By Rick Manning

Is the economy booming or is it riding a wave of paper money with no real underlying sustainability? That is the question which policy makers in Washington, DC should be considering.

The truth is no one actually knows, but that is exactly why this discussion must be had.

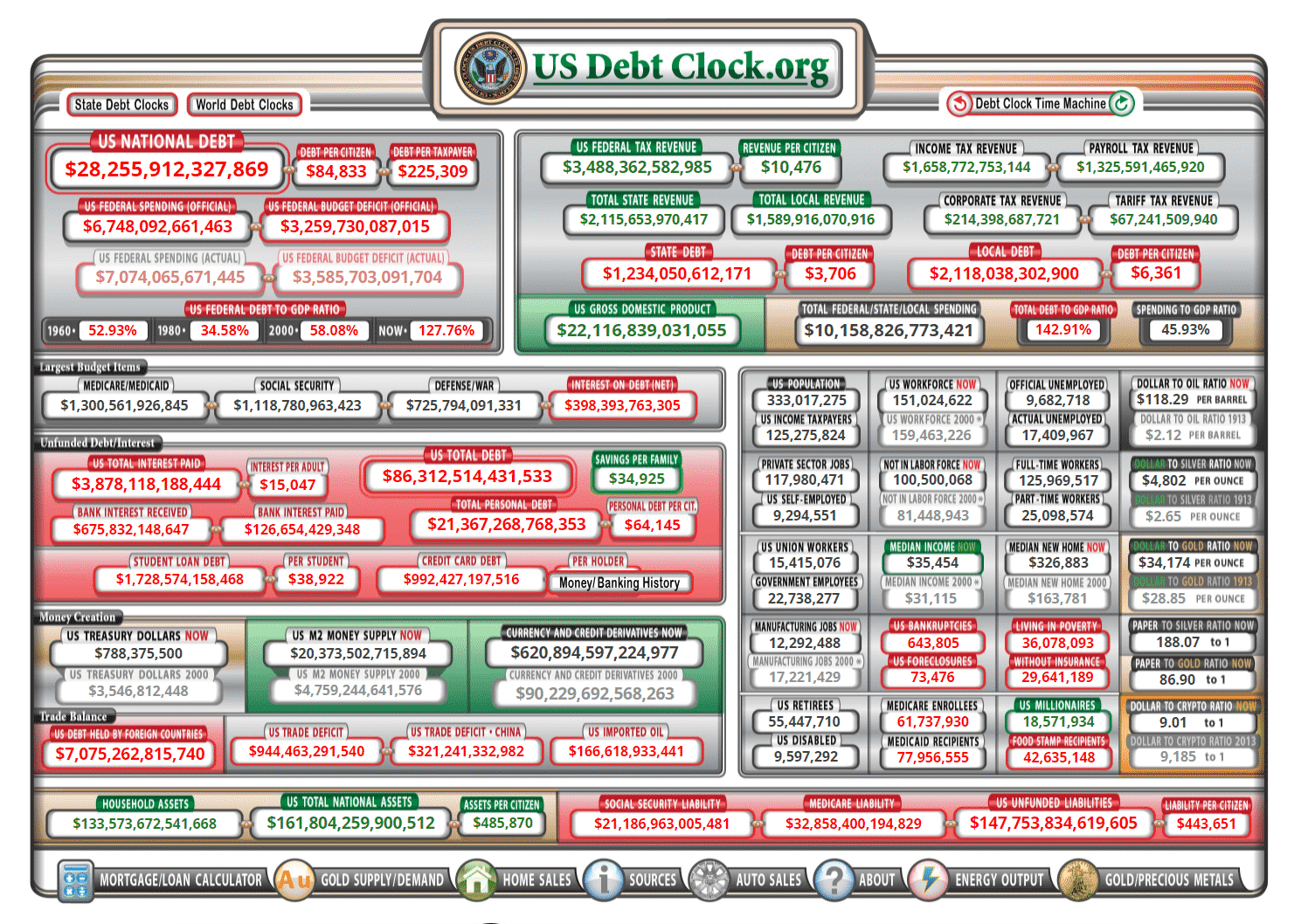

Since the China virus was inflicted upon the world, it is indisputable that the federal government has authorized $5 Trillion between the Trump spending of $3.1 Trillion to meet the crisis and Biden’s recently passed additional $1.9 trillion so he could sign checks to people too. This is on top of the $1 Trillion in planned deficits during the 2020 fiscal year.

