Over the past six weeks, over 30 million people have applied for unemployment in the U.S. As depressing as these numbers are, it is highly unlikely that the hemorrhaging has stopped. The federal loan fund known as the Paycheck Protection Program was established to help small businesses survive the economic shutdown and continue to pay their employees, but the program quickly ran out of money. Now another $321 billion has been approved for the program to provide further assistance to these businesses. Of course, this new funding is also likely to run out quickly. Before yet another coronavirus relief bill is needed or tens of millions more workers lose their jobs, policymakers should heed the words of small business owners and reopen the economy.

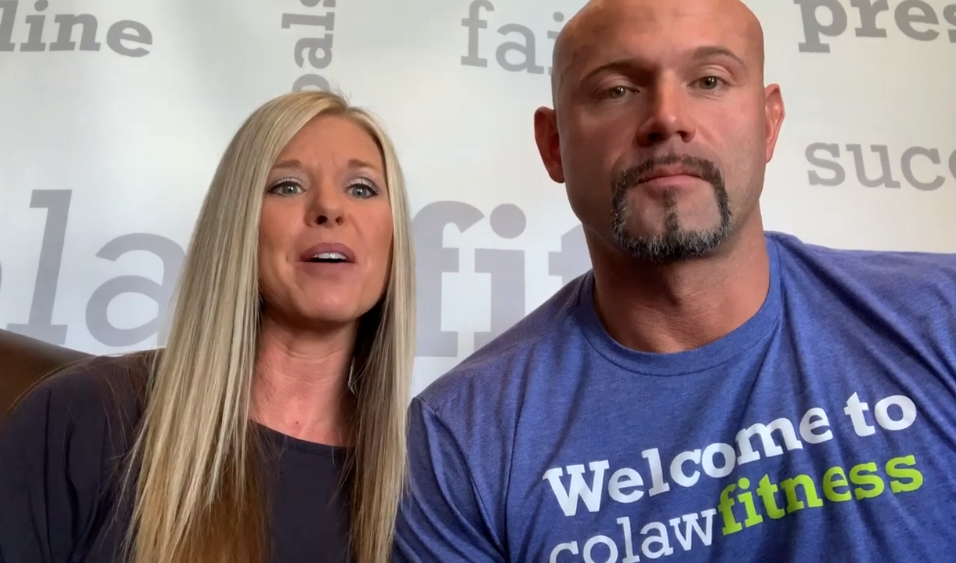

Charles and Amber Colaw, who own Colaw Fitness, know something about running a successful small business. They run three fitness centers and are in the process of building two more. Here is some of what they had to say about the shutdown just prior to Congress’ passage of the payroll protection plan and its impact on their business, their employees, and their customers.

Amber: “We’ve had to shut… the doors of all three of our locations… We are lucky. We have not stopped any construction that we’re doing on the other two locations yet. So we’re just really praying that that doesn’t have to happen… With all of our clubs shutdown, we can’t bill for a membership for a location that’s not open… There’s zero revenue coming in for us.

“We’ve have had to pretty much lay off 95 staff members which affect all of their families. We’re losing hundreds of thousands coming in. We’ve got hundreds of thousands in bills that are gonna continue to go out… If we can’t get these other two locations open… we’ll lose 200 or more jobs that those locations would have brought.

“And none of this is to mention the impact that this is having on… our members — tens of thousands across multiple states who don’t get to work out… We stayed open as long as we could. We’ve had great feedback on our social media — people very thankful that we stayed open as long as we did. They’ve been very supportive. They want to let us know that they will be back as soon as we reopen. We’ve also had other people say, ‘Go ahead and bill me. I want to be supportive of you’ — which we would never ethically do. So [the shutdown] has impacted us to a great extent.”

Charles: “We need the government to allow us to return to work. I’ve got probably about a dozen to two dozen good friends that also run small businesses, other business owner friends, and I would say all of them could never last even six months — maybe a month or two… We feel the effects. We know it’s going to come really quick — just within a few months for us ‘til we have like a zero balance and we have to file bankruptcy or have some sort of major issue…

“I would say most small businesses with competition — especially in the market of fitness… it’s hard to have over a 20% profit margin… If you are down even one month, you’re probably not going to have a profitable year at all… So we have to get back to work. We can’t last months without any revenue… Even one month of being closed, I think, is too long for most… businesses.”

Amber: “It’s like Trump said, we cannot let the cure be worse than the virus itself. So it’s time to lift these regulations and let the American people get back to work.”

In the short term, the government’s extraordinary spending is understandable, but it is unsustainable in the long term. The country was deeply in debt prior to the pandemic, and now we can expect our fiscal situation to grow worse as more jobs are lost and tax revenues plummet. That is why it is imperative that the economy be reopened, as small business owners, like the Colaws, are requesting.

Richard McCarty is the Director of Research at Americans for Limited Government Foundation.