The die is cast as President Donald Trump has nominated Judge Brett Kavanaugh, who has served on the D.C. Circuit Court of Appeals since 2006, to replace Anthony Kennedy on the Supreme Court.

Prior to the nomination, one criticism brought against Kavanaugh from the conservative side came from his dissent in the 2011 Obamacare case, Seven Sky v. Holder. The case involved a taxpayer who was objecting to the health care law’s individual mandate to purchase insurance as unconstitutional violations of the Commerce and Taxing Clauses of the Constitution.

This was one of many cases that ultimately found its way to the Supreme Court in National Federation of Independent Business v. Sebelius in 2012. In that ruling by Chief Justice John Roberts, the Court said for the purposes of the 1867 Anti-Injunction Act barring federal courts jurisdiction from hearing cases against a tax prior to its enforcement, the individual mandate was not a tax, but that for the purposes of the law’s constitutionality, it was a valid exercise of Congress’ taxing power.

Famously, the dissent in Sebelius by Justices Antonin Scalia, Samuel Alito, Anthony Kennedy and Clarence Thomas stated, “What the Government would have us believe in these cases is that the very same textual indications that show this is not a tax under the Anti-Injunction Act show that it is a tax under the Constitution. That carries verbal wizardry too far, deep into the forbidden land of the sophists.”

What Kavanaugh is accused of, wrongly as it turns out, is somehow supplying the argument that ultimately prevailed in Sebelius. In reality, just the opposite occurred. The administration had argued the case could be heard under the Anti-Injunction Act. Kavanaugh said it could not. If he had had his way, the case wouldn’t have proceeded to the merits.

In his dissent, Kavanaugh stated the court lacked jurisdiction to hear the case under the Anti-Injunction Act because the individual mandate would not take effect until 2014.

Kavanaugh wrote, “For judges, there is a natural and understandable inclination to decide these weighty and historic constitutional questions. But in my respectful judgment, deciding the constitutional issues in this case at this time would contravene an important and long-standing federal statute, the Anti-Injunction Act, which carefully limits the jurisdiction of federal courts over tax-related matters.”

Here, Kavanaugh would have applied the Anti-Injunction Act on a seeming tax provision without proceeding to the merits of whether the individual mandate was a valid exercise of Congress’ taxing powers. That is a critical distinction. Deference was being urged towards Congress for the time being until the case had ripened. Given that the mandate would not take effect until 2014, Kavanaugh felt he had to presume it was a tax under the Anti-Injunction Act, but not necessarily a constitutional use of the taxing power because Kavanaugh felt he could not hear the merits of the case until the tax had actually been levied.

Agree or disagree with the Roberts ruling that the individual mandate was a constitutional tax, Kavanaugh never said it was. He was punting. To him it was a case on the statutory interpretation of the Anti-Injunction Act first and foremost. He believed he lacked jurisdiction and so exercised judicial restraint. Arguments could be made that since it was not a tax at all, the case could be heard. That’s certainly what the dissent in Sebelius did. But Kavanaugh, perhaps lacking the persuasive insights of Scalia, Alito, Kennedy and Thomas, went in a different direction.

In fact Kavanaugh hinted there might be a case to be made against the law’s constitutionality on the grounds that it violated the Taxing Clause. How? Kavanaugh wrote, “For the purposes of the Taxing Clause, mandates and prohibitions might be one step beyond the traditional kinds of regulatory taxes that the Taxing Clause has authorized.”

Why? Kavanaugh answered, “the government’s Taxing Clause argument may have a potential problem because of the statute’s legal mandate…” from the law that stated, “An applicable individual shall… ensure that the individual, and any dependent of the individual who is an applicable individual, is covered under minimum essential coverage…”

Meaning, Kavanaugh, without ruling on the merits, was holding out the possibility that the law could be overturned as unconstitutional even it was deemed a tax as exceeding the limits of Congress’ taxing power. Certainly, not what the Roberts ruling stated.

To be fair, we also have no idea how Kavanaugh might have ruled in Sebelius, which was a different case. We’ll never know.

But one impact Kavanaugh’s dissent could have, once seated on the Supreme Court, may come as courts once again consider the health care law’s constitutionality now that the individual mandate’s tax penalty has been zeroed out by Congress in the Trump tax cut bill. Without the tax penalty but with the mandate still in place, there no longer appears to be a constitutional basis for the individual mandate — even in Roberts’ contorted logic — which the Roberts ruling had stated was unconstitutional under the Commerce Clause.

Could Kavanaugh persuade Roberts that without the tax, the law cannot stand? We may find out very soon, provided the Senate sees fit to confirm Kavanaugh.

The point is, nobody really knows how he or any of the other justices might rule in such a case if all we have to go on is Kavanaugh’s dissent in the Seven Sky v. Holder case. What is clear is that the dissent he wrote is far from disqualifying. It was an exercise of judicial restraint, something many wish we saw more of from Supreme Court justices.

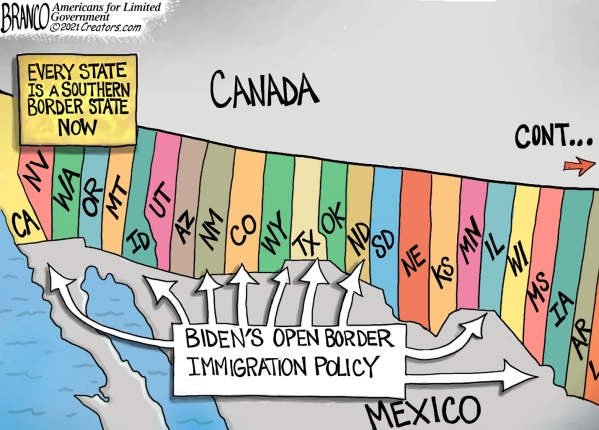

Robert Romano is the Vice President of Public Policy at Americans for Limited Government.