By Natalia Castro

For nearly a decade, the American people have been able to look back on the 2008 recession as a lesson in how to deal with economic turmoil. But these lessons have not only been reactionary, economists have noticed trends that point to the likelihood of future recessions as well. Now, these economic indicators serve as a ticking time bomb, warning us that another recession could be on the way.

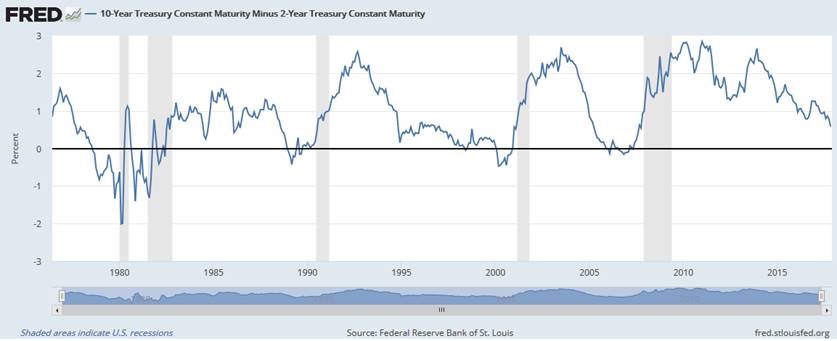

The yield curve shows several interest rates across different contract lengths for U.S. Treasury bond. In a normal environment, short-term rates tend to be lower than longer-term rates. The longer the term of the loan, potentially the higher the risk, the longer the principal is being held and the higher the profit a lender will demand.

The problem becomes when the curve begins to flatten. A flat yield curve means all maturities have similar interest rates, and could mean that investors are more worried about economic outlook. In rare cases, the curve even inverts, meaning that longer-term interest rates have fallen below short-term interest rates, this is a signal that investors are willing to settle for lower yields over the longer haul due to fears of economic decline in the near future.

This week, the gap between 2-year and 10-year bond rates narrowed to 56 points, the flattest in about a decade. Jamie McGeever, an economic commenter for Reuters explains, just a month ago the yield curve was hovering around 85 basis points, this rate of flattening suggests an inversion of the curve could not be more than a year away.

Robin Wigglesworth of the Financial Tribune notes ominously, “That is worrying because the yield curve has flattened and ultimately inverted ahead of every U.S. recession since the second world war. Given that this is already the second-longest spell of growth on record, the flattening curve has exacerbated concerns that the US economy might be heading towards a setback.”

The flattening of the yield curve has also sparked particular concern as the U.S. dollar also continues to weaken. With 10-year Treasury yields falling, they weigh down the dollar value and as concerns over inflation grow.

Morgan Stanley economic strategist Matthew Hornbach predicts that by the third quarter of 2018, “all Treasury yields will be in the lower of that 2.00-2.25 percent range”, making the curve almost completely inverted and economic outlook dim.

But not all sights seem to be negative.

Bloomberg economist Tim Duy reminds that is not flat curves that point to recessions, but inverted ones. Duy notes, “That is what typically happens during tightening cycles… It is the inversion of the yield curve that signals recession (this is especially the case if the Fed continues to tighten after the yield curve inverts). For example, the curve was extremely flat during the second half of the 1990s, a stretch of high growth. Only late in that period did the yield curve invert, finally foreshadowing the 2000 recession.”

Sure enough, despite a flattening curve and weak dollar, the Bureau of Economic Analysis has revised the third quarter Gross Domestic Product to an inflation-adjusted 3.3 percent annualized.

While this seems positive, in order to achieve even above three percent annualized growth for the entire year, the US would still have to achieve a ludicrous 13.9 percent annualized growth in the fourth quarter, owing to the slow start to the 2017 calendar year and how the average, annual GDP growth number is calculated.

That said, a strong fourth quarter could set up 2018 very nicely to be the first year the U.S. breaks above 3 percent growth since 2005.

The yield curve can account for rapid economic growth just before inversion, which is why the American people can take some solace that Hornbach predicts inversion is still at least a year away.

Americans for Limited Government Vice President of Public Policy Robert Romano noted, “In recent history, the 10-year-2-year yield curve has tended to hit a low in negative territory about 12 to 18 months prior to past recessions striking, swinging back positive prior to the recession’s onset. We’re not there yet but even if that level was reached in 2018, that would still mean that the next recession was still on the horizon, another year or so away.”

Meaning, using the inverted yield curve as a predicter, a recession may not come until 2019 or later, but nonetheless, close watch of this indicator remains necessary should it invert sooner than expected.

Whether or not a recession is around the corner, the yield curve remains a consistent, critical economic indicator. Right now, it suggests that current growth can be sustained the next couple of years, but may be followed by decline. As we reminisce on the 2008 recession, looking to the yield curve serves as a reminder that we must always be prepared for an uncertain economic future and plan accordingly.

Natalia Castro is a contributing editor at Americans for Limited Government.