The actual outlays from October 1, 2019 to September 30, 2020 (FY 2020) as reported by the U.S. Treasury Department: Receipts: $3,420 Trillion; Outlays: $6,552 Trillion; Deficit $3,132 Trillion. And this doesn’t count the money from the December stimulus or the Biden stimulus as they both were authorized after the end of FY 2020.

To put the budget deficit in perspective, here is what last year’s deficit number looks like when written out: $3,132,000,000,000.00.

Another way to think of this one-year deficit, two-thirds of which was driven by pandemic spending, is that every one of the 331 million people in America owed an additional $9,462 to those who owned our debt over the course of last fiscal year.

Still think all those stimy checks were free?

The good news is that the unemployment rate continues to drop, the Gross Domestic Product has recovered from the trough it fell into due to the shutdown of our economic system and is projected to grow an astonishing 13.6 percent in the second quarter of 2021 by the Atlanta Federal Reserve as consumer spending continues to be off the charts.

It is still true that if you give people a bunch of money that they had not planned on receiving they will spend it.

And it is also still true that when lots of dollars chase a limited number of products, prices go up. In the first three months of 2021, inflation has risen by .3 percent in January, .4 percent in February and .6 percent in March with a now annualized rate of 2.6 percent, up from 1.7 percent reported in February, which was up from 1.4 percent in January. Meaning that in the first three months of 2021, the annualized inflation rate has almost doubled.

Is this a trend or is it an anomaly? Biden Treasury Secretary and former Federal Reserve Chairwoman Janet Yellen on May 4th speculated that interest rates may have to rise to slow down an overheated economy, which should give Congress pause in their spending spree as that very spending could create a vicious cycle of higher inflation leading to higher interest rates.

A reasonable person would ask whether the current stimulus spending is doing more harm than good for our nation’s economic health, because right now something can be done about it by simply rescinding much of the unspent funds from both the Trump and Biden spending bills which passed in the last five months dramatically lowering the projected deficit spending in 2021.

One theory which has minority support in the economics world but which seems reasonable from a logical perspective is that at some point, deficits create a drag on economic growth, the same way the Laffer Curve explains why high tax rates have a negative impact on total government revenues.

The idea is that when a nation’s debt reaches a certain level, the cost of servicing that debt (the interest payments) deny capital to other productive investments. America better hope that this theory is not valid, as the $28.1 trillion in debt already accumulated is likely to easily explode past $30 trillion by the end of the 2021 fiscal year due to spending already appropriated monies.

Last year, the United States spent $523 billion servicing the debt largely due to historically low interest rates. The additional $3.13 trillion in debt added last year alone at a conservative 1.5 percent interest rate will push total interest costs up by about $47 billion. Given that it is unlikely that there will be much lower interest rate cost savings from rolled over and refinancing existing debt, being saved by continually dropping interest rates becomes less probable.

And the annual debt servicing costs ate up fifteen cents of every tax dollar the federal government collected in 2020. For perspective, the entire Defense Department only cost twenty one cents of every dollar collected last year.

So what does all of this mean?

Some believe that America can remain on an unending carousel of increasing debt and the paper money boom can continue forever. Others walk around with signs warning the end is near.

For the past decade, I have been worried about the nation sinking into a fiscal death spiral due to our inability to balance our budget, let alone pay down the debt. I have been wrong every one of these years, and for the sake of our nation, I pray that I am wrong again this year.

But in the meantime, can we at least have an adult conversation about how to get our nation’s spending under control. It is better to have the discussion now than to wake up tomorrow and wish we had thought through the consequences of the trillion here, trillion there spending policies that dominate Washington, DC today.