“My dream is a hemispheric common market, with open trade and open borders, some time in the future with energy that is as green and sustainable as we can get it, powering growth and opportunity for every person in the hemisphere.”

That was Hillary Clinton in a paid speech to Brazil-based Banco Itau in 2013, now released by WikiLeaks, saying that her dream is the entire Western hemisphere without borders, open trade and a single economy.

In other words, let them eat NAFTA. She really is Marie Clintonette. Clinton’s dream is a de facto end to American sovereignty, where capital continues to flow overseas while hundreds of millions of people who want to move to America would be given a free pass. It is an unbelievable statement from somebody who at that point knew she would be running for president in 2016. A statement, not of U.S. interests, but global interests.

In this speech, Clinton revealed what she really thinks about the critical issue increasing U.S. participation in trade deals once she’s talking with the corporate interests involved: “I think we have to have a concerted plan to increase trade already under the current circumstances… There is so much more we can do, there is a lot of low hanging fruit but businesses on both sides have to make it a priority and it’s not for governments to do but governments can either make it easy or make it hard and we have to resist, protectionism, other kinds of barriers to market access and to trade and I would like to see this get much more attention and be not just a policy for a year under president X or president Y but a consistent one.”

Got that, Ohio, Pennsylvania and Michigan? Clinton doesn’t think the U.S. has outsourced enough industrial production, jobs and wealth to foreign economies. She wants to double down on trade, end borders and finish off what’s left of the U.S. economy.

Since 2000, the year China entered the World Trade Organization and Congress granted it permanent normal trade relations, the U.S. has racked up more than $8.5 trillion in trade deficits, directly subtracted from the nation’s gross domestic product (GDP). If we had produced those goods here, U.S. GDP would be nearly $27 trillion, instead of today’s $18.4 trillion. Instead, the economy has not grown above an inflation-adjusted 4 percent since 2000 and not above 3 percent since 2005, the slowest economic growth since the Great Depression.

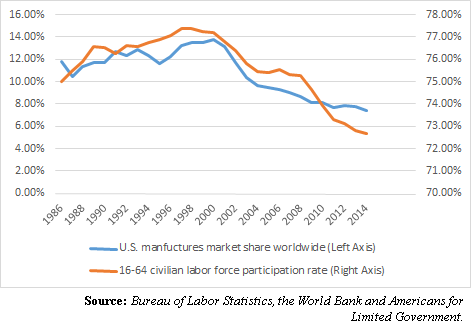

Since that time, the U.S. has been losing labor participation among 16 to 64 year olds, those in their prime working years, which has declined from more than a 77 percent rate at the turn of the century to just 72.6 percent in 2015, accounting for more than 10 million who either left the labor force or never entered on a net basis since then.

So was it job outsourcing?

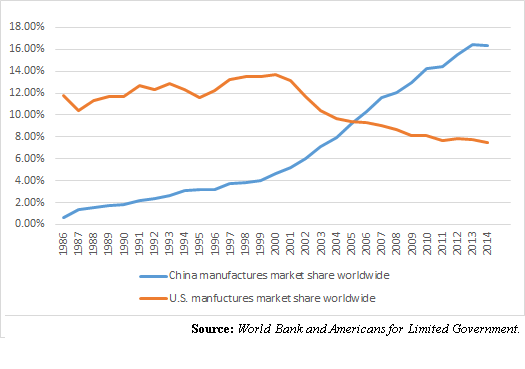

Consider, the U.S. market share of manufactures exports worldwide — that is, U.S. exported manufactures as a percent of worldwide exported manufactures — peaked in 1999 at 13.48 percent, and has been declining ever since, according to data compiled by the World Bank. In 2014, it was down to 7.45 percent.

Going back 30 years shows that as U.S. market share of manufacturing rose worldwide in the late 1980s and 1990s, so too did labor participation. And that once we were losing market share, labor participation followed closely behind.

In the meantime, countries we supposedly have “free trade” agreements with devalue their currencies in effect levy a major tariff on our goods and grant themselves a major discount on their goods shipped here. That’s not free trade, which is supposed to include reciprocal tariff reductions. It’s a one-way trade war.

The Oct. 2015 World Economic Outlook from the International Monetary Fund (IMF) study of 60 economies including China found that “A depreciation in an economy’s currency is typically associated with lower export prices paid by foreigners and higher domestic import prices, and these price changes, in turn, lead to a rise in exports and a decline in imports. Reflecting these channels, a 10 percent real effective exchange rate depreciation implies, on average, a 1.5 percent of GDP increase in real net exports,” which much of the increase happening in the first year.

This means that the more exporters, particularly China, have devalued their currencies in recent history — whether through fixed exchange rates or building up foreign exchange reserves or both — the more products they were able to export. As a result, while U.S. global manufacturing market share has been dropping, China’s global manufactures market share jumped from 4.67 percent in 2000 to 16.35 percent in 2014.

With Clinton, based on her 2013 comments, we could expect these trends to continue. She will not only pass the 12-nation Trans-Pacific Partnership (TPP) trade pact, but work towards global climate treaties and work to integrate the U.S. economy with other economies. It will result in less growth, fewer jobs per capita, fewer opportunities and more outsourcing, more trade deals, more immigration and more cronyism selling out to global corporate interests.

And an end to U.S. sovereignty. When you get down to it, Clinton is not running for President of the United States. She is selling us down the river to service a globalist agenda. The only question is whether the rust belt states of Ohio, Pennsylvania and Michigan are paying attention.

Robert Romano is the senior editor of Americans for Limited Government.