Federal Reserve Janet Yellen broadcast to the world on Nov. 17 that an interest rate hike by the central bank is likely to come soon, maybe even the next time the Fed meets.

“At our meeting earlier this month, the Committee judged that the case for an increase in the target range had continued to strengthen and that such an increase could well become appropriate relatively soon if incoming data provide some further evidence of continued progress toward the Committee’s objectives,” Yellen testified to the U.S. Joint Economic Committee Sept. 28.

This is not the first time Yellen had indicated that the rate hike would happen after the election.

On Sept. 28, she testified to the same committee that, “While there’s no fixed timetable for removing [accommodation], many of my colleagues indicated in their recent projections, the majority, that they would see it as appropriate to make a move to take a step in that direction this year, if things continue on the current path and no new significant risks arise.”

There are only a few meetings of the Board of Governors left this year, and barring a rate hike right before Thanksgiving, it may mean the rate hike will come in December.

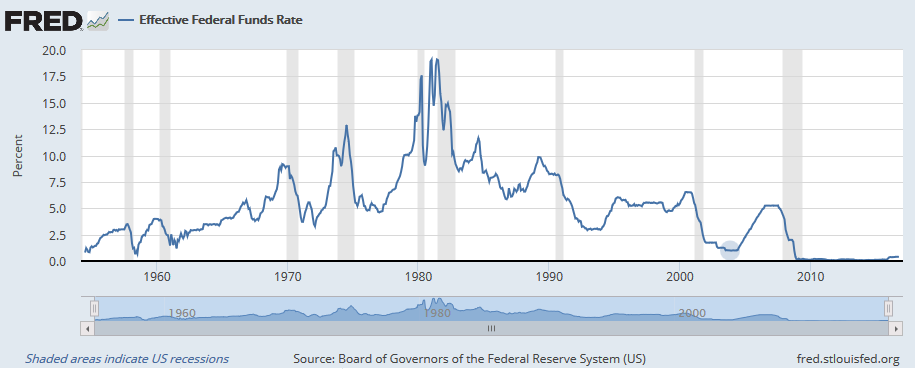

Which, if the Fed is just planning to hike the federal funds rate anyway — which currently stands at a miniscule 0.4 percent — why hasn’t the Fed already raised rates?

Was the central bank acting politically, say, to help Hillary Clinton get elected? What has appreciably changed between September and now to warrant the rate hike now? That said, if the Fed is ready to raise rates, they should normalize and just get it over with.

Even if doing so would probably be extremely bearish since the Fed tends to hike interest rates right before elections.

And may even be viewed politically as knee-capping the incoming Trump administration. That is, the Fed could have gotten the rate hike out of the way already, but waited until right before Trump got sworn in.

If recession does result, it will create a ready-made narrative and strengthen calls among Republicans in Congress to remove rate-setting away from the Board of Governors altogether, perhaps by letting larger banks just set the low rate themselves. Or even making the federal funds rate publicly traded via some investment vehicle.

Who knows what might happen? But the Fed made its bed, now it must lie in it. The central bank has put off normalization for long enough. It’s time to let the economy sink or swim.

Robert Romano is the senior editor of Americans for Limited Government.