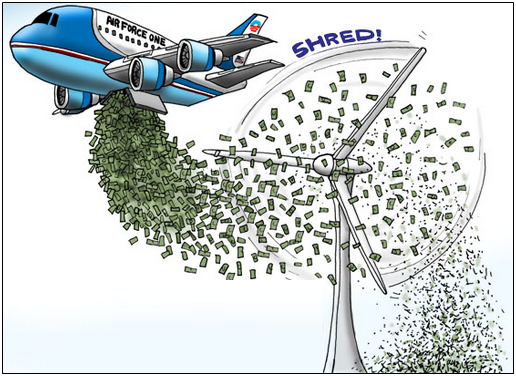

It may be time for the wind energy industry to finally stand on its own two feet.

On January 28, the U.S. Senate defeated an amendment by Sen. Heidi Heitkamp (D-N.D.) in favor of the now-expired wind production tax credit. It failed by a vote of 47 to 51.

And that was merely a “sense of Congress” non-binding resolution in favor of the policy, which funds an inflation-adjusted 2.3 cents per-kilowatt-hour (kWh) tax credit for electricity generated that were constructed before January 1, 2015.

In 2014, it cost taxpayers $6.4 billion paid out to owners and operators of wind turbines.

That credit lasts for 10 years, and so taxpayers are still on the hook until at least January 1, 2025, but as most projects were constructed before 2014, the amount of the credit should gradually be winding down on an annual basis.

Any new wind projects will not be eligible to receive the tax credit, leading American Wind Energy Association head Tom Kiernan to complain, “We worry about the industry going off the cliff again if we don’t get the Production Tax Credit extended as soon as possible.”

Industry experts warn that the tax credit expiration will halt production of new turbines, since current market participants would have a built-in cost advantage versus new entrants into the industry unable to take advantage of the tax incentive.

Such are the perverse incentives Congress creates when it doles out tax subsidies to any industry.

In this case, in 2012 wind only generated $5 billion of revenue, according to the U.S. Census Bureau. Compare that to the $6 billion tax subsidy from that year, estimated by the Joint Committee on Taxation.

By that count, new entrants into the marketplace will be seeing as much as a 55 percent markdown, on average, compared to subsidized competitors.

Which is why the subsidy should be eliminated altogether. It’s the only way to have a truly level playing field with real competition.

Proponents will argue that, actually, this is why the tax credit should be made permanent, a position we’re certain the American Wind Energy Association would support.

But what industry wouldn’t want a permanent, annual subsidy totaling billions of dollars?

Ultimately, it is for Congress to decide whether the cost is worth it to subsidize an industry that only produces 4.5 percent of U.S electricity, according to the Energy Information Agency.

As it is now, the remaining subsidies appear to create a barrier for new wind turbines to be built and thus will impact the growth of the industry by its own admission. And Congress has shown no interest in renewing the tax credit.

Therefore, the only fair way to proceed is to eliminate the remaining subsidies, too. Right?

Robert Romano is the senior editor of Americans for Limited Government.