It’s official.

The U.S. economy has not grown above 3 percent since 2005, making it a full 10 years since that level of growth has been seen. And it has not grown above 4 percent since 2000, marking a 15-year era of much slower growth.

For context, from 1947 to 2004, the economy averaged 3.45 percent growth each year, according to data compiled by the Bureau of Economic Analysis.

But from 2006 to 2015, it has averaged just 1.41 percent.

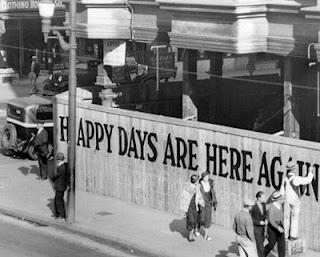

That makes this the slowest 10-year period of economic growth since 1930 to 1939, which came in at average annual 1.33 percent growth rate.

That is, this is the worst economy — using growth as a metric — since the Great Depression.

But worse, it shows no signs of speeding up. All it may take is another recession in the near future — say, the next 2 years — and it is highly conceivable that the current economy will produce a number actually worse than the Depression.

No matter how you cut it, it’s been a lost a decade of opportunity, and Americans may be paying the price for years to come.

Still, despite a decade of failure, policy makers have not yet gotten up to speed on the reality of slower economic growth.

A Federal Reserve forecast from Dec. 2014 had projected the Gross Domestic Product to expand between 2.6 and 3.0 percent for 2015. The annual figure came in at 2.4 percent.

This just adds another black mark to the Fed’s atrocious record of making forecasts, where the central bank has been off on almost every one of its projections since 2008.

In Jan. 2008, the Fed neither saw a recession nor a financial crisis on the horizon. At best, it saw a slowdown. It projected between 1.3 to 2.0 percent real growth in 2008, and between 2.1 to 2.7 percent growth in 2009.

Instead, the economy contracted by -0.3 and -2.8 percent in 2008 and 2009, respectively.

By Oct. 2008, as markets were crashing, the bank changed its tune. The economy was slowing down considerably, but likely would not shrink. 2008 would see between 0.0 to 0.3 percent growth, and 2009 between -0.2 to 1.1 percent. Wrong again.

In Jan. 2009, in the midst of severe financial distress, the Fed finally thought a recession would happen, but would be mild, projecting a contraction between -1.3 to -0.5 percent that year. Still way off. Again, in 2009, it went down -2.8 percent.

Similarly, the Fed’s track record in projecting a recovery has been way off. That year, the Fed projected a V-shaped recovery after 2009. The economy would grow between 2.5 and 3.3 percent in 2010, and between 3.8 and 5.0 percent in 2011.

By Jan. 2010, the Fed had changed its expectations slightly for 2010 — by raising them. Then, they said the economy would grow between 2.8 and 3.5 percent in 2010, although they lowered their expectations for 2011 to between 3.4 and 4.5 percent.

Instead the economy only grew by 2.5 percent in 2010, and by 1.8 percent in 2011. Wrong again.

Even as late as June 2011, the Fed was projecting between 2.7 and 2.9 percent growth for 2011. Way off. Again, the economy only grew by 1.8 percent in 2011.

In Jan. 2012, the Fed said the economy would grow between 2.2 and 2.7 percent — just barely meeting its forecast that time when it came in at 2.2 percent for the year. Like the broken clock, it finally got one right.

In March 2013, the Fed predicted the economy for that year would be 2.3 to 2.8 percent. Wrong again. It only came in at 1.9 percent.

In Dec. 2013, it projected 2.8 to 3.2 percent growth in 2014. Nope. That one came in at 2.4 percent, too.

Remarkable, isn’t it? What a terrible track record. Right once in 8 years. What stock should we put in its Dec. 2016 projection of 2.3 to 2.5 percent growth?

Perhaps more, since this time it’s not such a great number. On the other hand, the economy does average a recession once every 6 to 7 years, and we’re pretty much due for another one.

What is clear is that the nation’s central bank — and the entire world — has been wrong about the U.S. economic growth engine for a decade now. And we need to start asking ourselves why.

Robert Romano is the senior editor of Americans for Limited Government.