President Donald Trump has unveiled his big tax plan, and naturally, it has provoked a much-needed debate about what it will take to grow the economy and start creating new jobs.

It is largely axiomatic that the more people who are working, the faster the economy tends to grow, such that the only work to be done for those in power is to create the conditions for further, additional job creation — and then to get out of the way.

The easiest way for Congress to do that, naturally, is to cut taxes, both on businesses and individuals. It lowers the cost of doing business, and simultaneously increases the take home pay of every single American who pays taxes, having more to invest, save and spend. That means more businesses, more jobs and more customers.

Ultimately, that means more tax revenue, too.

You don’t have to look far for proof. Just look at data allocated by the Office of Management and Budget and the Bureau of Labor Statistics. In 2016, an average of 151 million Americans had jobs throughout the year, the economy’s average, annual GDP was almost $18.6 trillion and income and payroll tax revenue was projected to be $2.728 trillion.

But suppose we had added 10 million new jobs to the mix? All other things being equal, the GDP would have been about $19.8 trillion. Federal income and payroll tax revenues would have been $2.908 trillion.

So let’s say we cut taxes by $180 billion per year, or about $1,114 per person with a job. Might that grow the economy by $1.2 trillion and create 10 million jobs, thus not adding a penny to the deficit?

We don’t know. It’s a hypothetical stimulus, meant to demonstrate that the more people working boosts the economy and increases revenue. If cutting taxes creates jobs, then it must be a part of the mix.

10 million additional jobs is also offered as a goal — because that is roughly the amount of people aged 16 to 64 who either left the labor force or never entered on a net basis since the late 1990s, the people who would have been active in the economy had labor participation among working age adults remained what it was during that era.

Those 10 million missing jobs are the slack that exists in today’s labor market, the surplus of potential labor that, consequently, keeps demand for labor lower than it might otherwise be, which hurts income growth, economic growth and everything else. It is that lost generation that we are creating if we don’t get the U.S. economy back into the job creating machine it once was.

We are coming off the worst decade ever for economic growth, even worse than the Great Depression. We haven’t had average annual growth above 4 percent since 2000, and not above 3 percent since 2005.

Take a look at the alternative. The federal government cannot create 10 million jobs by taxing everyone at higher rates. That would be a counterproductive job killer. You might increase revenue a bit, but not by nearly as much as it would take to pay for 10 million make-work jobs.

Only the private sector and free markets are capable of rapid job creation. Government simply has no talent, except in waging war — and we don’t want one of those — for marshalling human resources on that scale.

Sadly, it is likely that simply cutting individuals’ taxes $180 billion a year would not, on its own, create 10 million jobs. You’d still have to lower the cost of doing business.

Here, Trump’s plan to cut the corporate rate down to 15 percent looms large. But still, on its own, probably not enough to rapidly create those 10 million jobs.

Coupled with reducing the regulatory burdens on businesses, repealing Obamacare, cutting spending, repatriating overseas earnings, stop over allocating funds for higher education at the expense of trade professions, and getting better trade deals for the U.S. economy, the combination might free up the capital needed to invest in creating the jobs we need here in America.

No matter what, the number one goal should be creating jobs here. That is what will get people off of government dependency, grow the economy and start to increase incomes. No other task is more important. President Trump deserves his chance to do so. The country simply cannot afford to wait 4 years to get the economy moving.

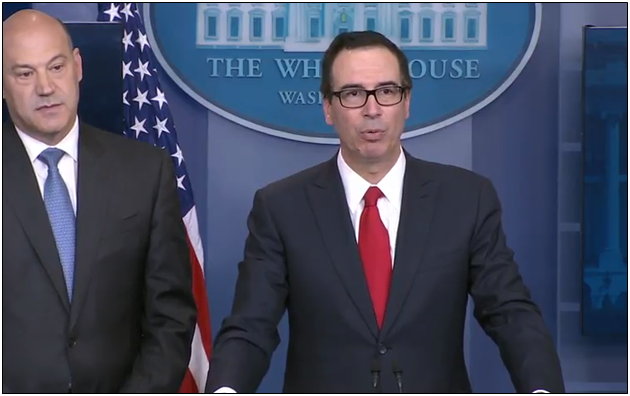

As Treasury Secretary Steve Mnuchin noted at the conclusion of his press conference yesterday touting the President’s tax plan, “What this is about is creating jobs and creating economic growth.”

The goal is to create jobs, whatever it takes. On that score, there are many challenges that must be addressed, which disincentivize creating jobs here. Tax policy is just a piece of that puzzle — a huge one that Congress should urgently turn its attention to.

Robert Romano is the senior editor of Americans for Limited Government.