still in the thick of a major recession.

Overall, oil consumption in the OECD is down this year.

As a result, the trade deficit should begin going down, meaning less dollars exported overseas.

The budget deficit, the amount of net, new U.S. treasuries entering the market, has also been decreasing from its recession highs. Meaning there are fewer new government bonds to buy.

Yet, demand for dollars, and dollar-denominated assets like treasuries, is rising — seen in the strong dollar on international currency markets.

As a result, interest rates in the U.S. have been dropping all throughout 2014.

The Fed has not moved its zero interest rate policy since 2008. And as of this writing, still has not hiked interest rates. And as far as quantitative easing goes, the Fed has been tapering new asset purchases since 2013.

Therefore, there is little reason to expect interest rates to rise even with the end of quantitative easing, since there has been little correlation between interest rates and Fed asset purchases in the first place.

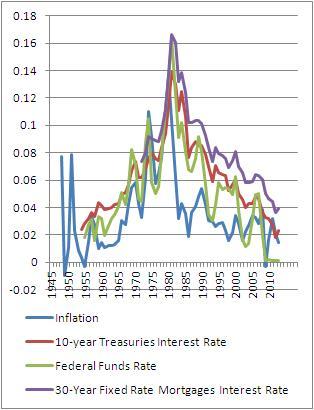

The $3.5 trillion of treasuries and mortgage-backed securities purchases was unprecedented when it announced at the end of 2008. Whereas interest rates have been dropping since 1981. The fact that rates continued along a 30 year downward trend in the past five years, in that sense, is not at all surprising.

Yet it is hard to know what the counterfactual might have been.

Would the excess treasuries and mortgage backed securities have been bought by markets without the Fed intervention?

Once could argue that, eventually, yes, they would have, but at prices the market demanded. That might have meant higher interest rates, but it could have just as easily meant lower or the same rates if the flight to safety was going to ensue anyway in 2008 and 2009.

Leaving that aside, a key factor looking forward is the Fed’s position on existing assets. If it keeps its current level of bonds — purchasing new bonds as the old ones mature — then quantitative easing is not really over at all. It will continue to eat a certain market share particularly of government and mortgage bonds.

Now, if the Fed was going to dump its surplus $3.5 trillion of holdings all at once, one might expect a short-term interest rate shock. But nobody’s talking about that. It’s not even contemplated. Alternately, allowing its bond portfolio to mature might put upward pressure on interest rates, but only if the rate of maturity exceeded the rate of demand shift.

Finally, there is the policy rate. One can show a strong correlation between the federal funds rate and overall interest rates. And this makes a lot of sense, since that is the rate that financial institutions borrow at. If their borrowing costs temporarily rise, one would expect overall interest rates to rise.

However, that too could be offset should overall demand for bonds and dollars remain high, resulting in a higher policy rate but overall lower interest rates, or even an inversion of rates.

For example, in 2006 and 2007, the federal funds rate exceeded the rate on 10-year treasuries, even as the 10-year rate actually dropped in 2007, the second year of the inversion. Inversions also occurred in 2000, 1998, and 1979 through 1981.

The point is that the Fed could hike its policy rate, but it might only have a temporary effect on overall rates, meanwhile the overall trend could very well remain downward.

While there are ups and downs, any reasonable analysis of the 30-year downward trend of interest rates must conclude that it is based less on the Fed’s infrequent policy proclamations than the day to day supply and demand of bonds, particularly those denoted in dollars.

Robert Romano is the senior editor of Americans for Limited Government.