That was Mark Fleming, chief economist of First American Financial Corp., writing for Investor’s Business Daily an eye-opening piece behind the continued decline of homeownership in the U.S.

In it, Fleming notes that the homeownership rate has declined from 69 percent in the mid-2000s to just 64 percent today. He discounts factors such as student loan debt or lack of finances as the primary culprit.

In fact, as in past generations, a college degree still predicts a higher rate of employment, and higher levels of income.

Instead, writes Fleming, “My research has led me to an unconventional, yet surprisingly obvious, answer. Lack of finances is not the primary reason millennials are shunning homeownership — in fact, it’s not a significant problem at all. The real reason they’re delaying or avoiding homeownership is their lifestyle choices, especially in the realm of marriage and children.”

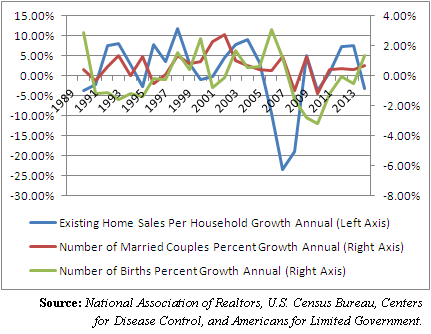

Indeed, considering a combination of data compiled by the National Association of Realtors, the Centers for Disease Control, and the U.S. Census Bureau, surges in the marriage rate appear to precede jumps in home sales, which in turn, precede increases in the birth rate.

Fleming notes over the past generation, as the baby boom abated, the percentage of families with children has declined from 50 percent to 42 percent, and the percentage of married couple households has also dropped from 58 percent to 48 percent.

Fleming sums up the problem, “For a variety of reasons, millennials are getting married later and having children later — if they do either at all.”

This, in turn, is suppressing demand to own a home. All of which does not bode well for the real estate market.

After all, why buy a 3-bedroom, single-family home if you’re still single? Regardless of income, the additional expense and risk of taking on a mortgage is apparently not compelled except by the necessity of more space that comes with raising children.

However, since economic growth, job creation, and a lot of other vital indicators tend to rely on a robust housing market, the decision of younger Americans not to get married and have children in as great of numbers as they once did is a troubling one.

Declining birth rates will also drag down growth over the long term, with fewer working-age adults producing less and also spending less. Indeed, what is the point of increasing production if demand will be falling?

Something to consider.

In the meantime, don’t be surprised if the collapse of American families continues to drag down everything from home sales to growth, sorry to say.

Robert Romano is the senior editor of Americans for Limited Government.