Congress has passed another round of relief to save as many of the 30 million small businesses nationwide as possible, with another $310 billion on top of the $350 billion that was already spent. An additional $60 billion is going to small businesses in the form of the Economic Injury Disaster Loans (EIDL), $10 billion of which will be grants, coming atop $10 billion of EIDL loans already given. The total rises to $730 billion going to the backbone of the American economy, the Main Street small businesses.

The funds could not come more quickly. Every day and week of dragging their heels, Congressional Democrats watched as millions more jobs were lost to COVID-19 government-directed closures, now up to more than 26 million job losses in a little over a month.

When added to the 5.8 million who were already unemployed when the pandemic struck the U.S., that means more than 30 million are jobless right now. Effective unemployment could already be more than 20 percent, even if the reported rate will come in lower than that next week.

Even as the spread of the Chinese coronavirus has been slowed and is waning across the country, the situation economically that is emerging could be the worst recession of our lifetimes, with the job losses more than tripling the 8.3 million lost in the financial crisis and Great Recession more than a decade ago.

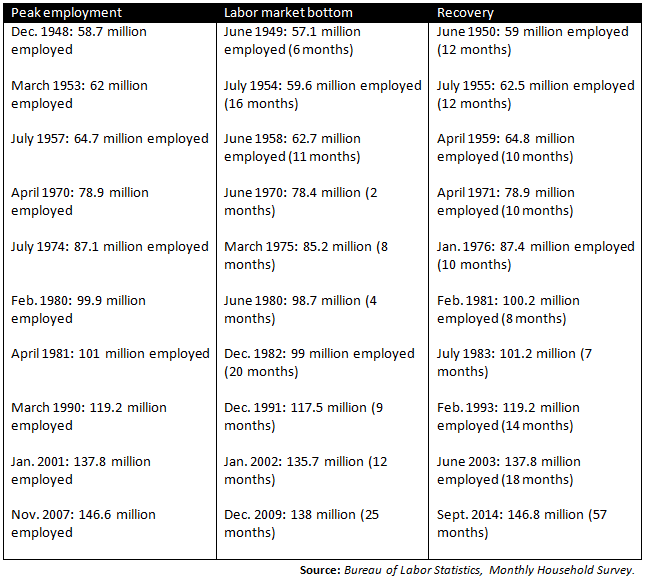

For perspective, it took more than two years to lose all those jobs before labor markets bottomed in Dec. 2009. More jobs were lost than that in two weeks in this crisis.

And how long it goes on is anyone’s guess. My greatest worry is that even after states reopen, the job losses could mount, property values could take a hit and Americans could wind up upside down on their mortgages again, and we could be struck by another financial crisis.

Sadly, even with the supports Congress put in place, it is still more cost effective for many businesses large and small to simply lay workers off. The ones toughing it out right now and going for the payroll protection and EIDL loans therefore are indeed heroic, and actively seeking to maintain ties to their employees and very patriotic for doing their part to help to save the U.S. economy from otherwise certain ruin.

That is neither to deride the action Congress and the Trump administration are taking, or to those businesses who simply could not survive this cataclysm. We’re all in this together.

That likely means Congress will have to reconvene soon for phase four legislation that will seek to shorten the duration of time it takes to recover all the jobs that have been lost and rebuild the economy from what could be compared to an asteroid striking it.

Unfortunately, it’s a lot easier to burn down a house than it is to build one. In the aforementioned Great Recession, it took almost five years to recover the jobs that were lost.

So, does triple the jobs lost mean triple the time to recover the job losses no matter what government does? We better hope not. If that were the case, we’d already be looking at 15 years to recover, but with millions of jobs being lost every week, the 26 million already lost might not even be the extent of it.

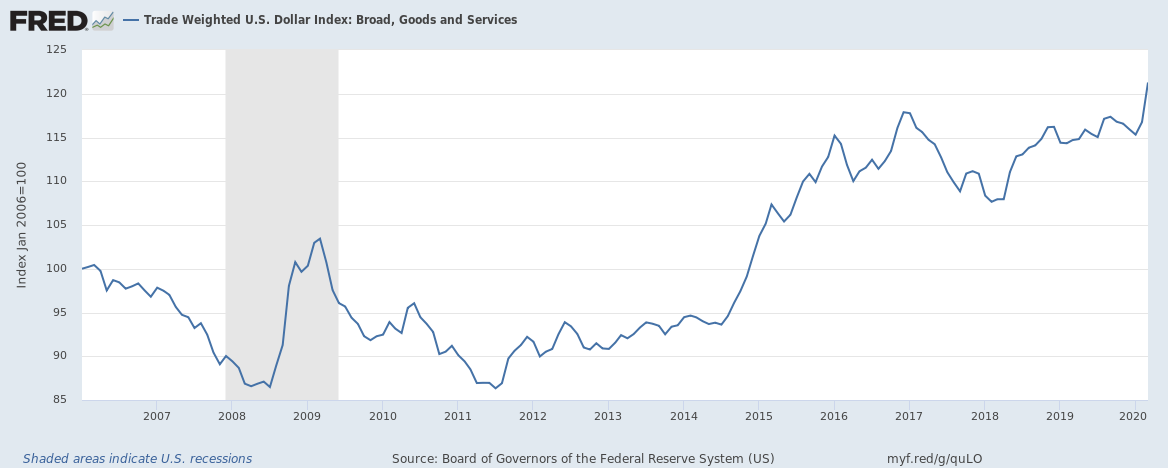

Still more attention needs to be focused on problem areas. Top of the list are the strong dollar, which every month that goes by gets stronger relative to other currencies as financial institutions and central banks stockpile and will most certainly contribute to deflation for as long as that remains the case. Strong action by the Federal Reserve to ensure price stability could not be more urgent, especially after years of leaving the dollar too strong, for too long.

Additionally, even if property values do not plummet and households don’t get behind on their mortgages, state and local government revenues will surely plummet and create real pressure in municipal bond markets. Similarly, corporate bond markets are threatened. Fortunately, the original $2.2 trillion bill that Congress provided for in part does allow the Federal Reserve to support state and local governments and corporate debt with lending available up to $6 trillion.

Therefore, the longer the closures last, certainly the worse the economy will get. That is why Americans for Limited Government has launched www.ReopenAmericaNow.org to urge the American people to contact their governors and state legislatures to reopen their economies as soon as they possibly can. The actions taken to save lives to date by President Trump, governors and the American people have already helped save hundreds of thousands of lives, and now, as the virus begins to wane, it is time for America to begin to get back to work.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government.